Katie Steinfeld

@katiesteinfeld

Broker of Record, On The Block Realty | Co-Founder, On The Block Auctions

ID: 236206283

https://www.getontheblock.com 10-01-2011 01:57:12

2,2K Tweet

1,1K Followers

93 Following

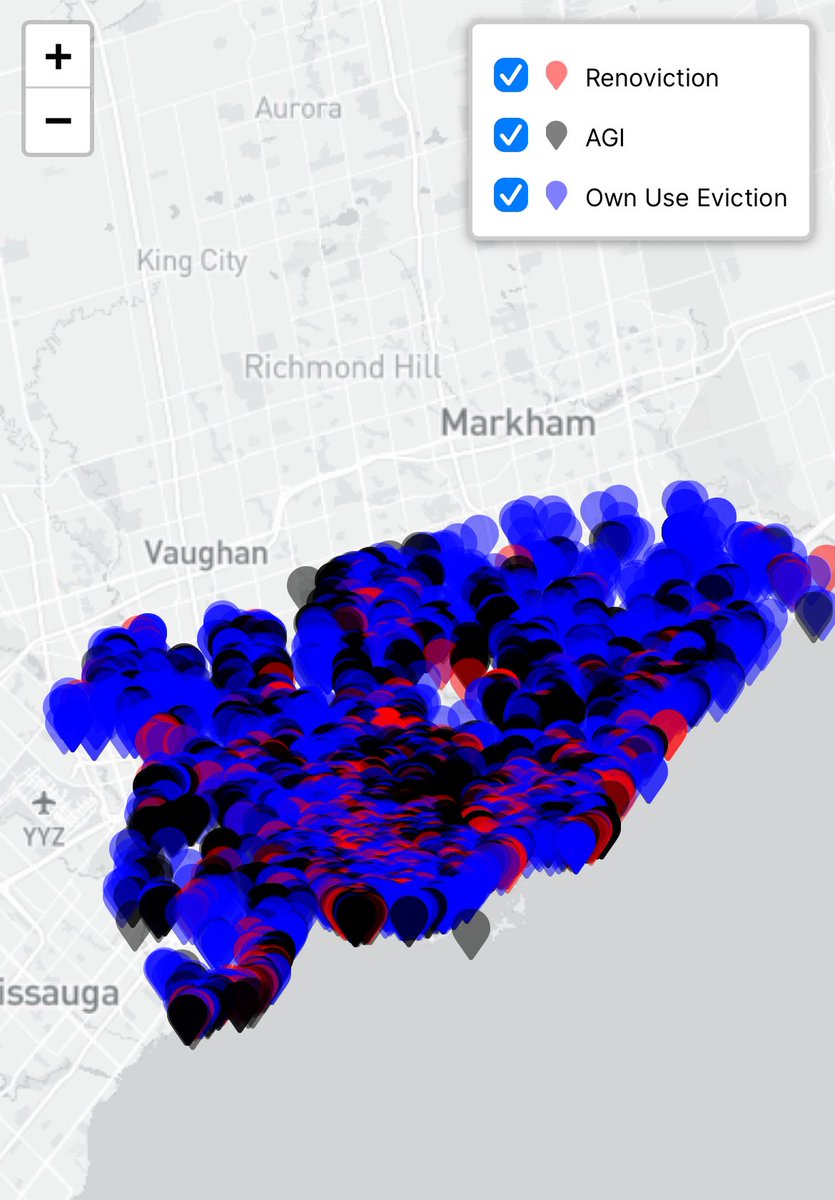

According to RenovictionsTO there are thousands of renoviction, eviction and above guideline rent increases for tenants in the City of Toronto. Will the new renoviction by-law help to reduce the amount of renovictions we see in Toronto?