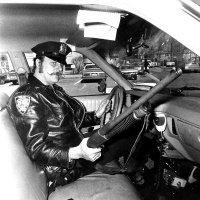

Sgt Muldoon

@s_ziti

trying to figure it all out

ID: 1363687307136688128

22-02-2021 03:09:40

626 Tweet

32 Followers

306 Following

Bill Ackman Federal Reserve The inflation target only became 2% when central banks could not engineer 3% inflation on the back of global financial crisis. 3% will be the new target. Possibly 4%. Not a disaster scenario either. The economy can function fine with mid-single digit borrowing rates.