TML Trader

@tmltrader

Growth Stock Investor. Focused on finding & trading True Market Leaders. Lead PM tickermonkey.com/tml TML Model Portfolio.

ID: 2715646770

http://tickermonkey.com 08-08-2014 00:14:59

13,13K Tweet

89,89K Followers

86 Following

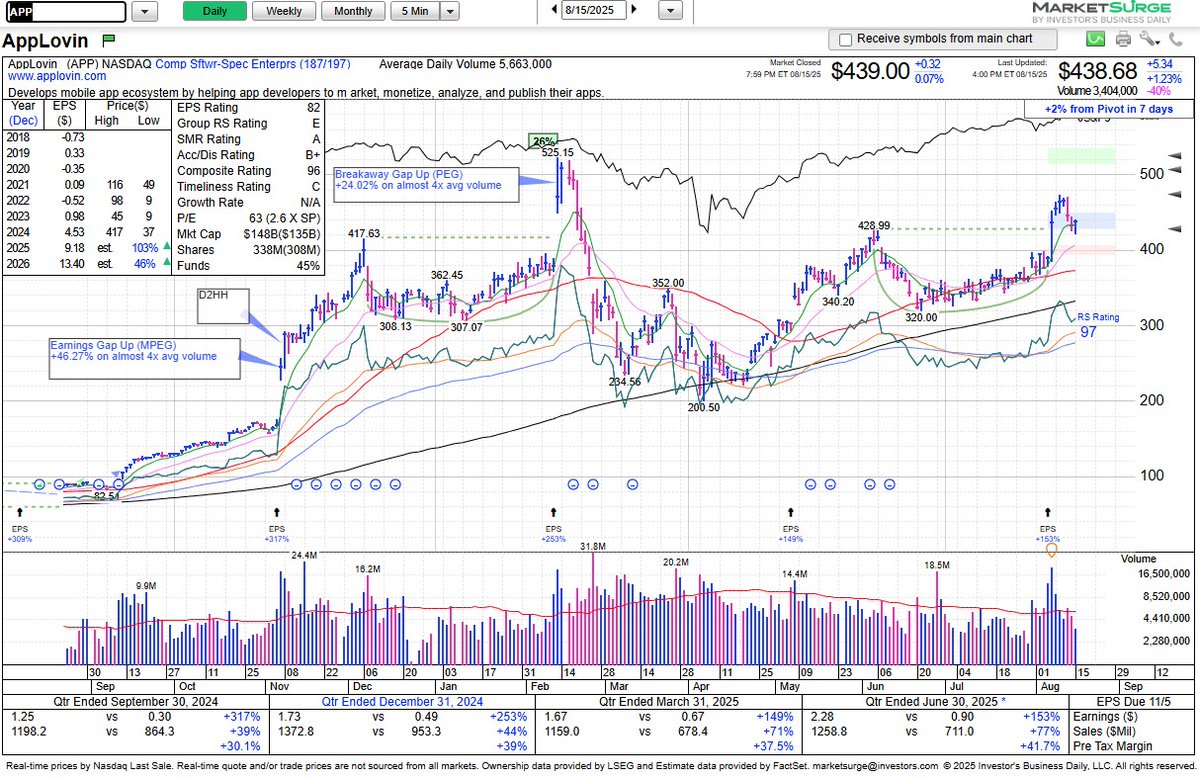

