Keith Kaplan

@keithtradesmith

CEO of TradeSmith, a leading fintech and quantitative investment research firm. Investors trust over $30 billion to be monitored and analyzed on our platform.

ID: 1583453781747965953

21-10-2022 13:43:14

114 Tweet

340 Followers

65 Following

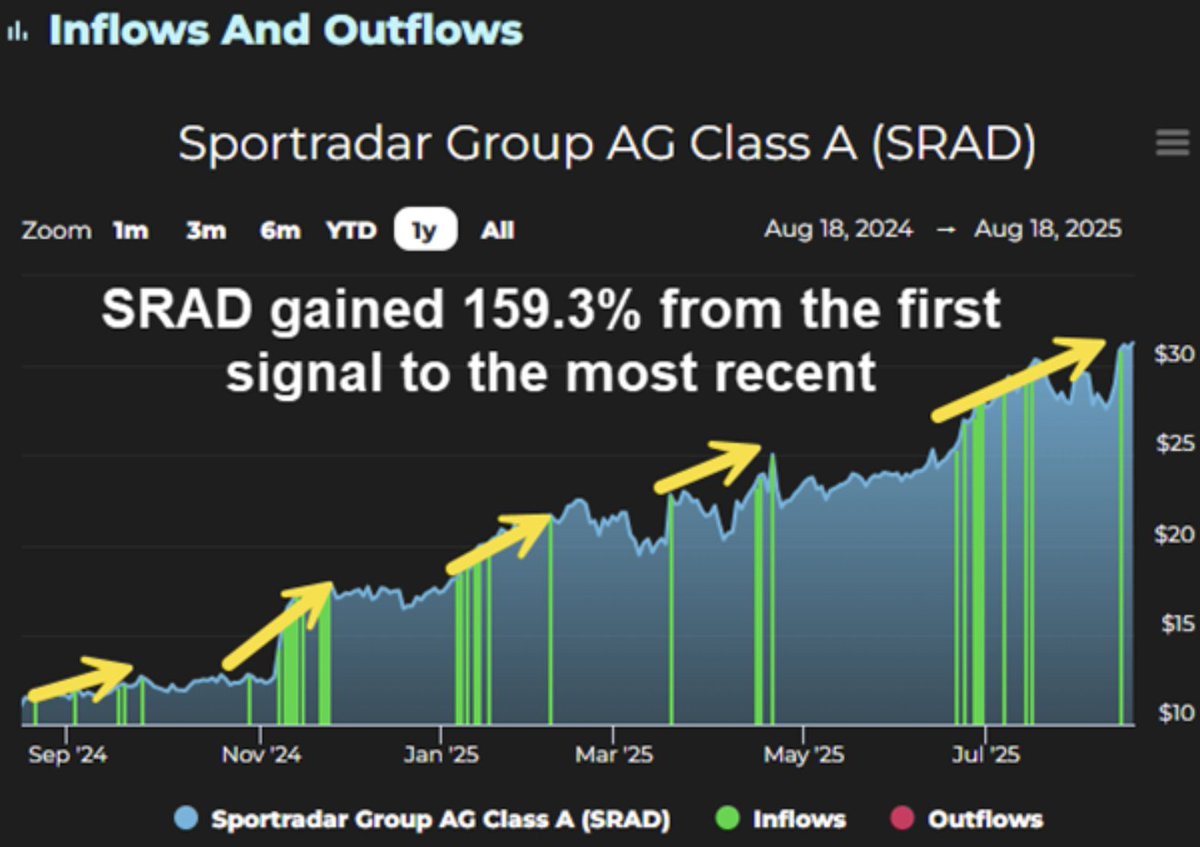

Wall Street is flooding cash into Sportradar $SRAD, the ultimate #AI powerhouse in sports data and betting—and savvy investors are taking notice! As revealed in a recent Jason Bodner TradeSmith_TM analysis, tracking "Big Money" flows from institutions (which drive 70% of