The Pulice Group

@thepulicegroup

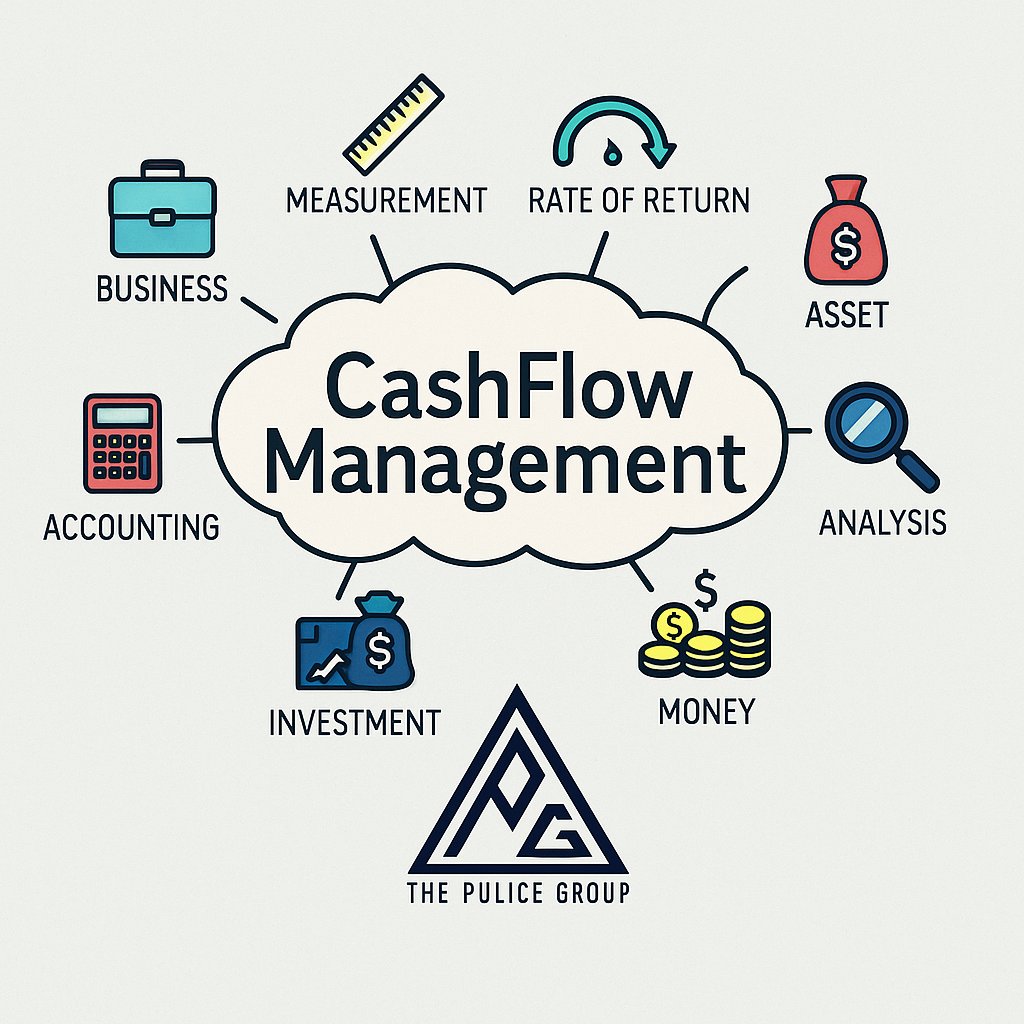

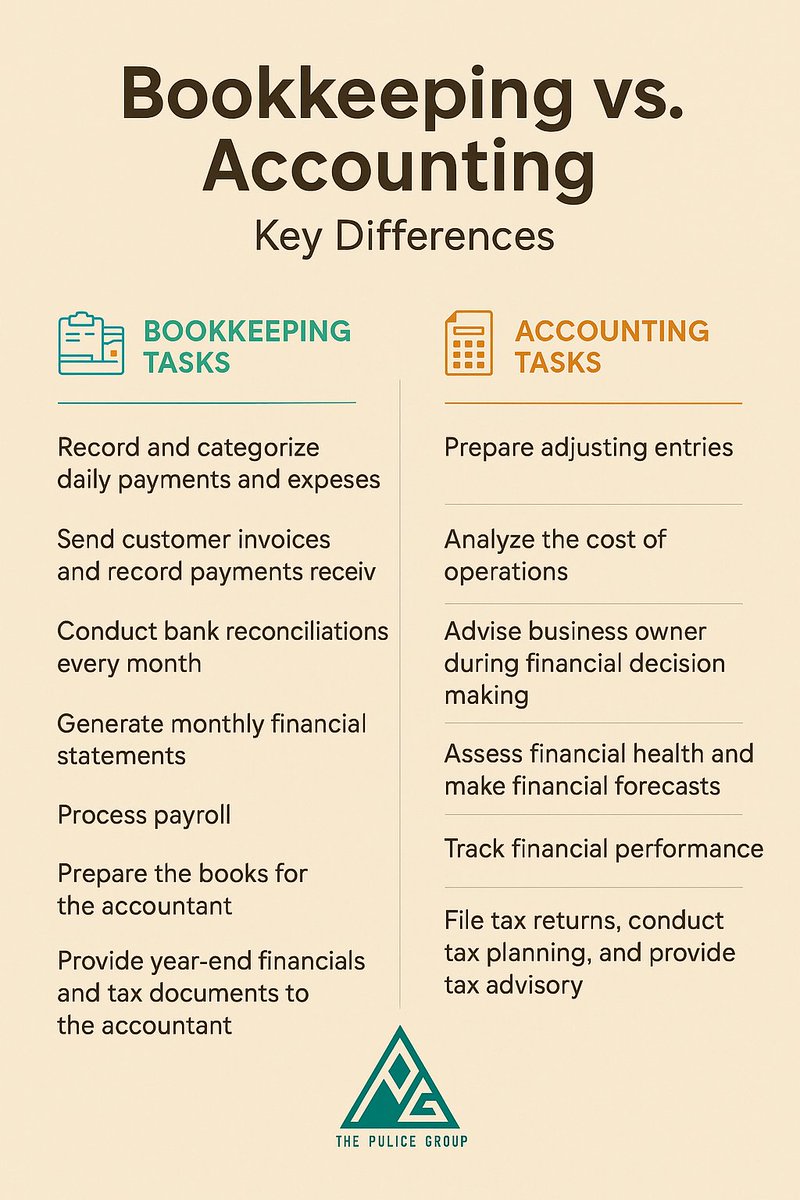

The Pulice Group is a tax and accounting firm that started in 2012 and is located in Herndon, Virginia.

ID: 1924798358868086784

https://www.thepulicegroup.com/ 20-05-2025 12:04:44

26 Tweet

17 Followers

52 Following

💻 Having Bank Connection Issues with QuickBooks Online? Here Are 3 Quick Tips! 1) Stick with Larger U.S. Banks Chase , Bank of America , Capital One , and other major banks have the most stable connections with QuickBooks Online. Smaller or international banks often need