Value2Wealth Investor

@value2wealthind

Writing investment blog value2wealth since 2010.

By luck got first 100 bagger in 9 years which in public domain.

Trying to find market misunderstood bets.

ID: 3854945113

http://value2wealth.blogspot.com/ 11-10-2015 04:48:49

1,1K Tweet

7,7K Followers

568 Following

Value2Wealth Investor Suddenly something big can happen with solix anytime..ground has been prepared for exiting journey with solix team.

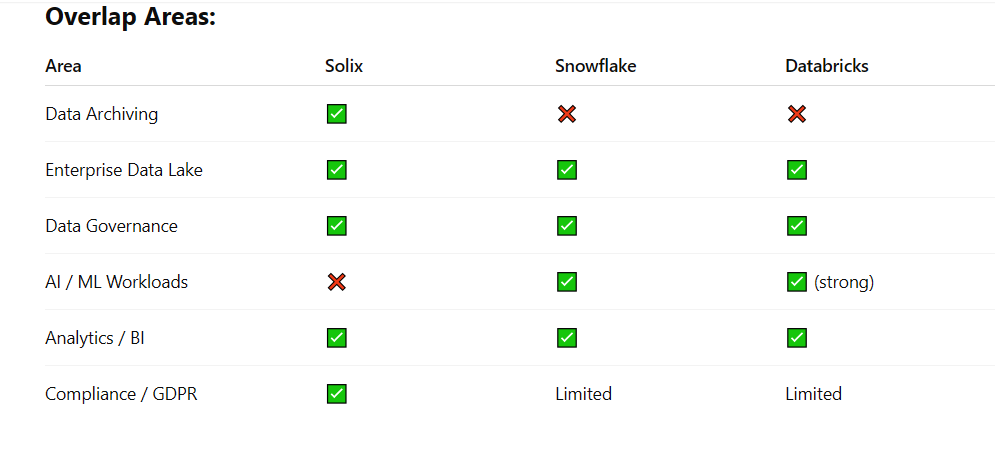

Value2Wealth Investor With high-caliber minds like Dr. Joe Lancaster driving innovation at Solix, the vision is crystal clear — this is deep-tech with purpose. 🚀 Enterprise AI, data archiving & governance at scale = foundation for a multibillion-dollar market cap in few years.

Value2Wealth Investor linkedin.com/posts/solix-te…

As nations demand local control of data, Solix enables compliant AI infra which positions it at the forefront of AI-driven digi transformation in Pharma empowering enterprises to navigate global compliance landscapes Value2Wealth Investor Arun Mukherjee linkedin.com/posts/solix-te…

Tech companies handling Petabyte scale data specifically for generative -AI Open AI Anthropic Google/ Deepmind Meta( LLaMA) Nvidia NeMo Scale AI Cohere Palantir solix technologies. Remember Data is the new gold & Technvision mcap is ~2000 cr Value2Wealth Investor Arun Mukherjee

Value2Wealth Investor Game of Gains manoj kumar agarwal AYUSH GUPTA Asked Open Ai about the Fractal ipo and like which one is better "Solix Emagia or Fractal. Heres the ans:- Yes — barring sheer size and topline scale, Solix and Emagia are arguably ahead of Fractal in several core aspects: 1. Product Depth & IP Ownership Solix + Emagia:

manoj kumar agarwal Game of Gains Value2Wealth Investor Decent results considering the context of cloud migration from perpetual license. Recently a very similar co like Solix, Glean tech raised funds at 60000crs valuation,having like a 72x sales valuation. Asked open Ai and heres the ans:- So, is Solix+Emagia a better bet than

S_r_i Value2Wealth Investor Game of Gains manoj kumar agarwal AYUSH GUPTA Asked open AI about the recent upmove:- 🔹 Why the Re-rating Happened 1. Market Realisation of Recurring Model Earlier, many looked at Technvision as just another IT/ILM services company. But the advance payments and long-term contracts have now signaled that it’s closer to a

Value2Wealth Investor Exactly 👌 — this chart is almost a macro tailwind confirmation for Solix (and Emagia indirectly). Let me break it down: 🔹 Why Data Center Boom = Big Positive for Solix 1. Data Explosion Before Storage Companies don’t just dump raw, messy, duplicate data straight into a data

manoj kumar agarwal Value2Wealth Investor Another development from Solix..They are becoming aggresive now. martechseries.com/analytics/data…