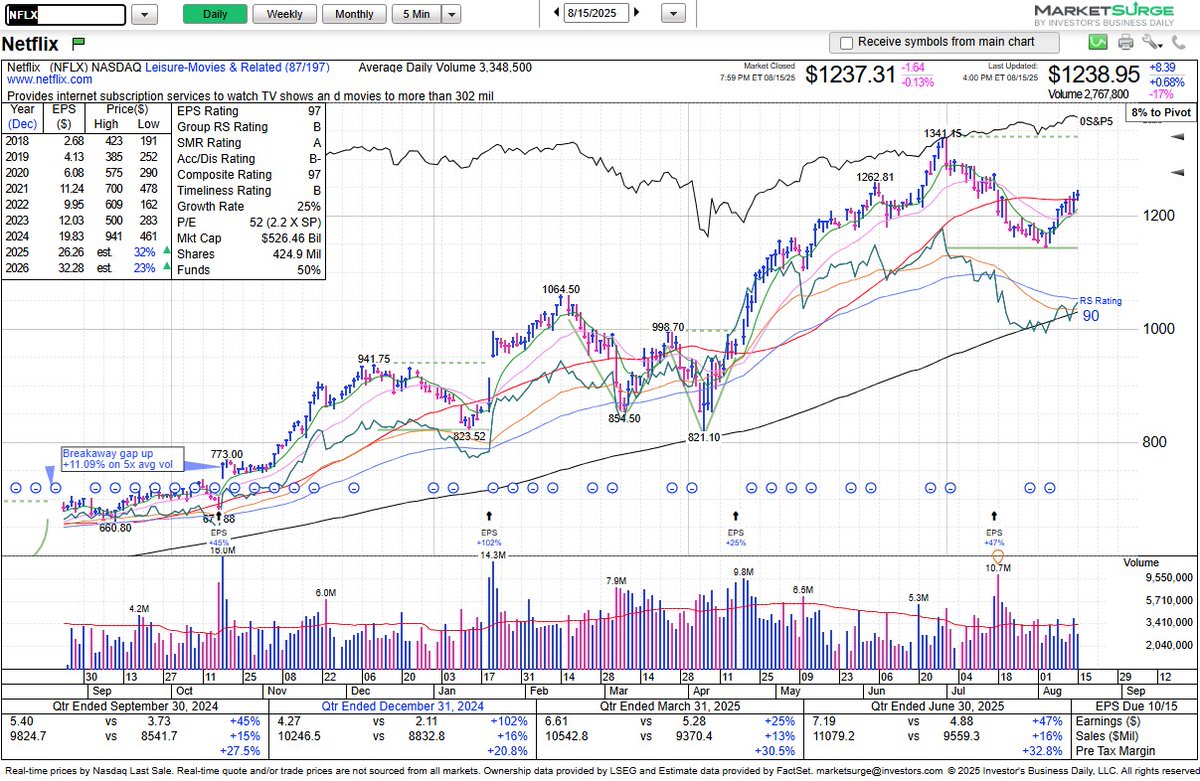

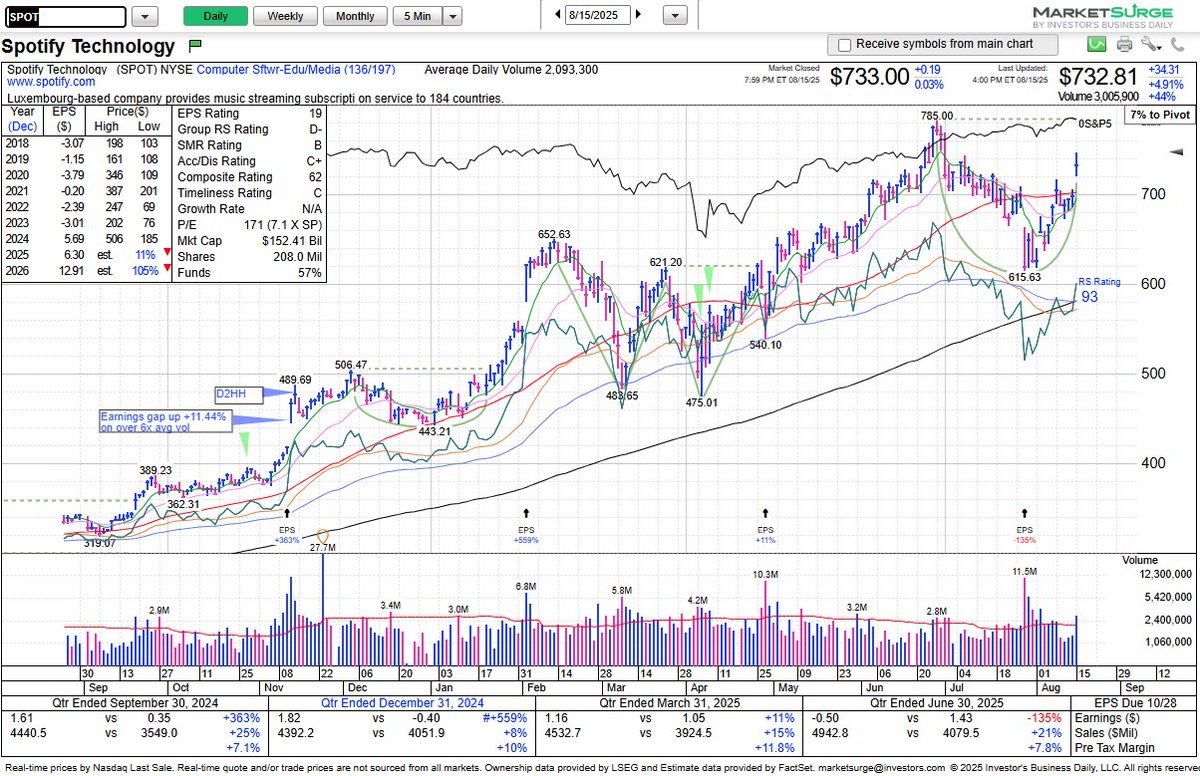

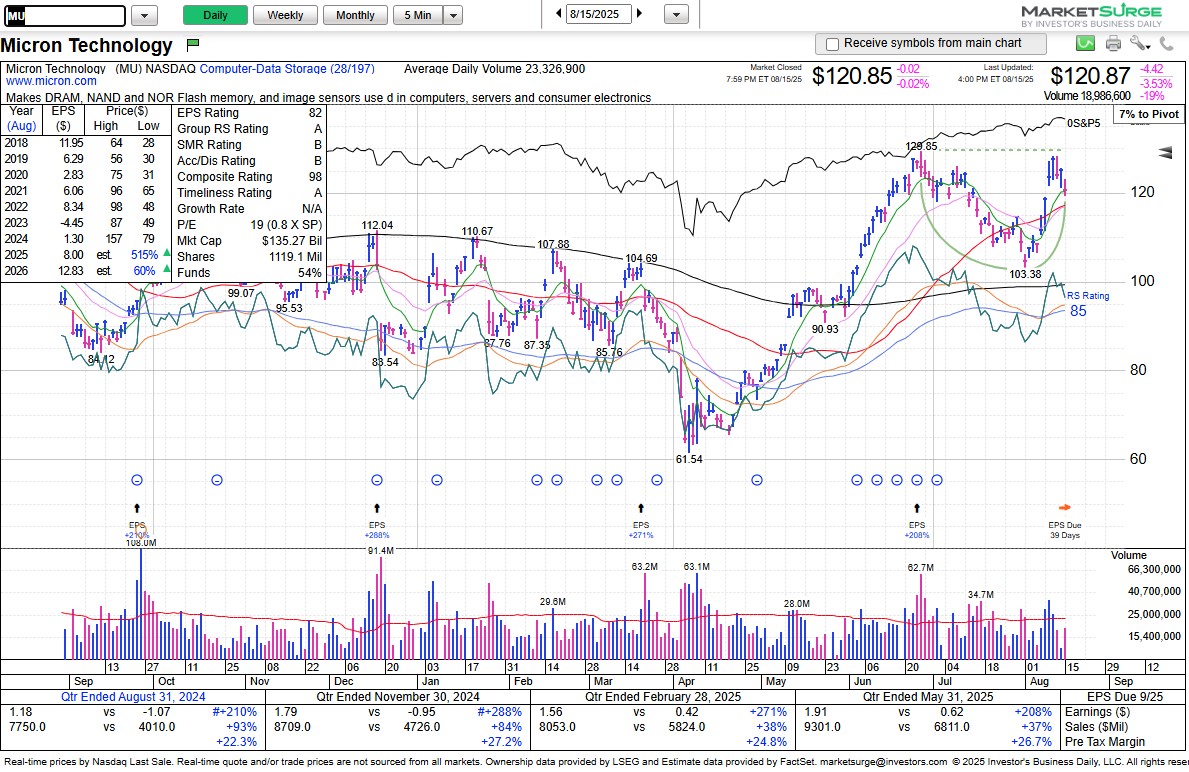

