Gavin Wendt

@minelifereport

Providing independent coverage of Australian resource stocks, commodities and issues impacting the broader mining and energy sectors internationally.

ID: 2556866400

http://www.minelife.com.au 09-06-2014 13:40:20

4,4K Tweet

3,3K Followers

1,1K Following

Coverage stock Melbana Energy is strongly outperforming the #crude #oil price as it makes encouraging progress on two major project fronts, in #Cuba and Western Australia. MAY is targeting maiden commercial oil production from Cuba in early 2025.

Coverage stock New Murchison Gold (ASX:NMG) is up 200% over the past 12 months and significantly outperforming the A$ #gold price (up 42%). NMG is enjoying great drilling success at its Crown Prince gold deposit in WA and has released strong feasibility results that demonstrate a robust project.

Another emerging gold play that is outperforming is coverage stock Rox Resources (ASX:RXL). Over the past 12 months RXL is up 111% versus a 44% gain for A$ #gold. The latest drilling results are adding confidence to RXL's Youanmi Gold Project resource in Western Australia.

Coverage stock dynamic metals ltd is up 114% since coverage initiation in Jan 2023, and has just kicked off a drill campaign of up to 75 holes to test two #gold targets, Anomaly A and Anomaly B, within the Cognac West prospect at its Widgiemooltha Project in Western Australia.

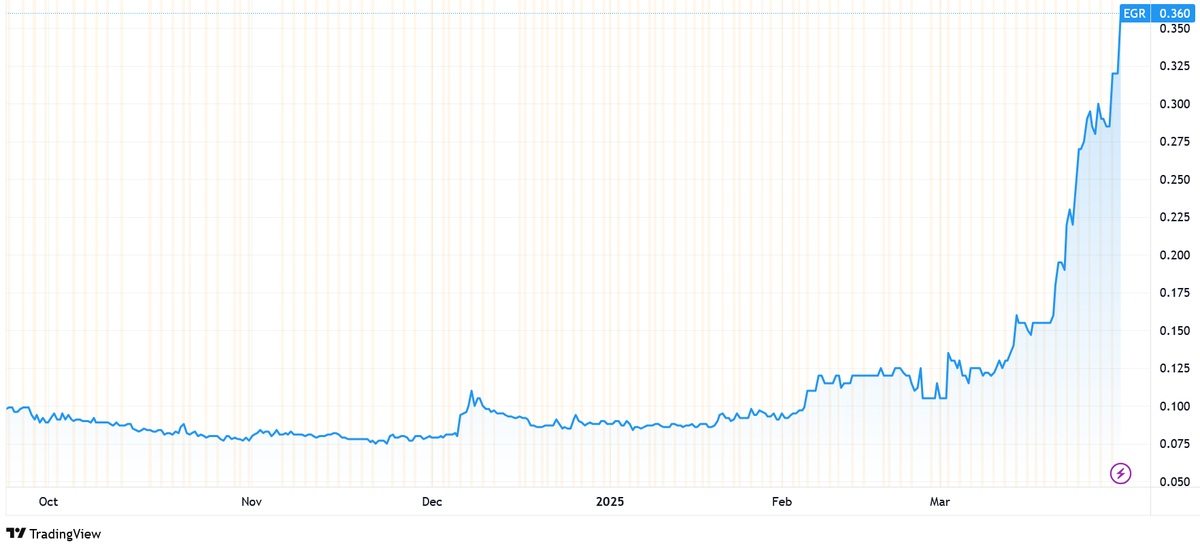

Coverage stock EcoGraf Limited has trebled in price over the past month as it has achieved two major milestones with respect to its Epanko #graphite project in Tanzania (granting of a 25-year mining lease and completion of an Independent Engineering Study) that boost funding prospects.

Coverage stock Trek Metals Ltd (ASX: TKM) is up from a recent low of 2c in Dec to 5.3c currently, with next drilling to begin in May to follow up visual #gold hits at its Christmas Creek Project in WA's Kimberley region. Former owner Newmont spent ~$6M on exploration on the project.

Coverage stock RAREX - Phosphate Enabled Rare Earths ASX:REE (ASX: REE) has surged from $0.008 in March to $0.036 on the back of significant updates with respect to its Cummins Range rare earths project in WA. Specifically, REE has provided specific details with respect to the #scandium and #gallium potential.

One of the best-performing emerging #gold stocks is long-time coverage stock Antipa Minerals Limited (initiated in 2015). AZY is up almost 400% over the past 12 months, significantly outperforming the A$ gold price (up 48%), as its Paterson province acreage has grown in size and appeal.

Coverage stock Flagship Minerals (ASX:FLG) has identified potential to expand #gold at depth, along strike and up-dip at its Pantanillo Project in Chile, hosting a 47.4Mt @ 0.69g/t Au for 1.05Moz Au qualifying foreign estimate (QFE). Rio2’s nearby 4.8Moz Fenix project is under development.