Top Gun Financial

@topgunfp

Greg Feirman (CEO) Registered Investment Advisor (RIA) Macroeconomics/Value Investing/Growth Investing/Technical Analysis MA/BA Philosophy

ID: 88265498

http://www.topgunfp.com 07-11-2009 20:36:34

27,27K Tweet

2,2K Followers

357 Following

Let me be clear: I don’t know anything beyond what’s in this article. But it does remind me of a certain infamous company James Chanos - and I’m sure I’m not the only one $NRG

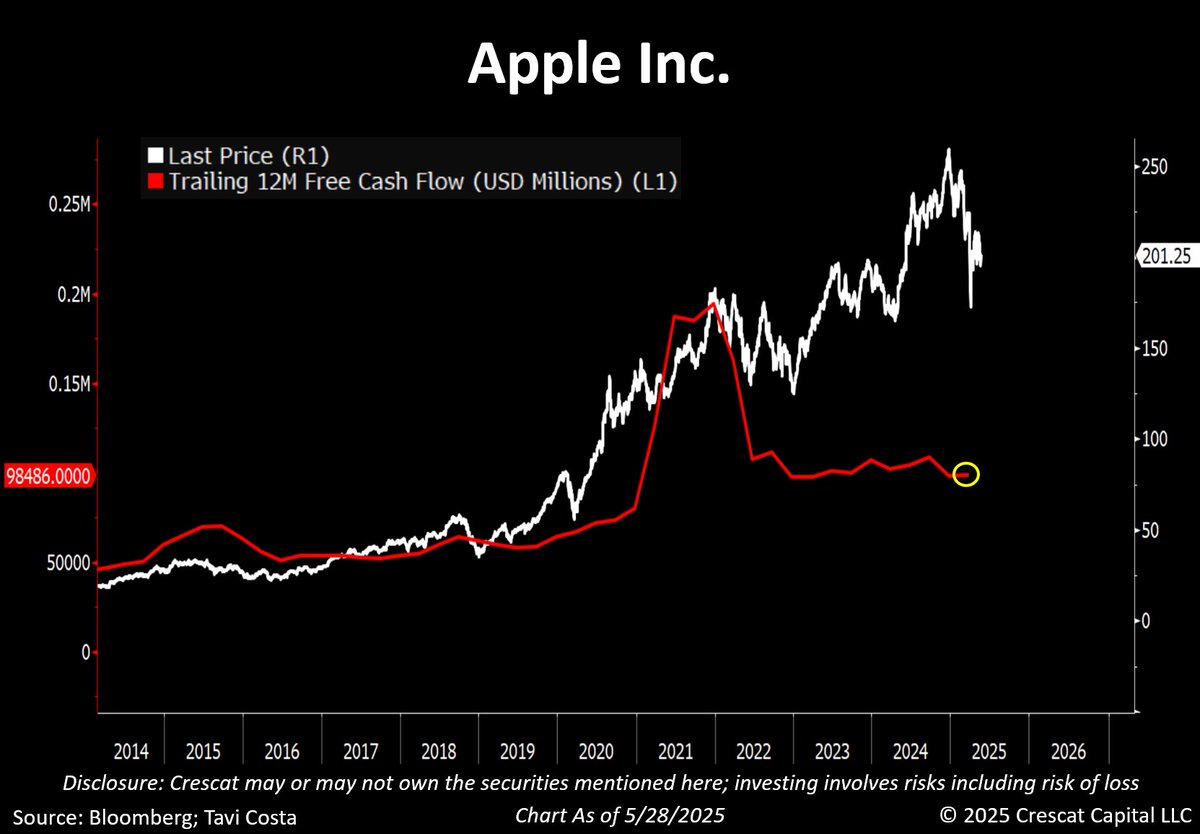

The Evolution Of Value Investing: From Ben Graham To Warren Buffett - And Beyond William Green Chris Begg $AMZN $AAPL $TSLA topgunfp.com/the-evolution-…