Keelan Cooper

@keelancooper7

Financial analyst & wordsmith @Stockopedia | Stock market enthusiast by day, globe-trotter by night | Views are my own 🌍📈

ID: 1324298812190527488

https://www.stockopedia.com 05-11-2020 10:33:47

228 Tweet

375 Followers

1,1K Following

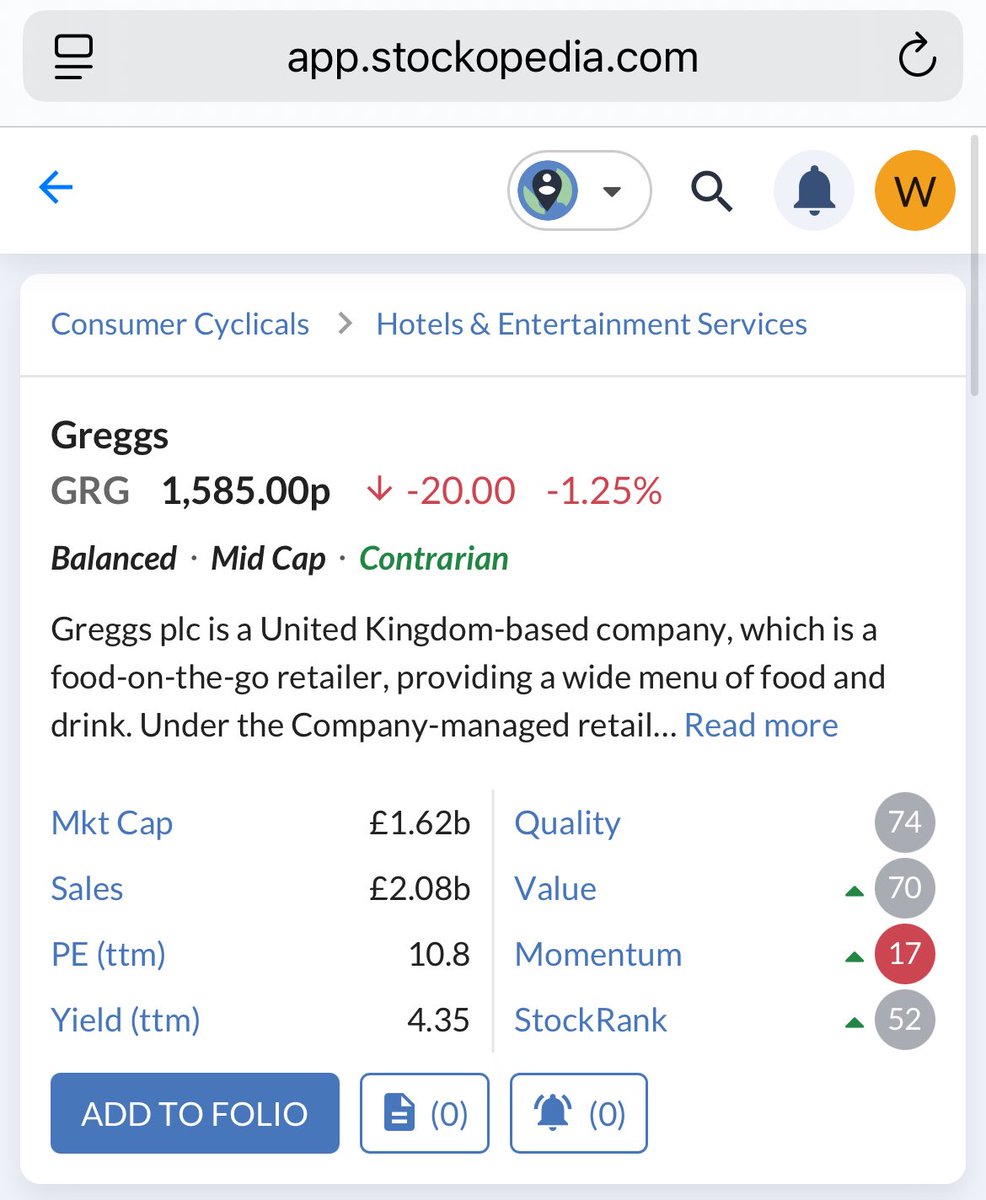

$GRG.L remains one of my favourite stocks to buy at the moment. Suppressed FCF, excellent domestic brand and a growth path that many are understating in my opinion. Stockopedia has both the Quality and Value rankings over >70, I actually think the quality ranking should be

Curious how top investors cut through the noise? 📈 Join Stockopedia CEO, Ed Page Croft, on Thursday 21st August at 5pm (BST) for a live walkthrough of the Stockopedia platform, and how to use it to become a more effective investor. 🔎 Assess any stock in seconds with the QVM

Before founding Stockopedia, Ed Page Croft was a wealth manager at Goldman Sachs. Today, he runs the platform thousands of investors use to beat the market, and on 21st August @ 5pm (BST) you’ll get a behind-the-scenes look at his own investing process. Join Ed for a live

🚀 At the end of June, the brilliant team at Financial Wisdom released a video breaking down the NAPS Portfolio, and it’s become our best-converting video to date. When Ed Page Croft launched the NAPS (No-Admin Portfolio System) in 2015, it started as a bold experiment. No stock tips. No