Stephen Koukoulas

@thekouk

Treasury, Head of Global Strategy TD, Advisor to PM, punter. Speaker at Ode Management - goo.gl/3Gj5VZ

MD Market Economics; Also pinkpear.com.au

ID: 43525891

http://www.thekouk.com 30-05-2009 13:14:58

81,81K Tweet

62,62K Followers

2,2K Following

2025 can get better: How's about.... Collingwood minor premiers Collingwood premiers Nick Daicos Browlow Jamie Elliott Coleman #GoPies Collingwood FC

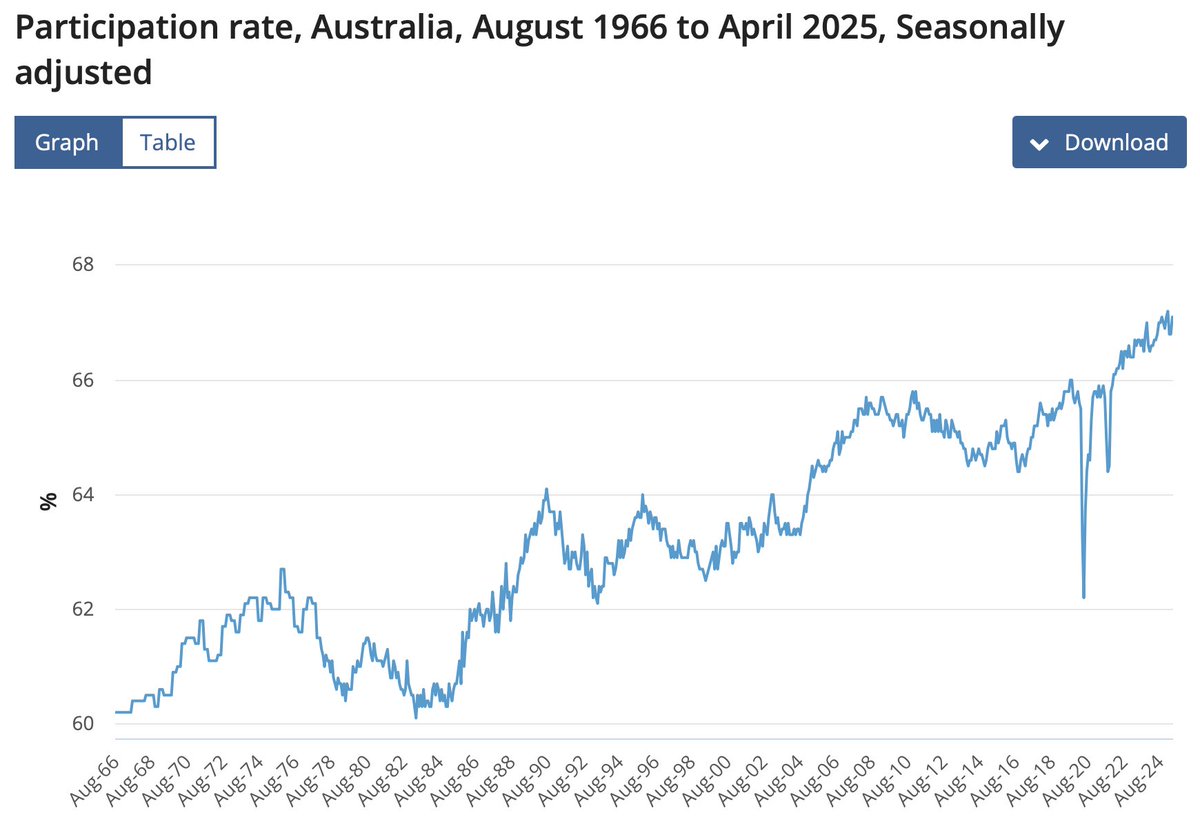

The slower the RBA is to cut rates, the bigger the pile-up of economic problems later. ~ Stephen Koukoulas Stephen Koukoulas The Reserve Bank's latest interest rate cut is too little, too late independentaustralia.net/politics/polit… via @IndependentAus

In retirement, superannuants are required to drawdown their investment assets to fund retirement. For those with a farm, this has to imply they sell it off it bits & bobs from 65 yrs old till death. Otherwise, how do they find the cash to drawn down? industrysuper.com/retirement-inf…