Rubyto.fuel

@rubenevolent

All things community @fuel_network | Member @safaryclub

ID: 1353463353914617858

24-01-2021 22:03:23

6,6K Tweet

5,5K Followers

1,1K Following

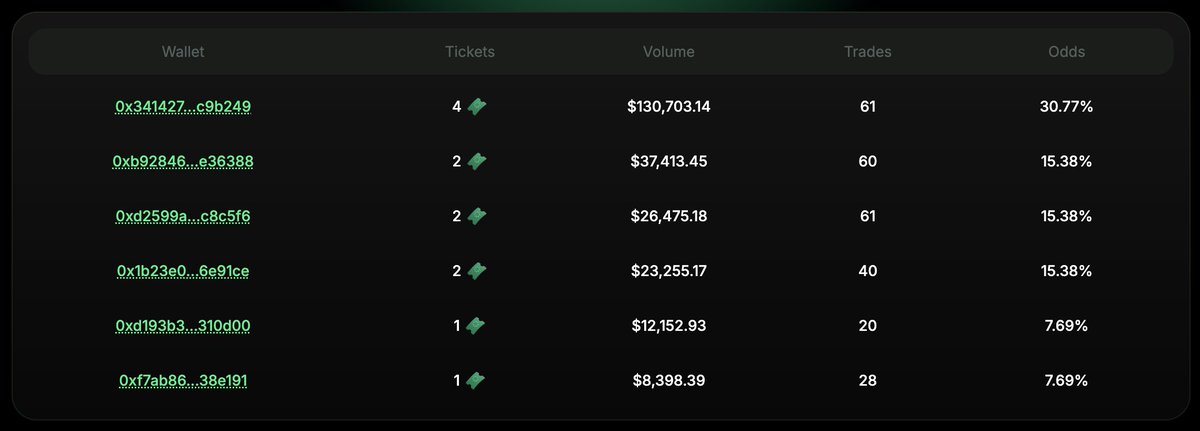

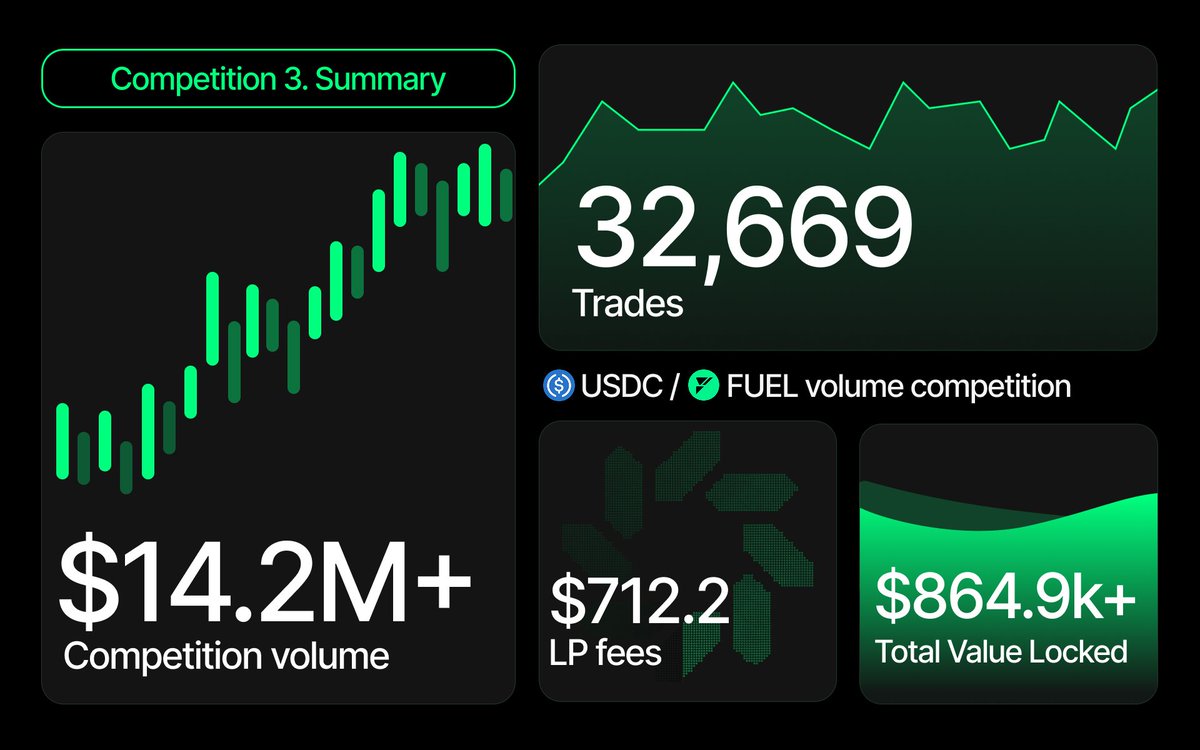

odds to win the lottery on Reactor | Fuel are absolutely ridiculous atm. farm volume at 1bp fees → earn tickets → daily draw → 3 winners per day → win → repeat pretty straightforward