Seabridge Gold Investor (NYSE:SA | TSX:SEA.TO)

@goldseabridge

$SA is an industry leader in gold & copper reserves/resources per share, all in North America. We track the factors driving metal prices. Not investment advice.

ID: 1055902408113479680

https://www.seabridgegold.com/ 26-10-2018 19:22:06

9,9K Tweet

4,4K Followers

1,1K Following

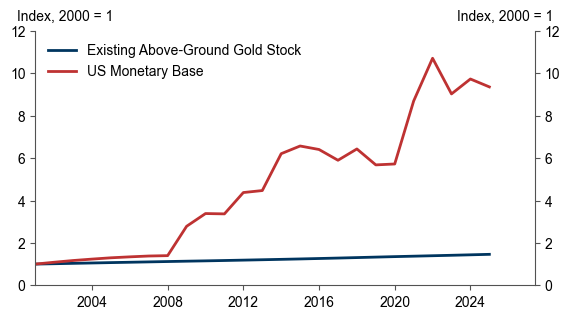

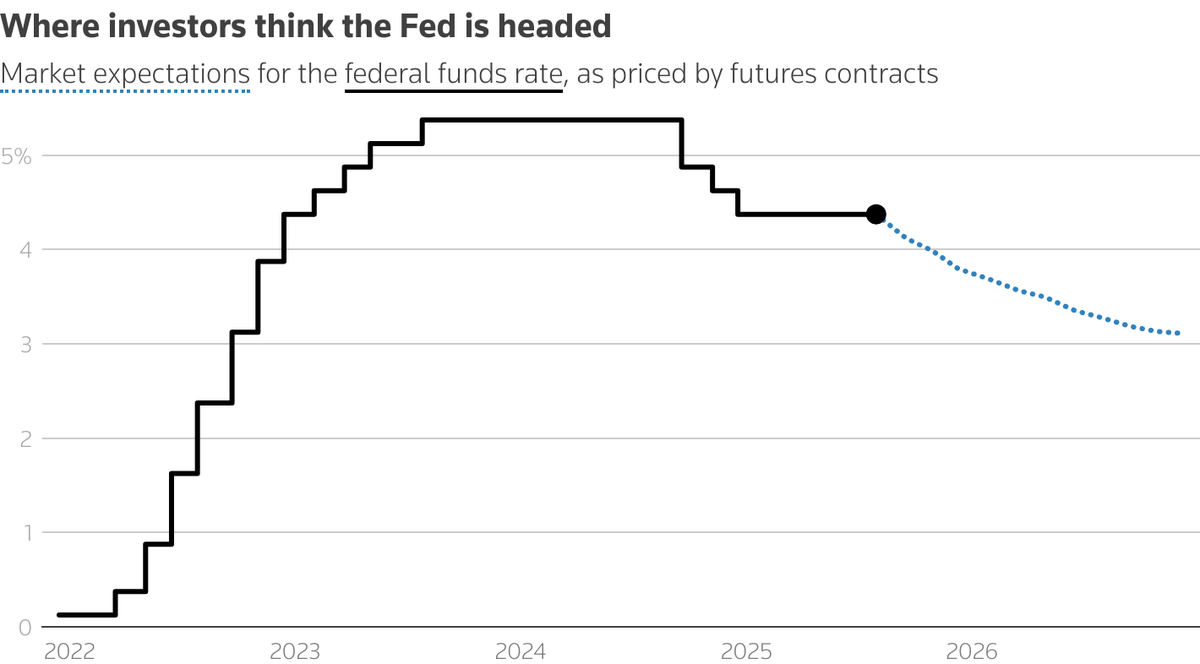

A Formula for a Higher US Dollar Gold Price "The Fed [is] talking about cutting rates into upside inflation risk due to rising downside employment risk while US employment receipts accelerated to up 7.2% y/y in the latest month and are running up 6.3% y/y YTD..." From Luke Gromen