Jon Arnell

@jon_arnell

Chief Investment Officer på von Euler & Partners en del av Säkra. I marknaden sedan 2004. Fokus global tillgångsallokering. Tidigare aktieanalys och trading.

ID: 3058343356

24-02-2015 07:09:49

3,3K Tweet

928 Followers

182 Following

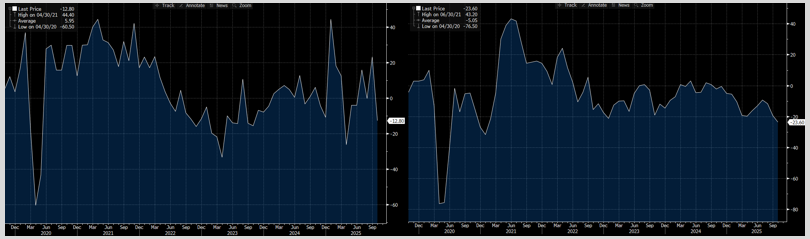

Kommenterade kort i EFN Finansmagasinet ang eventuella följdeffekter i vår marknad på det som nu händer i Japan. #finanstwitter