Michał Moneta | michal.onchain 🔥

@michmoneta

Chief Chef at @OnchainHQ & Assistant Professor at the University of Lodz

⛓️ Web3 | 💡 Research | 📈 Marketing | 💰 Behavioral economics

ID: 2835133977

17-10-2014 15:46:23

3,3K Tweet

6,6K Followers

329 Following

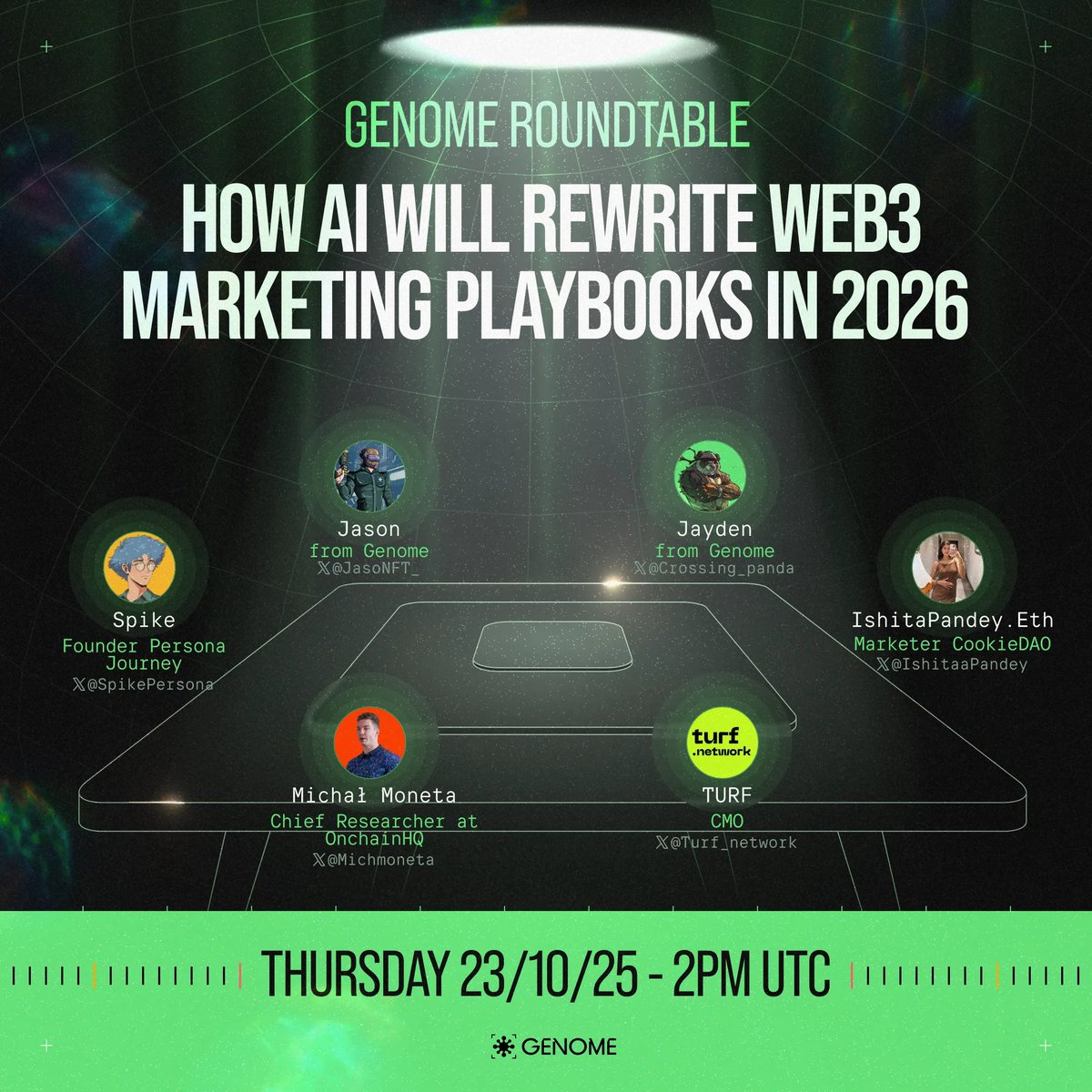

🧬 Genome Roundtable How AI Will Rewrite Web3 Marketing Playbooks in 2026 🤖 Tomorrow, we dive into how AI reshapes marketing - from campaign automation to adaptive strategies Jason 💪 powerlifter.eth @Crossing_panda Spike @Michmoneta IshitaPandey.eth @Turf_network 📅 Oct 23, 2PM UTC