Joshua Meyer

@jmeyer01223

Research Manager at @ALEC_states | Go Utes! | Opinions are my own

ID: 1427335224543760402

16-08-2021 18:23:45

364 Tweet

149 Followers

783 Following

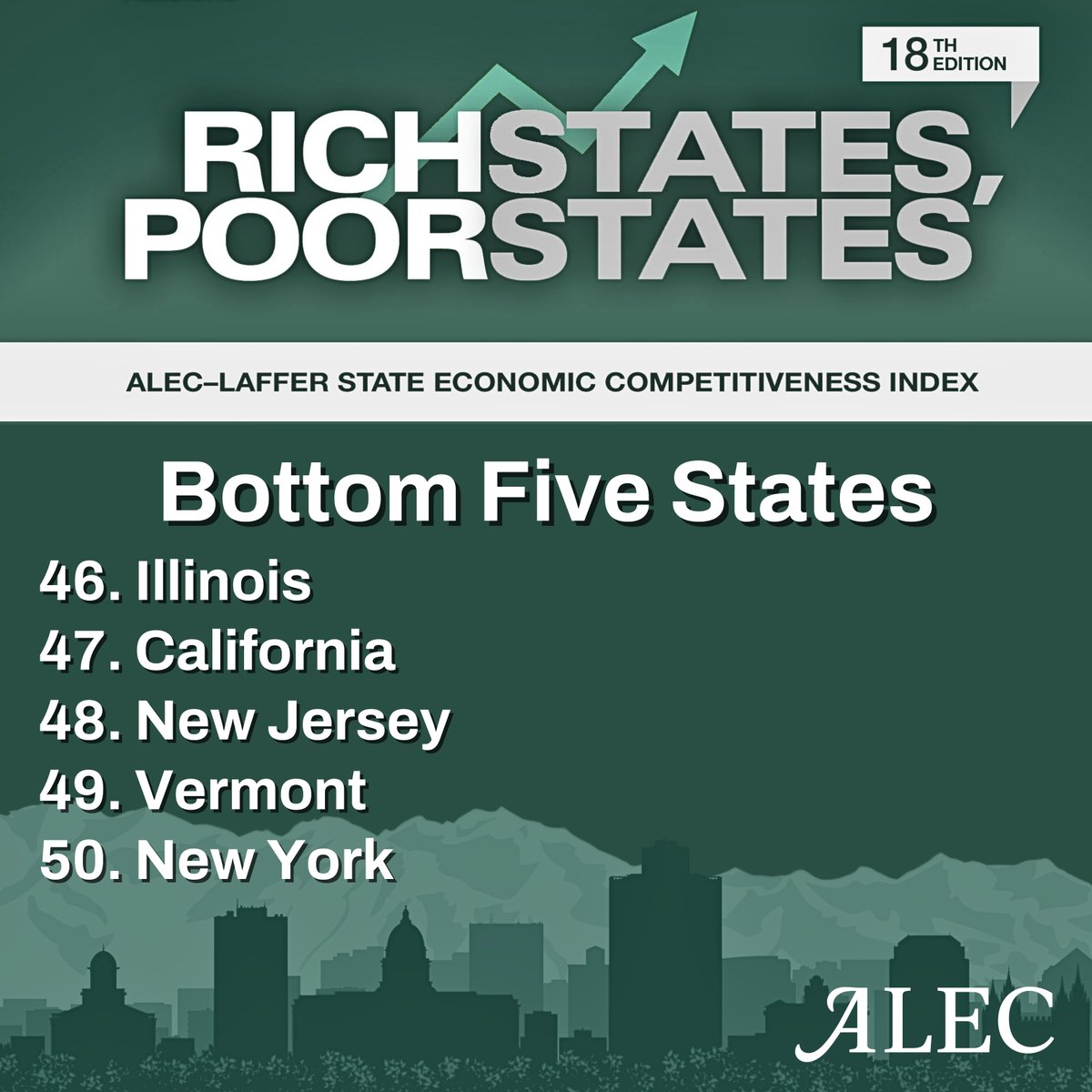

Rich States, Poor States, once again illustrates that Americans vote with their feet—leaving high-tax, high-regulation states in favor of those embracing low taxes, balanced budgets, and worker freedom. RichStatesPoorStates.org Jonathan Williams

Utah is No. 1 in U.S. for economic outlook, according to ALEC (The Center Square) – Utah tops the nation for best economic outlook, according to the 2025 “Rich States, Poor States” policy rankings released Tuesday by the American Legislative Exchange Co... blackchronicle.com/rocky-mountain…

Utah’s consistent top ranking is a testament to the principles that have guided our state for nearly two decades—low taxes, responsible spending and policies that foster innovation and opportunity ~President J. Stuart Adams alec.org/press-release/… #Utah #RSPS #Economy

The Volunteer State’s recipe of low taxes and efficient government is a magnet for individuals and job creators, demonstrating that prosperity is possible when government gets out of the way. ~Jonathan Williams alec.org/press-release/…… #Tennessee #RSPS #Economy

From Stephen Hayes: We aim to become the definitive source for authoritative reporting and analysis of the rule of law. thedispatch.com/article/dispat…

Thank you American Legislative Exchange Council for hosting me to talk about the role economic development policy reforms can play in state government efficiency efforts this morning. Huge thanks as always to Jonathan Williams for the support.

My latest American Institute for Economic Research explainer: "Do The Rich Pay Their Fair Share in Taxes?" The answer: No...they pay MORE than their fair share! Learn more: aier.org/article/do-the…

It is official. Oklahoma is on the path to zero as Governor Kevin Stitt signs income tax elimination plan into law! The Governor has been a tireless champion for taxpayers. This historic achievement is hard-earned.

The House bill made significant gains… But if Congress wants to supercharge growth, restore U.S. manufacturing, and boost productivity—full expensing must be permanent. New The Wall Street Journal op-ed from David M. McIntosh & Jeff Yass: “Full Expensing Boosts Economic Growth” 🔗

Club for Growth The Wall Street Journal David M. McIntosh This is important Permanent tax cuts power the economy Temporary tax cuts do not change incentives

State-run supermarkets: A (bad) statist solution in search of a problem Scott Lincicome breaks down Zohran Mamdani’s plan for government grocery stores in his latest newsletter: thedispatch.com/newsletter/cap…

States can’t build walls to keep their taxpayers or businesses there. @taxeconomist spoke with Duane Patterson on the Hugh Hewitt show warning how high taxes drive businesses from CA & NY, citing In-N-Out’s move to TN and data from Rich States, Poor States.

Government policies directly shape household decisions. NC Rep. Representative Brian Echevarria spoke with Stranded Viking on ALEC TV about his first legislative experiences when taking on property tax reform.