Stefan Vikström

@vikstrom_stefan

Widely travelled psychologist with a passionate interest in human behavior. Nothing I write is financial advice.

ID: 1208746562240819200

22-12-2019 13:50:36

13,13K Tweet

1,1K Followers

1,1K Following

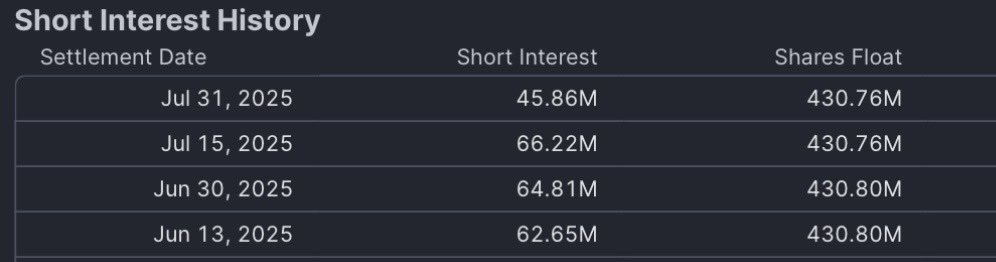

Note, claims like the one by Handle my candle to explain the 20M $AMC short interest drop since July 15 are clearly false. Else we would have seen a corresponding increase of the float. #AMC

I do like Retail Investor’ response to Matt Kohrs deceitful attempts to downplay $AMC and the role of dark pools. In general I stay cautious to any “big” account engaging in #AMC, regardless if the engagement appears to be positive or negative.

A bit too informed and well researched to be brushed off as a “conspiracy theory”. And anyone who has followed $AMC through the years realize there must be an explanation. If I may speculate a bit, I believe the timing of InvestorTurf’s post is chosen with great care. #AMC