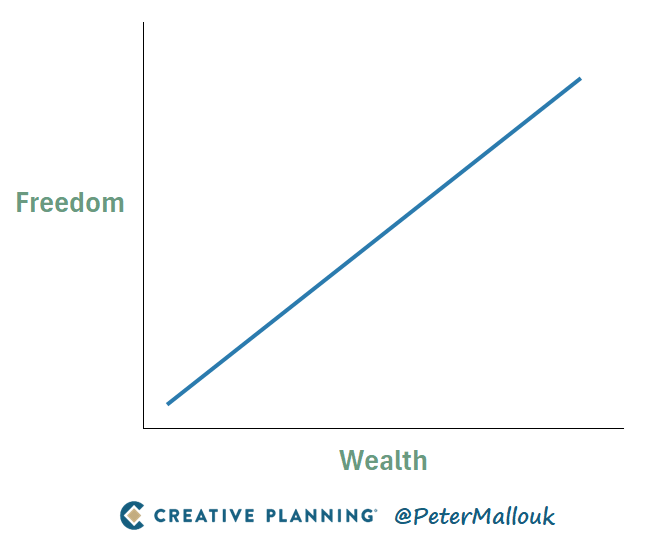

Peter Mallouk

@petermallouk

I simplify Money, Motivation and Mindset | CEO, @CPIWealth | #1 Financial Advisor in America 3 Times | Bestselling Author

ID: 712853262450429952

https://creativeplanning.com 24-03-2016 04:07:16

7,7K Tweet

56,56K Followers

361 Following