Mike Alkin

@footnotesfirst

Dad, husband, investor. Co-founder and Chief Investment Officer of nuclear power/uranium focused hedge fund @sachemcove. Tweets/retweets not investment advice.

ID: 90546527

http://www.sachemcovepartners.com 17-11-2009 02:40:23

1,1K Tweet

13,13K Followers

199 Following

Just read through the 2019 World Nuclear Fuel Report (released to WNA members today / public next week). Demand projections rising significantly, supply dropping without higher prices - reads very bullish. WNA Symposium next week will be interesting! #uranium World Nuclear Association

RJ Lyons: Everything you Need to Know about Shipping capitalistexploits.at/rj-lyons-every… via Capitalist Exploits

MH65 - Sabre Wound to the Chest Join Patrick Ceresna📈📉 and Kevin Muir as they welcome Mike Alkin to the show where he shares his experiences as a deep value Uranium investor. Then they talk charts using Koyfin, followed by an update from Kuppy youtu.be/lPyB2MRehBw

@timothychilleri and I talk Uranium with Capitalist Exploits Chris Macintosh capitalistexploits.at/the-big-questi…

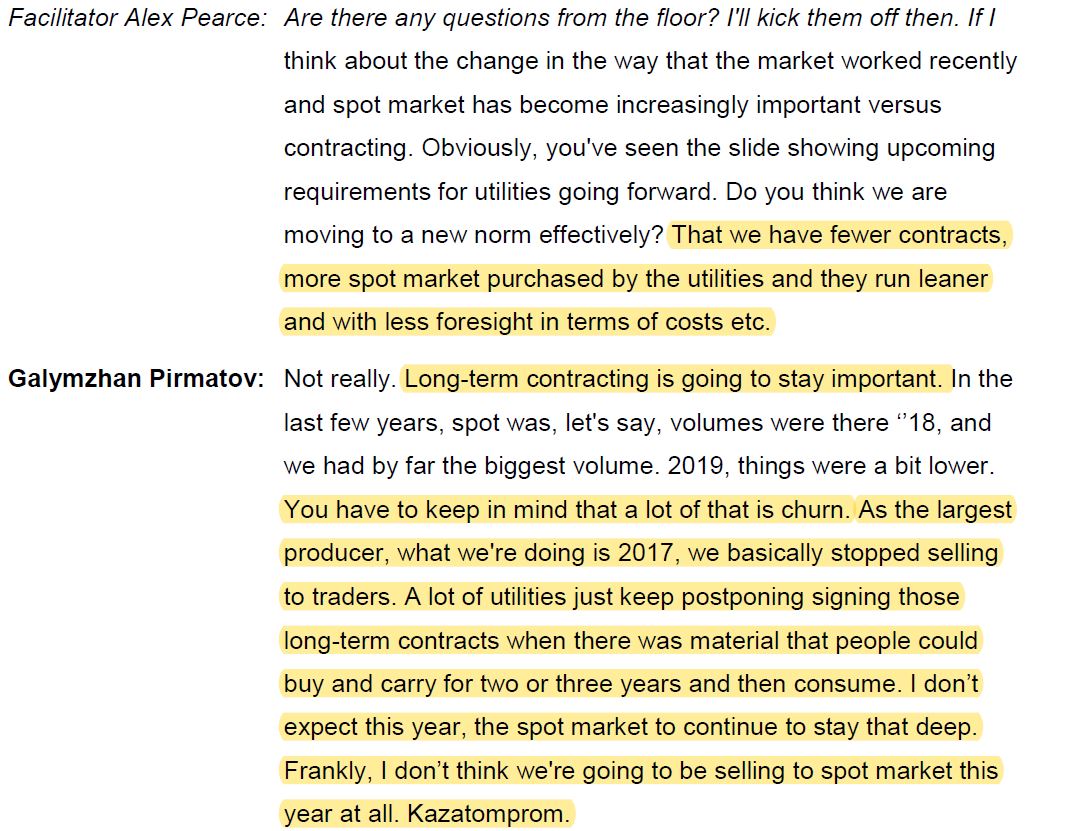

In case anyone questioned our read of Kazatomprom at BMO last week - transcript just released. Some highlights below. Very bullish for #uranium kazatomprom.kz/en/media/view/…

Our latest thoughts on #uranium in the era of COVID-19 (note this was filmed prior to Monday's Cameco Corporation update regarding Cigar Lake!) The Uranium Catalyst Nobody Expected | Real Vision realvision.com/shows/the-expe…

MacroVoices Erik Townsend 🛢️ and this week's guest co-host Kevin Muir welcome Mike Alkin Mike Alkin & Guy Keller to the show where Mike and Guy share some excellent insights on the Uranium market. bit.ly/3k5i35H