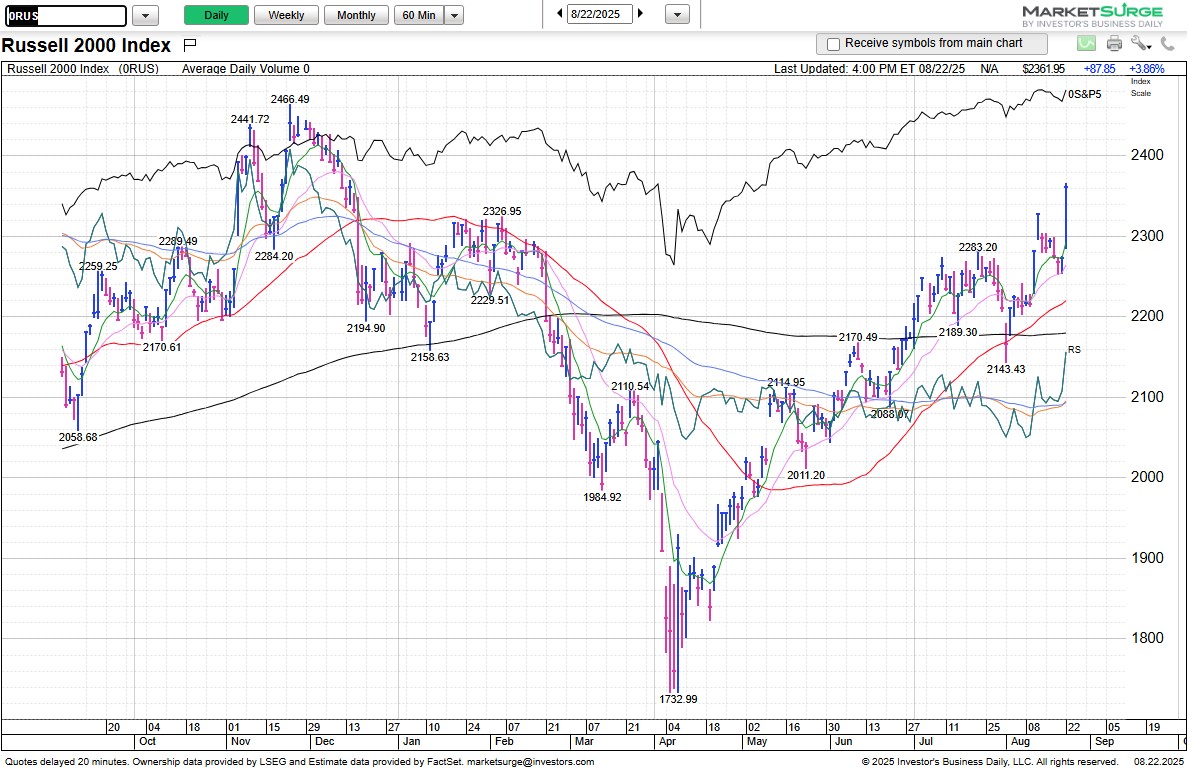

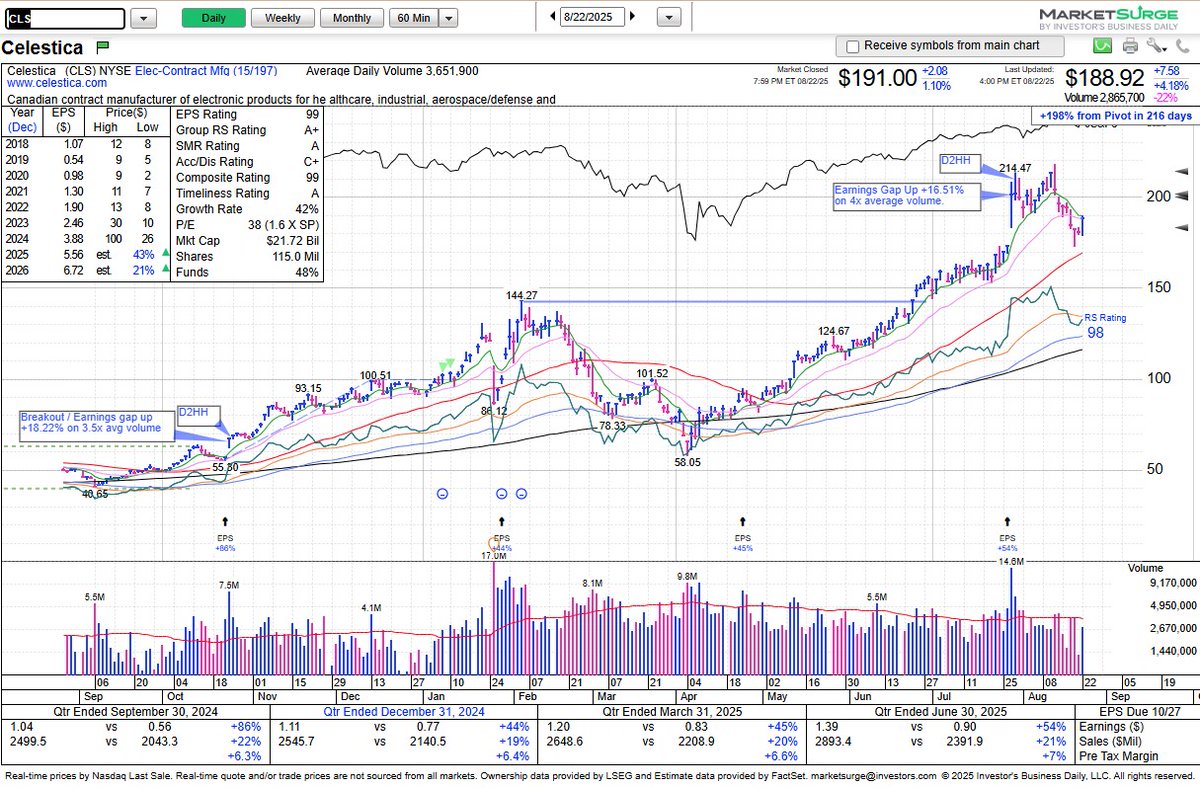

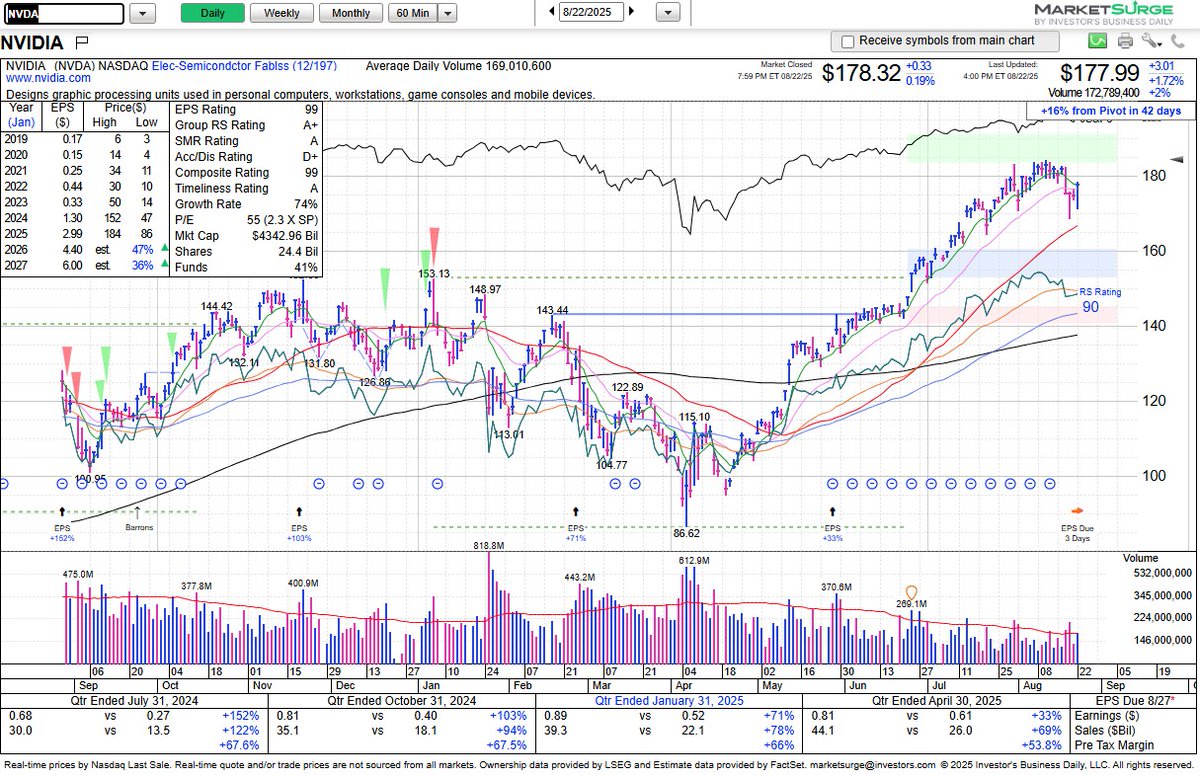

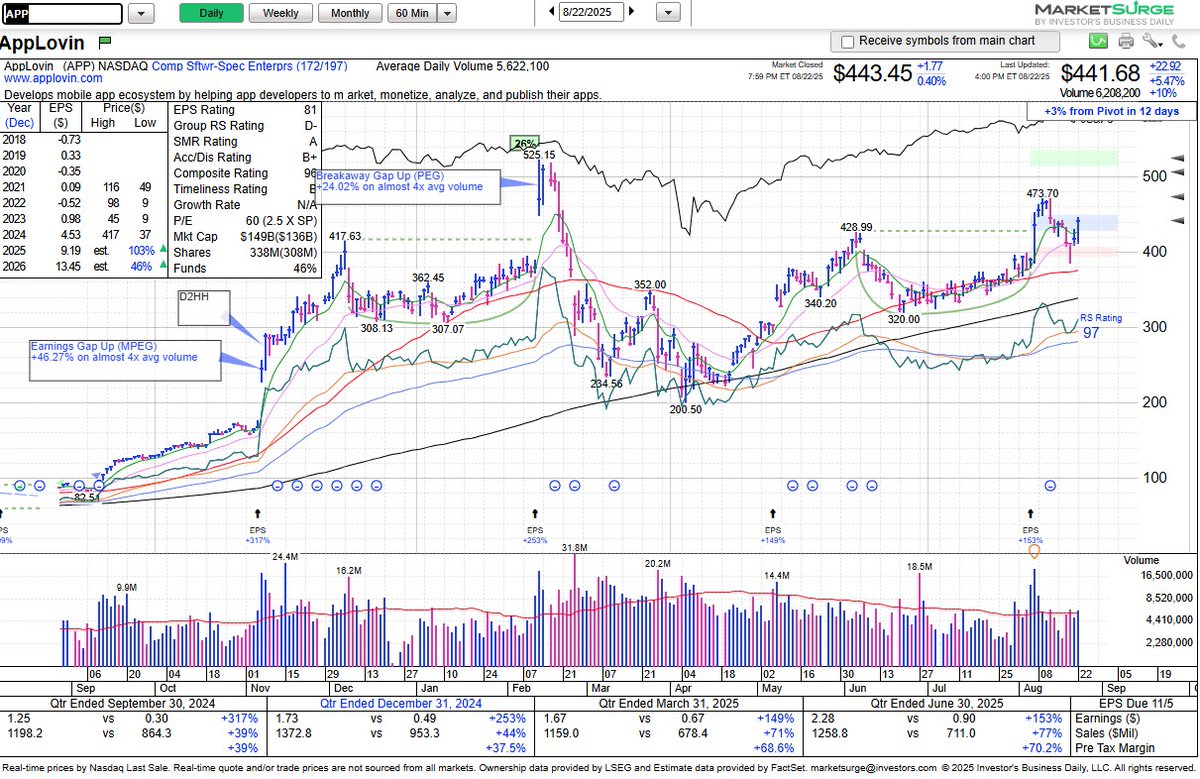

