VantageScore®

@vantagescore

Industry-leading experts on credit data, credit risk modeling & analytics.

ID: 784769136

http://vantagescore.com 27-08-2012 14:23:02

4,4K Tweet

46,46K Followers

966 Following

Millions More Creditworthy Americans Will Get a Fannie Freddie Mortgage Because of New Modern VantageScore: VantageScore CEO on FOX Business “VantageScore is a more modern credit score. It’s now time to bring that modernity and new technology to the mortgage system at a time

FICO's days of 100%+ price increases are probably over - in the battle between monopoly profits and regulatory pressure, the regulators usually win, writes Marc Rubinstein (via Bloomberg Opinion) bloomberg.com/opinion/articl…

Next week, Dr. Rikard Bandebo, VantageScore EVP, Chief Strategy Officer, and Chief Economist, will provide insights into trends in consumer credit health. Join VantageScore at the Structured Finance Association's 2025 Research Symposium and get a multi-sector view of consumer behavior,

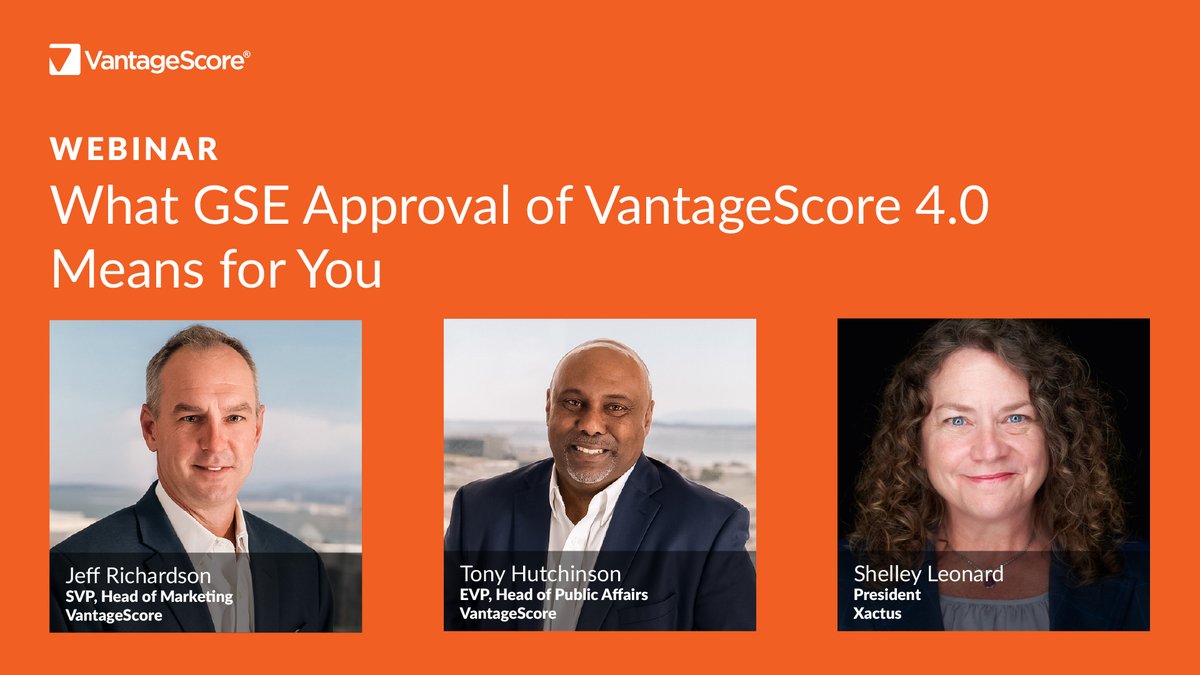

Miss our webinar last week? Dive into the U.S. Federal Housing (FHFA)'s decision to adopt VantageScore 4.0 and learn what that means for you. Watch our free webinar to help you take action now and stay ahead of the curve. VantageScore’s Jeff Richardson and Anthony Hutchinson are joined by Shelley

With the U.S. Federal Housing (FHFA)’s decision to adopt VantageScore 4.0 for mortgages purchased by Fannie Mae and Freddie Mac, many more creditworthy Americans will have the opportunity to enter the mortgage market they had previously been locked out of due to outdated credit scoring models.

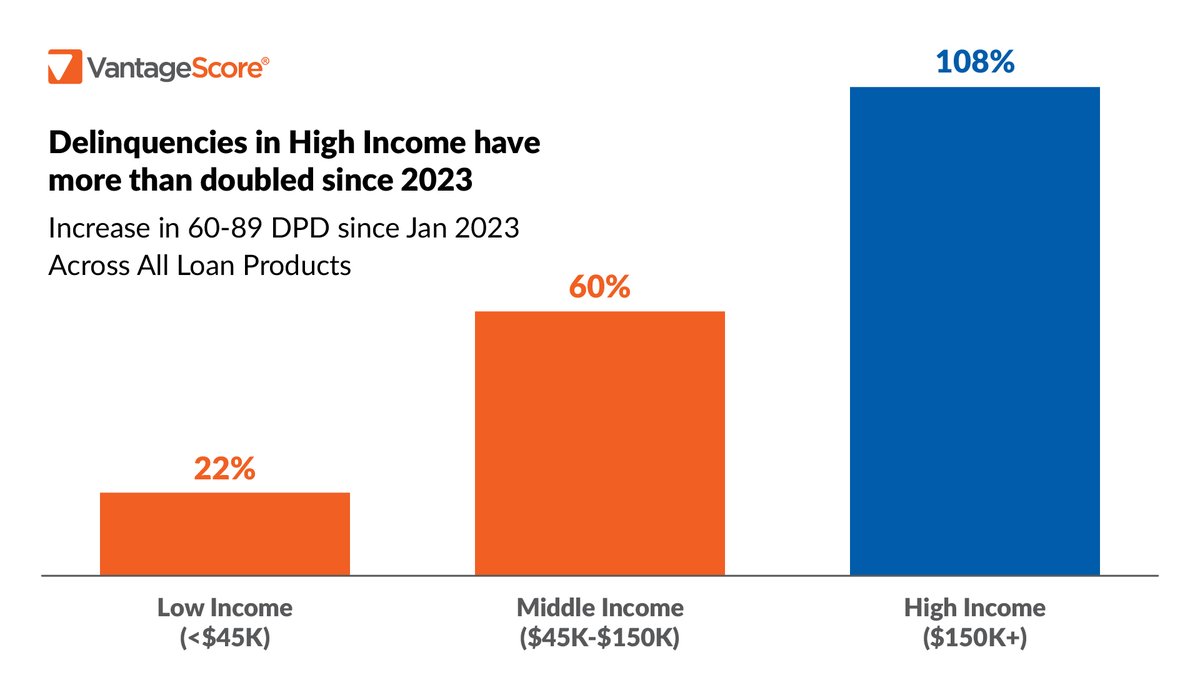

VantageScore Data Points to Potential Trouble for High-Income Consumers – VantageScore on CBS MoneyWatch “For white-collar workers, it's probably tougher than it has been,” says Dr. Rikard Bandebo, Chief Economist and Chief Strategy Officer at VantageScore. “This trend has been

July was an exciting month for VantageScore® – and even more meaningful for American homebuyers. The U.S. Federal Housing (FHFA)'s decision to adopt VantageScore 4.0 for #FannieMae and #FreddieMac mortgages means more creditworthy Americans will have access to a mortgage market they’d been locked out

We will get Vantage Score completed, quickly, while increasing safety & soundness! “The CEO of the Mortgage Bankers Association voiced his support for Fannie and Freddie to incorporate VantageScore 4.0 “as soon as possible” for credit scoring.” LINK: scotsmanguide.com/news/mba-suppo…