Persistdebt (José-Luis Peydró)

@persistdebt

ERC grant 'Debt and Persistence of Financial Shocks' led by José-Luis Peydró

(Banking; Non-banks, Shadow Banks, Fintech; Systemic Risk; Financial Crises; Macro)

ID: 1252974965122572289

https://www.upf.edu/web/debt-persistence-financial-shocks 22-04-2020 14:58:17

203 Tweet

1,1K Followers

649 Following

Forthcoming soon: Doerr Bank for International Settlements, Gissler Federal Reserve, Persistdebt (José-Luis Peydró) Imperial Business School UPF Barcelona, Joachim Voth Economics at Zurich find that Nazi votes surged more, pogroms & deportations more common, in locations more affected by German bank failures in 1931. doi.org/10.1111/jofi.1…

Thanks to all who made the 5th CEPR workshop in #Athens unforgettable! Your contributions were invaluable. Enjoy this snapshot from our gala dinner with the iconic Acropolis. Stay tuned for the 6th edition's CofP. Alex Michaelides/Αλέξανδρος Μιχαηλίδης Persistdebt (José-Luis Peydró) 👇👇 endlessconf.org

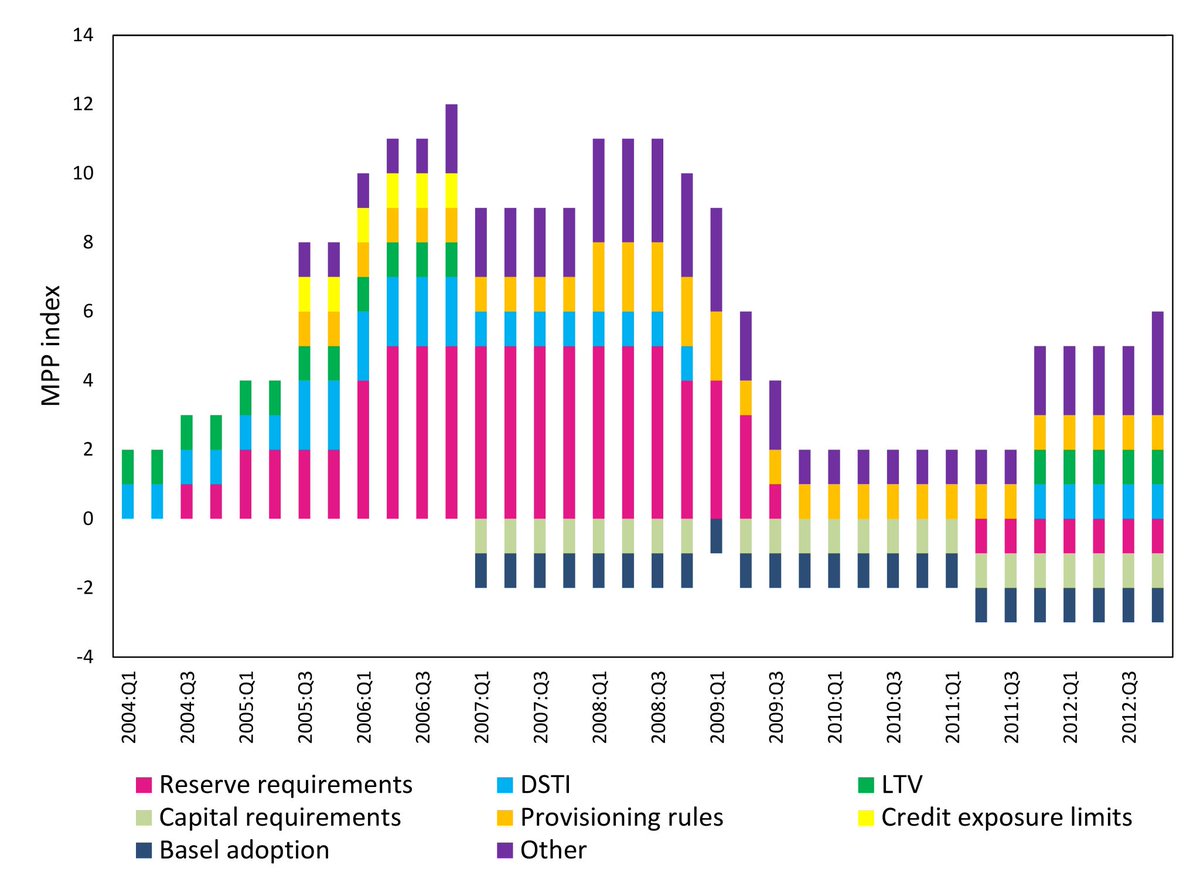

Very happy to share a new blog post on our Management Science forthcoming paper with Irina Mihai, @CMinoiu, and Persistdebt (José-Luis Peydró) Here's a great quick read about the effectiveness of macroprudential policies in "leaning against the global financial cycle": atlantafed.org/blogs/macroblo…

Incredibly happy (and a little proud) that my coauthor and former student Dmitry Kuvshinov, now AP at Pompeu Fabra, was awarded an European Research Council (ERC) starting grant for work on financial crises. So well deserved. MacroFinance & MacroHistory Lab upf.edu/web/focus/inic…

Today we host an impressive group of economists from academia and central banks at the workshop “Monetary Policy and Financial Intermediation: Learning from Heterogeneity and Microdata”, organized by CCA, Banca d'Italia and Norges Bank. bit.ly/3Jae9XR