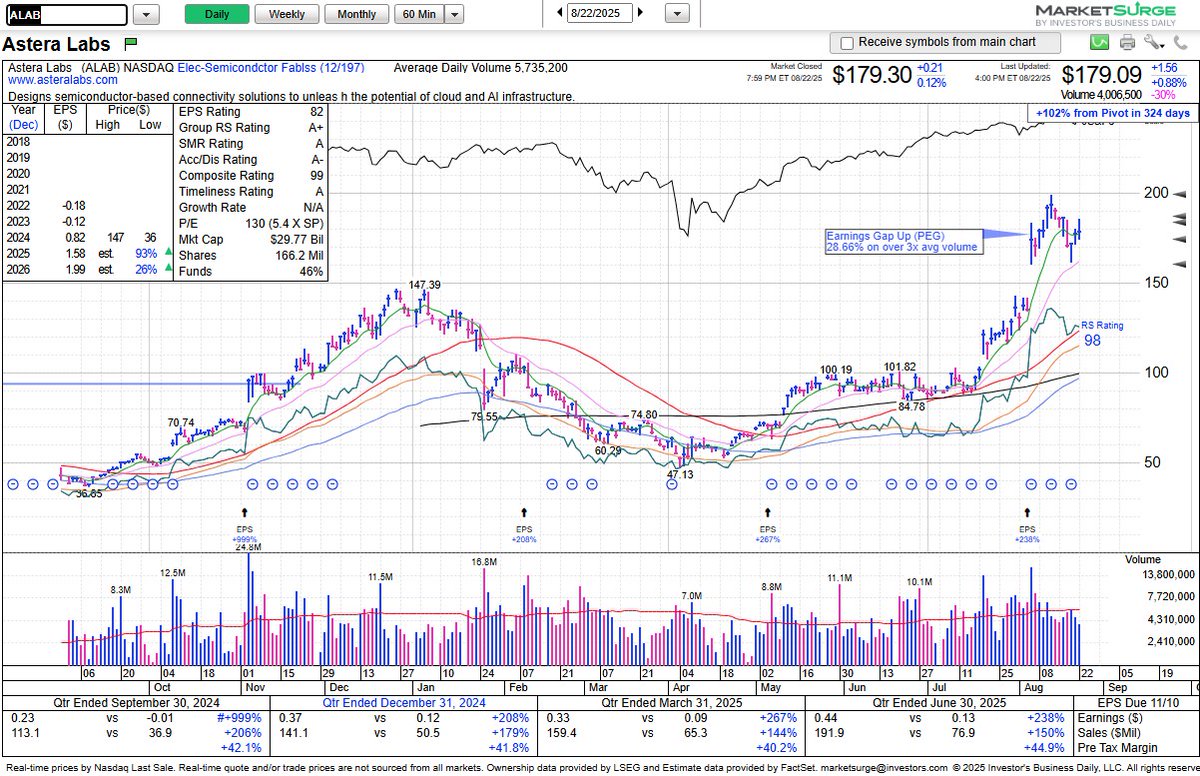

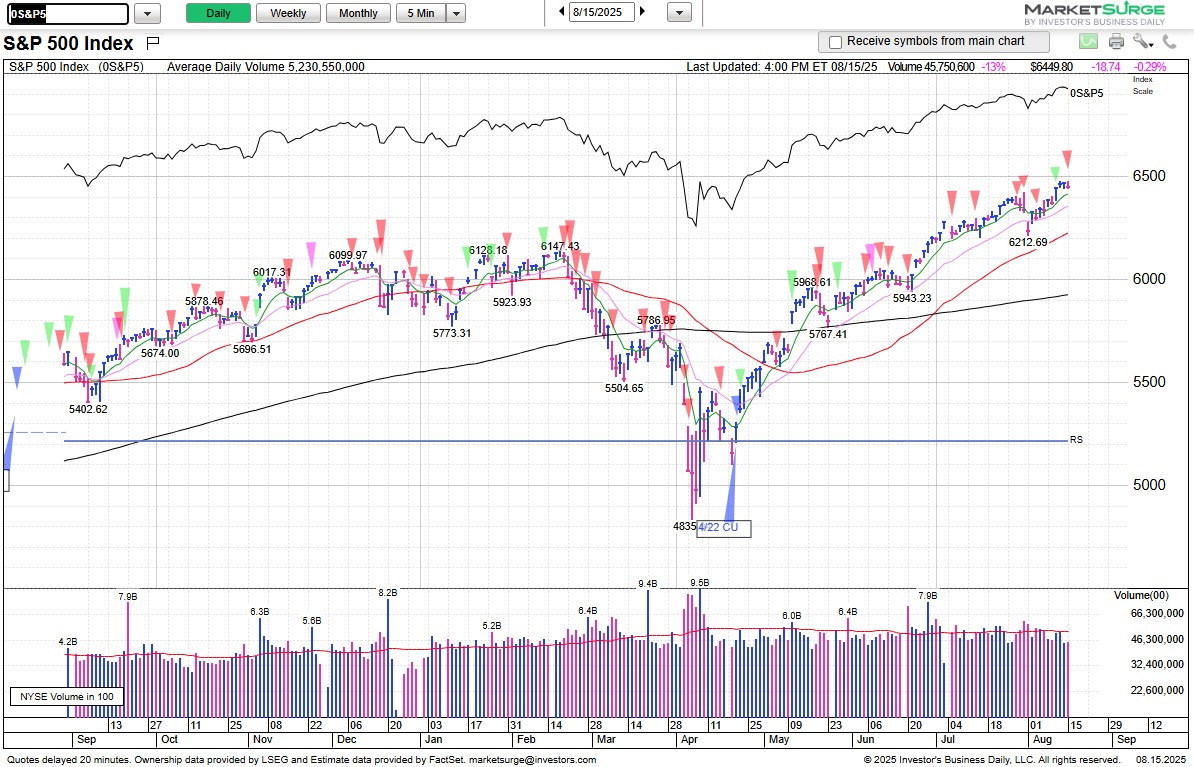

Weekend Review, 8/17: 80% to 100% Exposure Nasdaq & S&P 500 finished at all-time weekly closing highs. Russell 2000 outperformed as it confirmed a new higher high. Distribution days: Nasdaq - 3, S&P 500 - 5 $SPY $QQQ Charts courtesy of MarketSurge

$SOFI finished at a four-year closing high on above average volume as it tried to clear the tight flag pivot of 25.11 after an undercut and rally off the 21-day EMA. Look for an upside follow-through or see if it forms a handle. Charts courtesy of TradingView