Stackfi

@stackfibase

StackFi | DeFi on Base

Automated yield strategies.

DAO-powered farming.

Transparent. Modular. Onchain.

Early Access Live | Powered by Base

ID: 1918951218262560768

04-05-2025 08:50:10

172 Tweet

324 Followers

20 Following

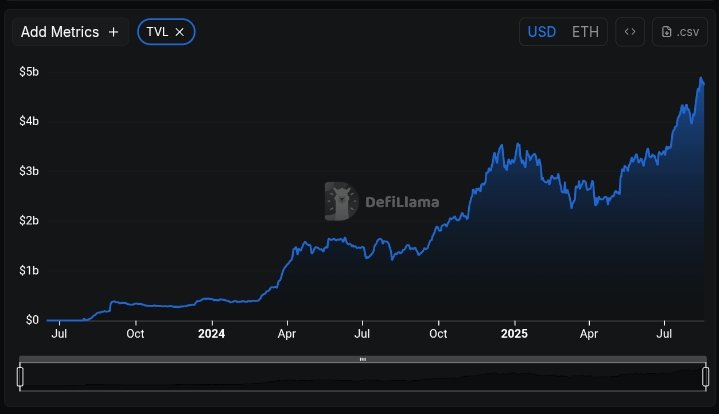

According to public DeFi dashboards (DefiLlama.com), lending on @Base now sits in the hundreds of millions in TVL – clear evidence that demand for leverage and sustainable yield is real. What’s driving it? Capital efficiency. Borrowers want more than plain overcollateralized loans,