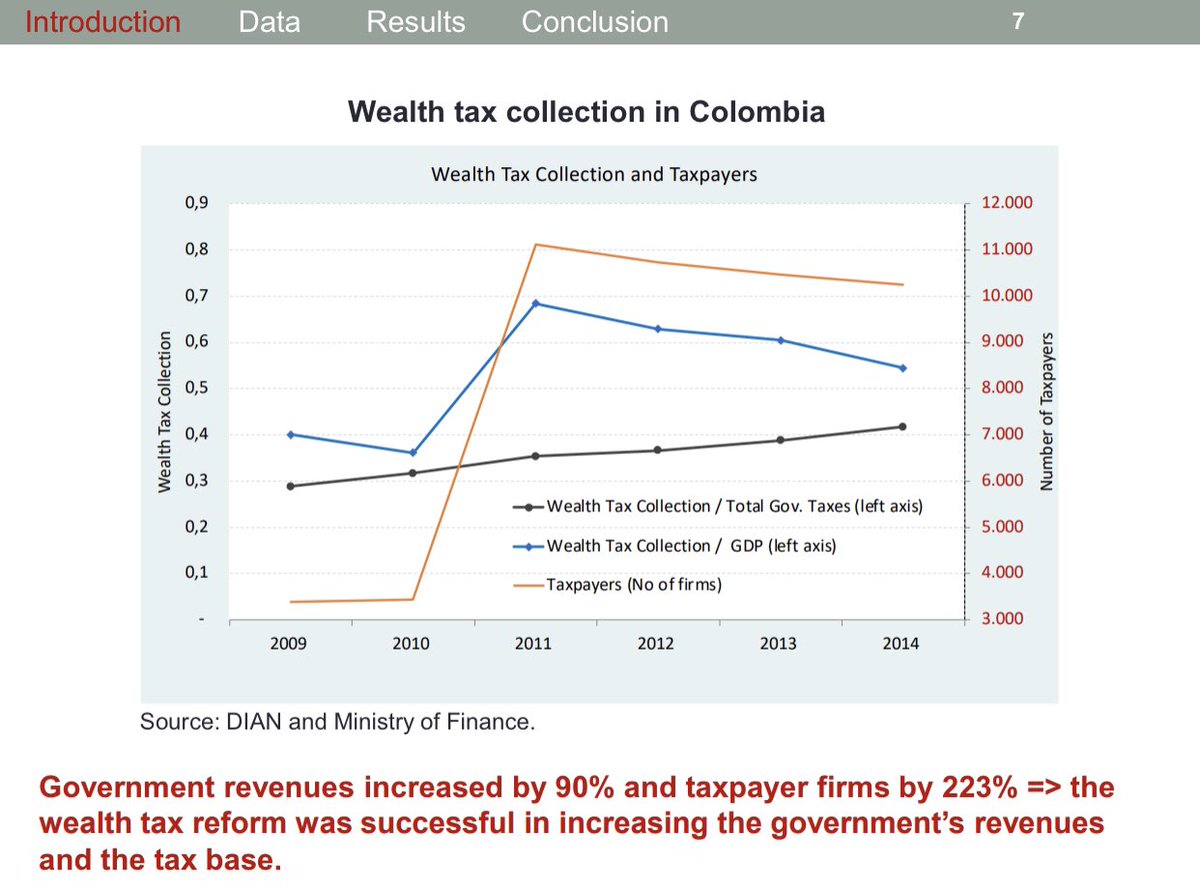

Big thanks to Persistdebt (José-Luis Peydró) for his great keynote on #monetary_policy and #financial_crises at the 100 anniversary of Banco República 🇨🇴 🇨🇴 and for the very useful discussions on our joint project on #taxes and #bank_credit during LACEA LAMES 2023 at Economía Javeriana #Banking #Taxes

Excited to share our paper "Systemic Risk and Monetary Policy" published in the July issue of the Review of Financial Studies! Joint work with amazing co-authors: Luc Laeven Dominik Supera Caterina Mendicino 🇪🇺 🇮🇹 ♒ Persistdebt (José-Luis Peydró) academic.oup.com/rfs/article-ab… Society for Financial Studies short🧵below

Congratulations to Prof Jose-Luis Peydro [Persistdebt (José-Luis Peydró)] whose paper 'The real effects of borrower-based macroprudential policy: Evidence from administrative household-level data' is published in the Journal of Monetary Economics 👏 Read here: imprl.biz/45FV35Z #IBResearch

📣 Speaker Announcement! 📣 We’re delighted to announce that Marcin T. Kacperczyk (Imperial College London and CEPR ) and Persistdebt (José-Luis Peydró) (Imperial College London, UPF Barcelona and CEPR) will be presenting their co-authored paper ‘Carbon Emissions and the Bank-Lending Channel’ at

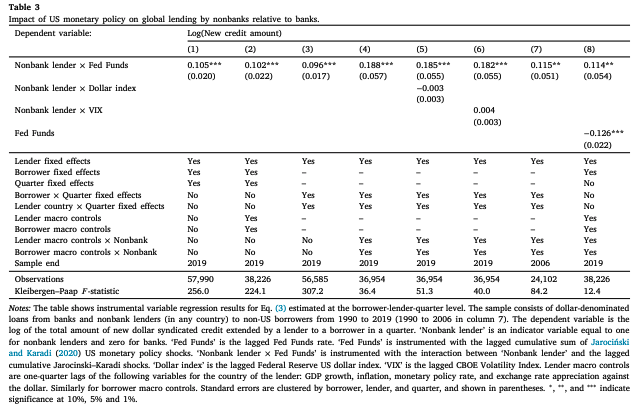

Recently at JIE: "Nonbank lenders as global shock absorbers: Evidence from US monetary policy spillovers" by David Elliott (Bank of England Research), Ralf R. Meisenzahl and José-Luis Peydró (Persistdebt (José-Luis Peydró)). doi.org/10.1016/j.jint… 1/2