Adam Collins

@eversightwealth

Founder of Eversight Wealth, a flat fee investment firm.

ID: 4718779053

https://eversightwealth.com/ 05-01-2016 22:24:59

11,11K Tweet

13,13K Followers

267 Following

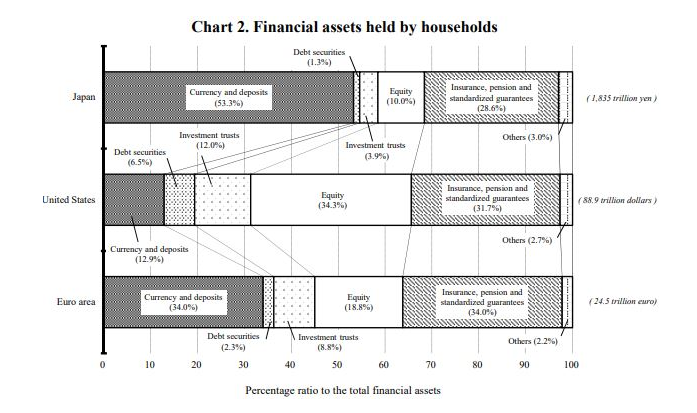

for years international stocks have seemed attractive at low valuations. but why have they remained cheap? Jesse Livermore says one potential reason is that foreign investors are less interested in stocks. average allocation is much lower than in the US osam.com/Commentary/ups…

belief in consistent mean reversion can be an expensive investing mistake until 1958 stocks yielded more than bonds. then bonds started yielding more and some people said it couldn't last. they were wrong for 50 years excellent post by Drew Dickson albertbridgecapital.com/post/was-value…

This snippet from Kathleen Zavala🎗🤐 latest blog is so good that I think everyone should read it every single month from here on out. Mental exercise.

I saw a lot of questions as to why TIPS underperformed despite the uptick in inflation. Here is the reason and outlook from Adam Collins