Tripcatcher

@tripcatcher

Tripcatcher manages those pesky mileage claims, using mobile and web apps – saving you time and money :) Try it for free tripcatcherapp.com

ID: 1633561765

http://www.tripcatcherapp.com 30-07-2013 18:26:11

812 Tweet

638 Followers

999 Following

Mark Duncombe @FullyChargedDan Tripcatcher Glad to hear the post was useful, Mark! Hopefully, this will bring some clarity for people who are unsure about the whole area of business miles for electric vehicles 👍

Thanks Debbie Whitaker for the shout - love the article too. Have a great weekend to you and your team 🚗🚗❣️

Hi Goddards Accountants (Cloud Accounting Surrey) thanks for the shout, we missed this in June! Love that we are mentioned with all these fab apps #debtordaddy, #freeagent, #kashflow, #mailchimp, #quickbooks, #receiptbank, #sageone, #software, #tripcatcher, #xero

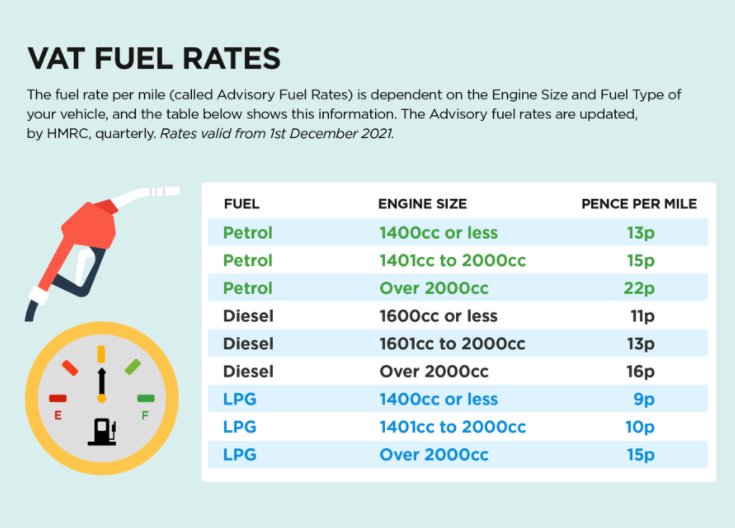

If you claim VAT on mileage expenses or drive a company car, you need to know that HM Revenue & Customs have issued the latest Advisory Fuel Rates for 1st March 2020 see bit.ly/3q1mMro. Its good news for some petrol and diesel vehicles as the rates have gone up!

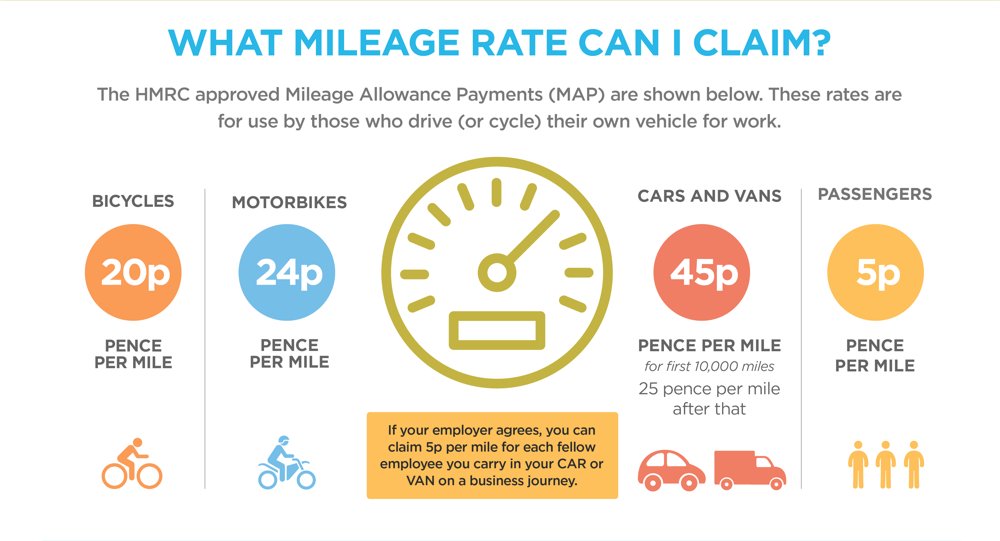

If your employer doesn't pay you the full #mileageallowance for your business mileage, you may be able to claim Mileage Allowance Relief🚗🚴♀️ Tripcatcher has the details of how to claim this tax relief. Check out their new blog post bit.ly/3rPnvO7 #business #expenses

What is Mileage Allowance Relief? Find out the easy way to make a claim with Tripcatcher over the XU Hub 👇

Tripcatcher No worries! Always happy to spread the word about Tripcatcher 🙌 #mileage #expenses #apps

Hi Amakari Services thanks for the mention, loving the fact you think Tripcatcher is a game changer! If we can be of help please do get in touch!🚗🚗🚗

Want to know which 6 apps can help you deliver seamless VCFO services? Featuring Float Cash Flow Dext Tripcatcher Unleashed Software bug bounty hunter #VCFO floatapp.com/blog/6-of-the-…