Ignition House

@ignitionhouse

Ignition House is a research consultancy specialising in financial services, public sector and B2B research.

ID: 837509094

21-09-2012 10:46:04

74 Tweet

103 Followers

162 Following

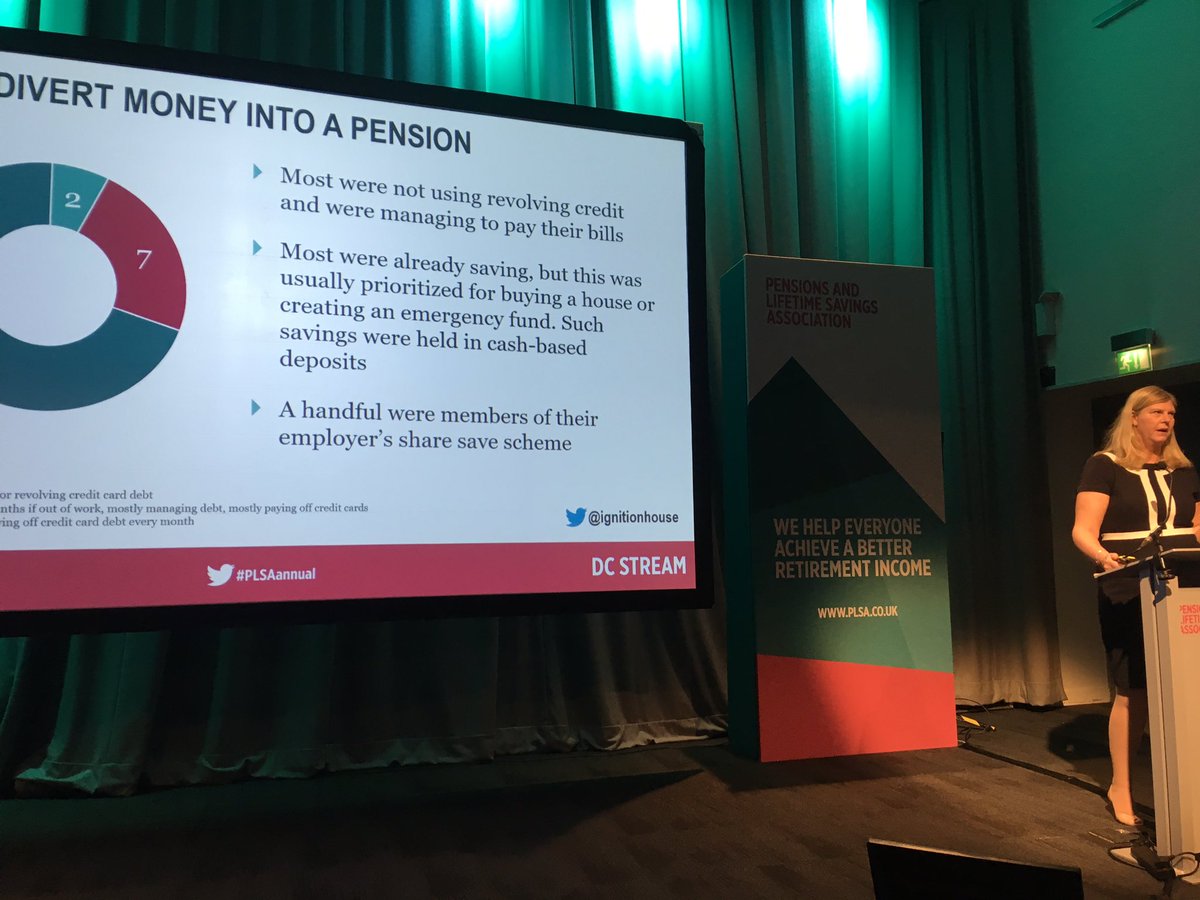

Ignition House research found that people opting out often did so as they feel they can't afford to have a pension. But when their lifestyle was measured the research found most people are actually financially comfortable enough to pay into a pension #PLSAannual

Watching clips from Ignition House with people explaining why they opted out of their #pension schemes makes me oscillate between feeling angry and wanting to cry. People have no idea about the importance of saving or how pensions work! Is the answer mandatory saving? #PLASannual

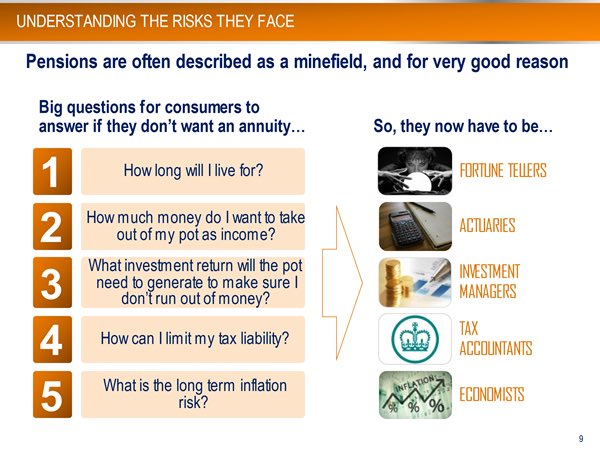

.Ignition House research shows distrust in pensions. Are providers and government the real beneficiaries? Will providers go bust? Do adverts about saving mean you should be more scared? #PLSAannual

Hey Keir McConomy do you think it is acceptable for you to leave a 90 year old man with medical conditions in a fire damaged house for 6 months with no remedial action? No- then please sort it . #vulnerablecustomer