️ 근면성실코인왕❤️ Memecoin Butter

@moonsik77

Alphagroup NFT Collabo manager Korea Number 1 Airdrop t.me/coinking77 youtube.com/channel/UCNlNY…

ID: 1355090754687832065

https://www.youtube.com/channel/UCNlNY3NMLcdKfkikDpMWzMw 29-01-2021 09:49:54

2,2K Tweet

5,5K Followers

1,1K Following

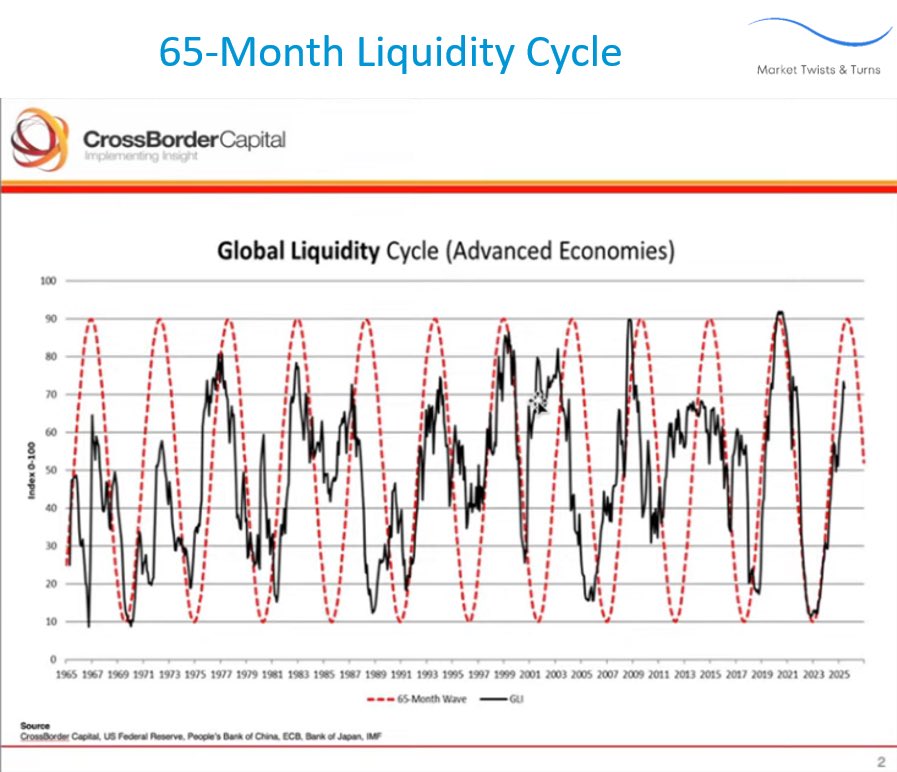

Where We Are in the 65 Month Liquidity Cycle (Nov 9, 2025) Look past the noise and this chart by CrossBorder Capital/ GLIndexes shows global liquidity moves in a 65 month tide. The red dashed curve is the rhythm; the black line is reality. When the black line climbs toward the dashed crest,