Jaime E. Carrasco

@ijcarrasco

Gold’s money all else credit and few grasp history or economics.

CWM brings decades of experience in fixed income, equity, and more, mining value others miss.

ID: 409640111

https://www.linkedin.com/in/carrasco1 11-11-2011 01:12:35

22,22K Tweet

9,9K Followers

521 Following

Grant Cardone Fully agree. What we do have is an accelerating global loss of purchasing power of the FIAT — and it will only get worse. So what do you do? You hold fast to your gold and silver positions. Not because of short-term price moves, but because paper-price noise becomes

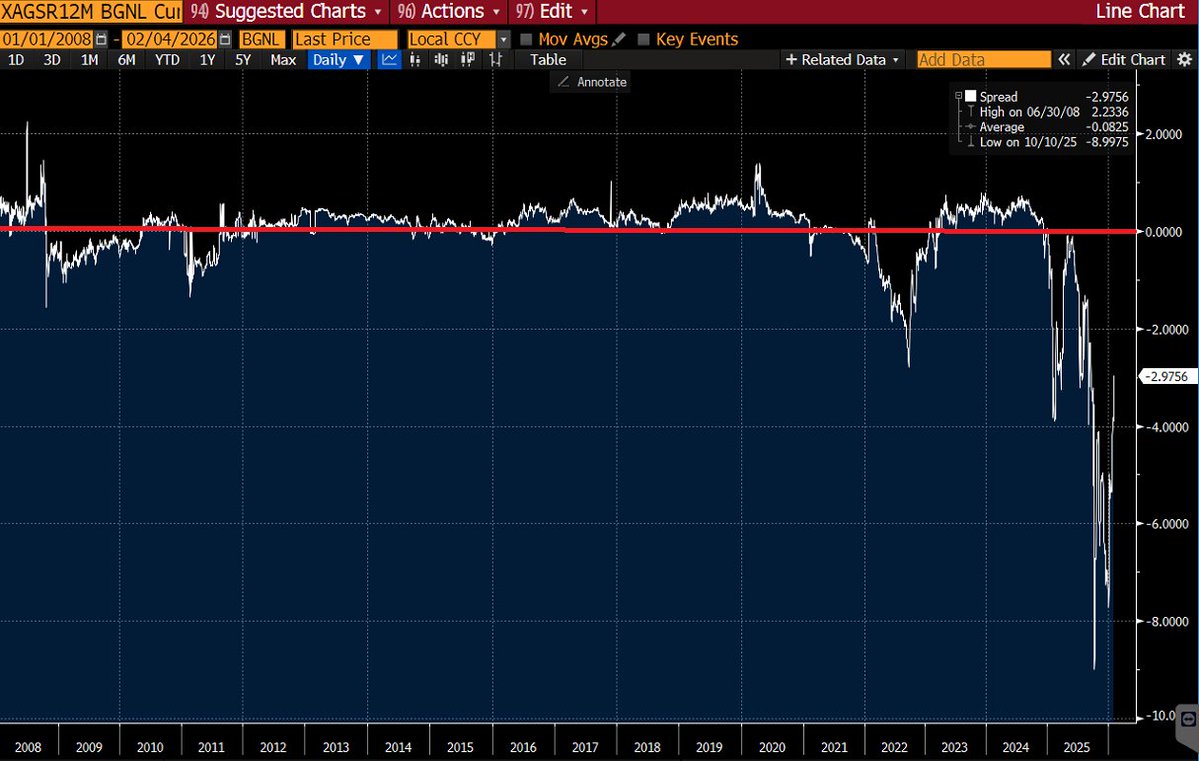

In preparation for my upcoming interview with Charlotte McLeod of InvestingNewsNetwork, I went back and listened to what we discussed last time, on September 14, 2025. Since then: Gold price: ~+42% Silver price: ~+112% Gold–Silver Ratio (GSR): 86.7 → ~59 GDX (Gold Miners ETF): ~+28% SIL

CALLING ALL DRAKE MAYE AND PATRIOTS FANS‼️🗣️ We’re giving away a signed Drake Maye football and all you need to do to enter is: 1) Follow Patriot Place 2) Repost this post The winner will be selected on Friday. Good luck!🏈🔥