Snippet Finance

@snippetfinance

Daily easy to digest Snippets on: stocks | investing | finance; Find them all here ➜ snippet.finance

ID: 1166420580515688448

http://snippet.finance/subscribe 27-08-2019 18:42:01

2,2K Tweet

2,2K Followers

263 Following

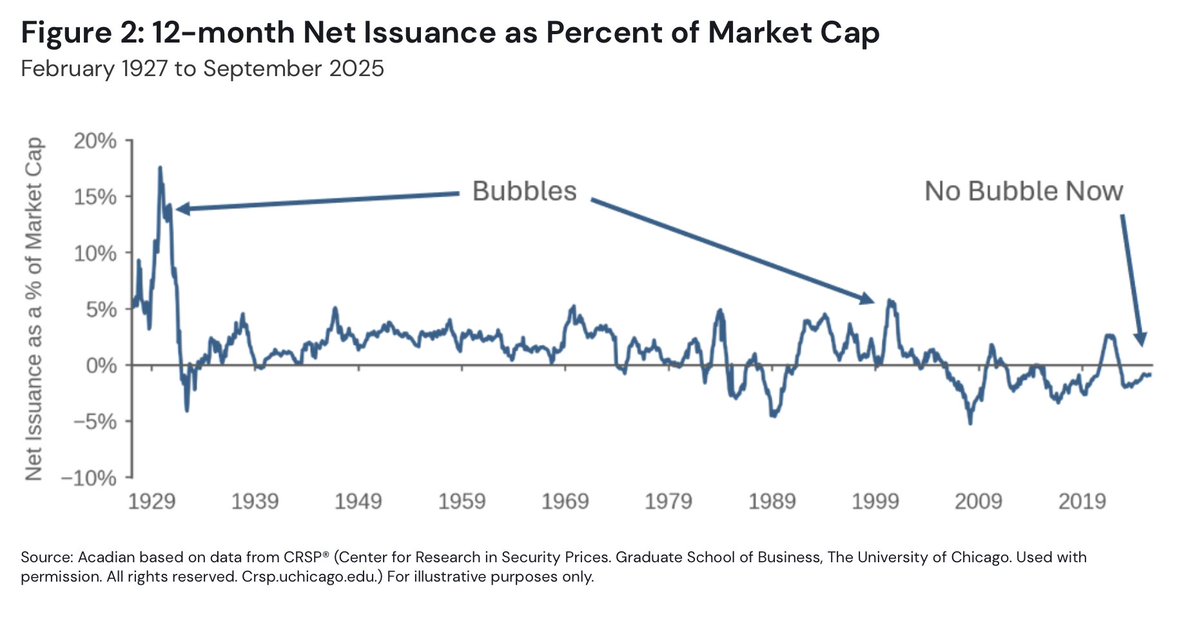

From Acadian Asset Net issuance a sign of bubbles? Does the rise of private assets distort this? Definition: “12-month sum of net issuance, divided by the total capitalization of the market today."

The US is not even close to the world’s most concentrated equity markets. Source: (((The Daily Shot)))

Continuation funds are nearly 20% of global private equity exits in 2025. Source: J.P. Morgan Asset Management