Max

@hyperm4x

founder @HyperstableX

ID: 254966504

20-02-2011 11:24:38

678 Tweet

548 Followers

1,1K Following

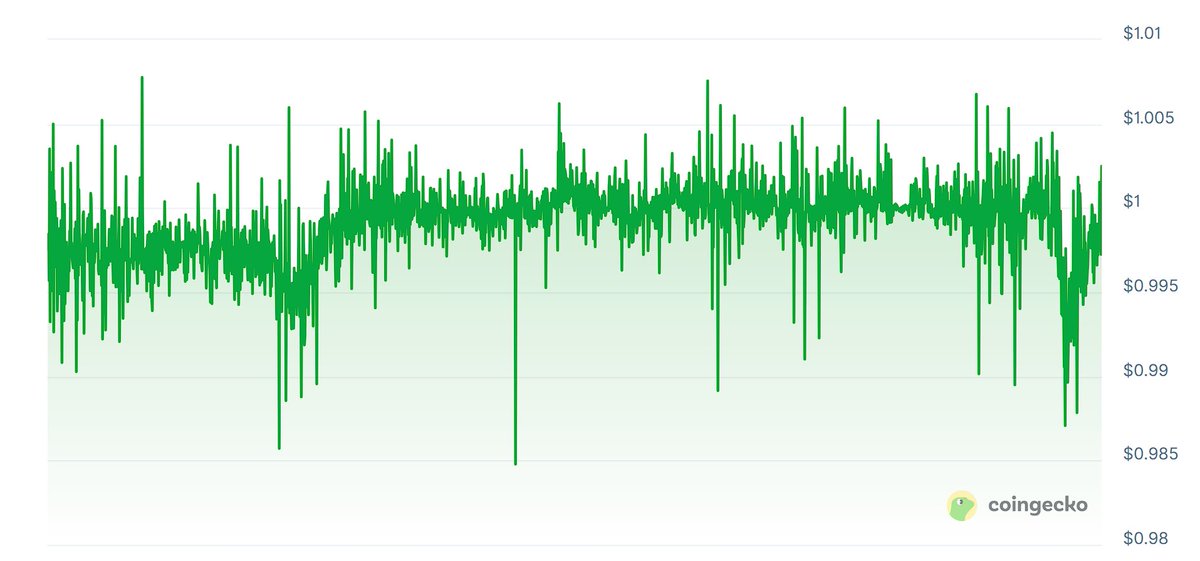

Late last year, we decided to build Hyperstable on Hyperliquid because the ethos of decentralization and neutrality from the Hyper Foundation resonated deeply with us. Since then, we've built and launched a novel decentralized and overcollateralized stablecoin that's backed by

A yield-bearing stablecoin is a wrapped investment claim, which limits its effectiveness as a medium of exchange. $USH by Hyperstable is non-yielding by design. Minters fully retain the upside potential of their $HYPE.

jez (blast era) Whoever gets the USDH ticker retires their whole bloodline. Keep this in mind when casting your vote.

All $USH revenue flows through the $PEG token. This allows voters, liquidity providers, and lenders to simultaneously capture value while contributing to the growth of Hyperstable. Meanwhile, a T-bill-backed, HL-native stablecoin directing over 50% of revenue to AF/HYPE

The Hyperliquid team benefits from a thriving DeFi ecosystem on HyperEVM, enabling them to borrow against their $HYPE on Hyperstable at just 5%, eliminating the need to sell.