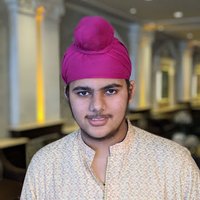

Sanjay Dutt

@thesanjaydutt

Three decades in equity markets. Watching global financial markets & sharing general gyan. Comments on stocks are not recommendations. RTs not an endorsement.

ID: 3103360434

22-03-2015 14:56:00

15,15K Tweet

37,37K Followers

1,1K Following

cc Mahindra Group Anish Shah... In case you haven’t seen it, take a look at this tweet and his timeline on the XUV700. My view — raise the vehicle’s price by ₹10,000, but elevate the service experience to a level where customers wouldn’t even consider exploring another brand in

Humbled and deeply grateful to receive the first-ever Lifetime Achievement Award from Regulation Asia this evening in Singapore. Thank you for this incredible honour recognising over three decades of contributions to shaping India’s and the global securities markets. Truly a

When Regulation Asia honoured Chauhan in Singapore this week with a Lifetime Achievement Award, it wasn’t just a nod to a long career — it was an acknowledgment of the man who quietly built the architecture of India’s modern stock market.* BW NEWSMAKER Column Ashish Chauhan

Here is another Mahindra Group experience... Muthukrishnan Dhandapani

Set Return Expectations Right—Before the Market Does It for You !!…do read by Nooresh Merani nooreshtech.co.in/2025/11/set-re…