Matthias Hanauer

@hanauermatthias

Executive Director Quant Equity @Robeco | Bridging Academia and Industry 💡| Exploring Factors, ML, and International Data 🚀

ID: 1139809536947163136

https://www.professors.wi.tum.de/fm/team/researcher/dr-matthias-hanauer-cfa/ 15-06-2019 08:19:05

1,1K Tweet

3,3K Followers

546 Following

Five Concerns with the Five-Factor Model now at 5,000 downloads! How long do we need to go to 5,555? Pim van Vliet Free download 👇 papers.ssrn.com/sol3/papers.cf…

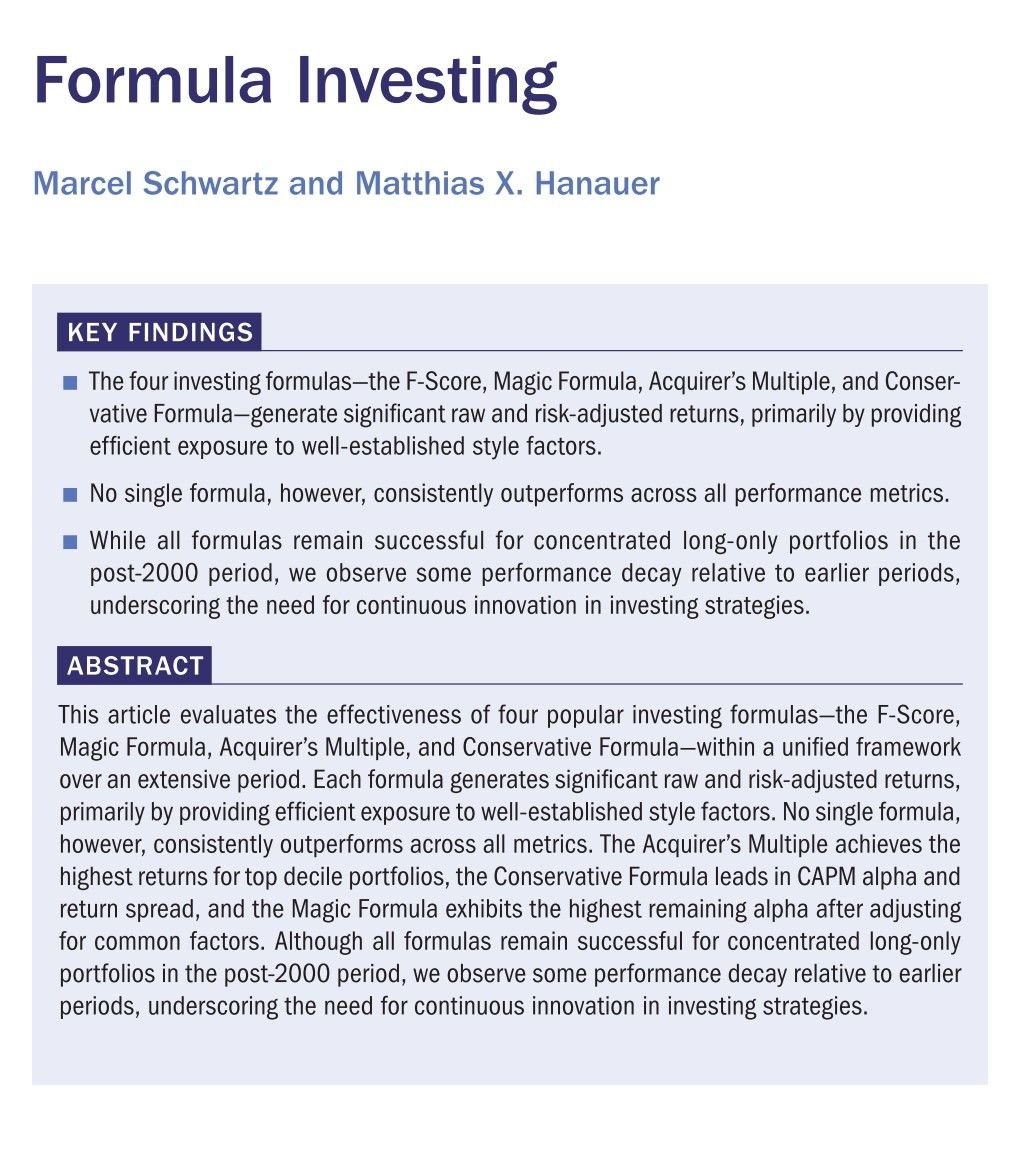

📣 New Publication Alert! I’m excited to share that my paper “Formula Investing" has just been published in the Journal of Portfolio Management! ❤️ to Pim van Vliet, Wes Gray 🇺🇸, Jack Vogel, and Tobias Carlisle for feedback! Comment 👇or DM me if you want the full paper!

Investment researchers Marcel Schwartz and Matthias Hanauer join 🥦 Jake Taylor 🎉 and me on Value: After Hours LIVE TODAY at 1.30pm E / 10.30am P / 5.30pm UTC / 3.30am AEST Watch it on the Acquirers Podcast channel: youtube.com/channel/UCJ27F… Subscribe to be sent a reminder: