Virtue

@virtue_money

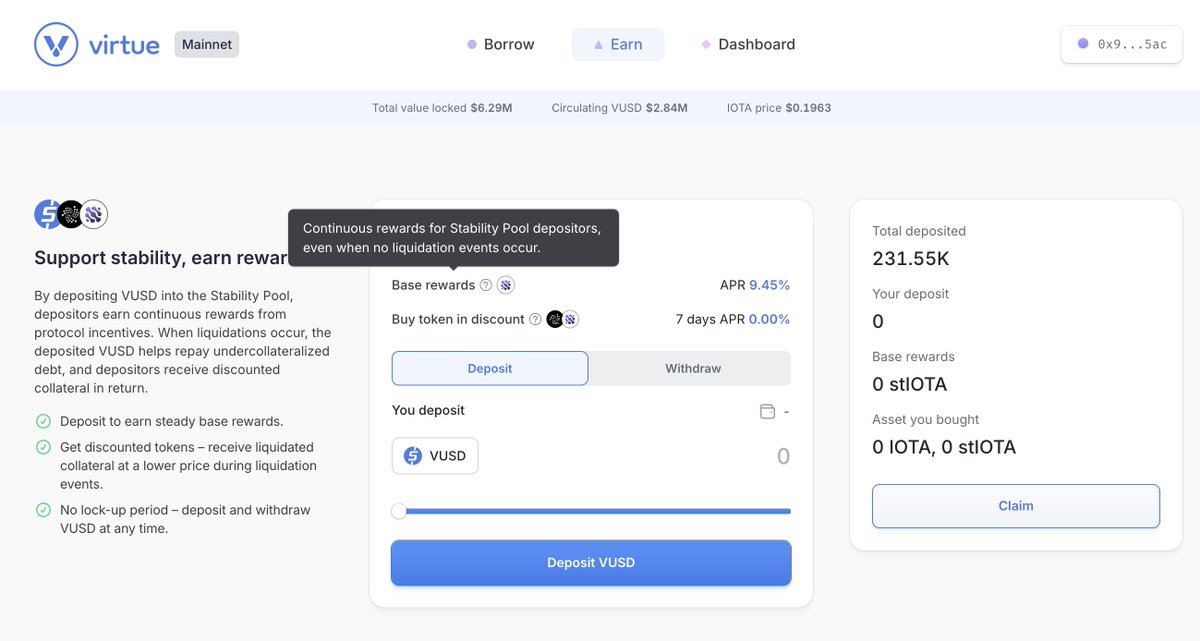

Virtue is a stablecoin lending platform on IOTA EVM powered by Liquity v2. Borrow vUSD and earn yield with ease.

Discord: discord.gg/2sM3AeBdGG

ID: 1678386930474528772

http://www.virtue.money/ 10-07-2023 12:53:42

198 Tweet

1,1K Followers

12 Following

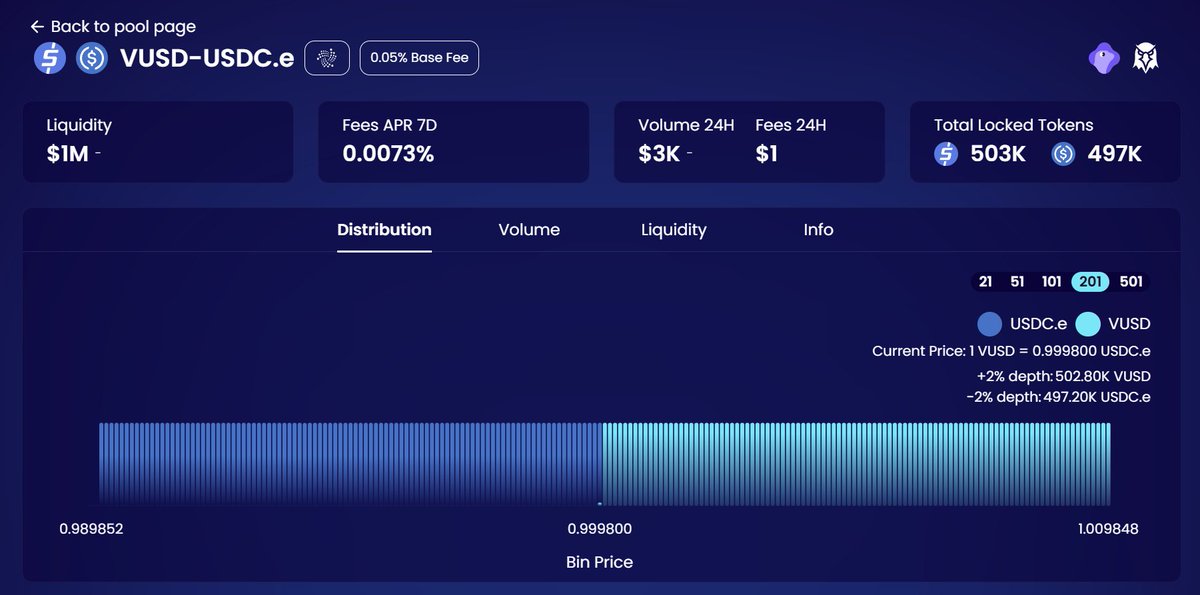

LiquidLink Virtue Pools Finance Goldsky ☀️ TWIN Foundation MY Blockchain Week You can now lock IOTA to mint vUSD, the stablecoin from Virtue. Borrow, lend, and earn – natively on IOTA’s network. Ready to test the DeFi waters? Get Started here: virtue.money 4/8

Just over a week since Virtue launched on mainnet… ✅ $7M+ TVL locked ✅ Listed on DefiLlama.com ✅ The first decentralized stablecoin protocol on IOTA We’re just getting started. 💥 Join us, mint VUSD, and be part of IOTA-native DeFi. 🌊 🔗 app.virtue.money/borrow