Nugget Capital Partners (NCP)

@nuggetcapital

Energy nerd. Markets enthusiast. Research analyst specializing in resources w/ focus on energy. Long-short specialist. Principal at Nugget Capital (NCP) #OOTT

ID: 1505028132226703368

https://nuggetcapitalpartners.substack.com/ 19-03-2022 03:47:28

7,7K Tweet

5,5K Followers

618 Following

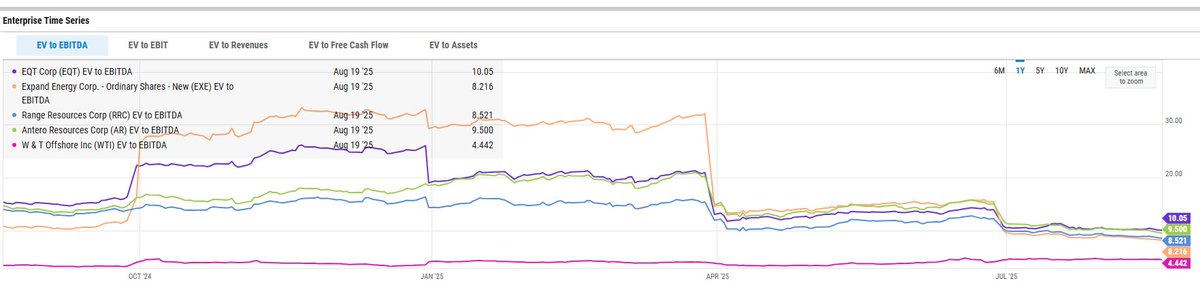

.Andrew Bell trying to drum on BNN ratings when he interjects to ask Eric Nuttall about $BTE.TO $BTE and cites it as being a drag on the portfolio. lol. Nuttall is full Appalachian shale natural gas and has left the Canadian oil bulls in the rearview. bnnbloomberg.ca/video/shows/co…

Happy days I hold h/t Nugget Capital Partners (NCP)

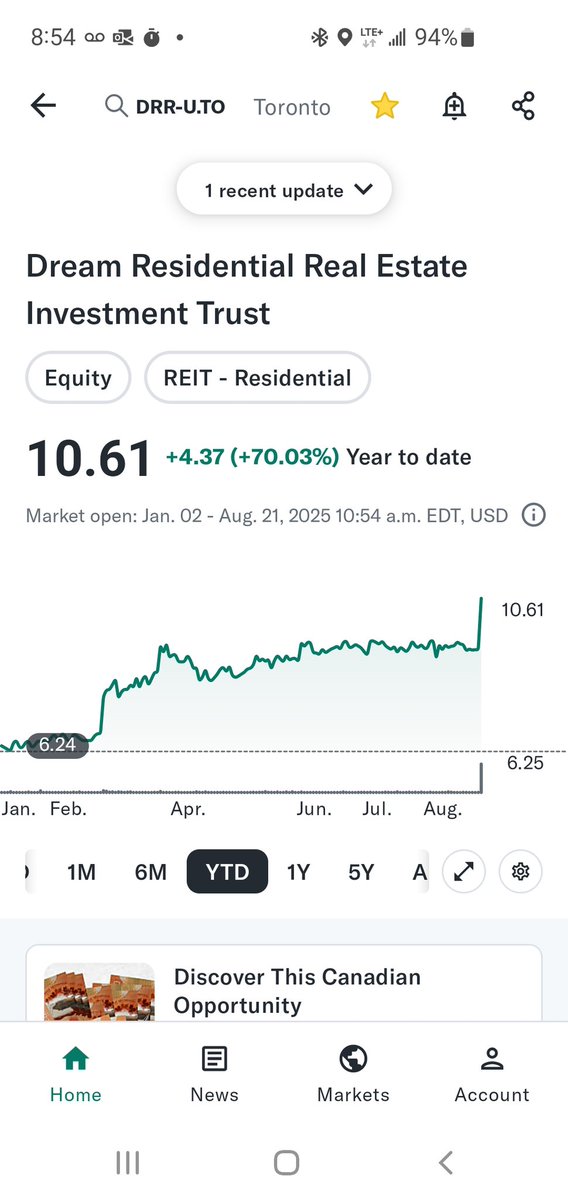

Huge congratulations to the $DRR.U unit holders that got ahead of the take private! No position personally. $HR.UN is next to go! Nugget Capital Partners (NCP) DilithiumCap Chris in Canada 🍁 PerpetualValue

Nugget Capital Partners (NCP) Parrafincontrol globenewswire.com/news-release/2…

Kind of makes you second question the entire market not just oil cos when $BTE.TO is up Zethus Capital ManitobaCanuck.