Edel Finance

@edeldotfinance

Stocks that pay you to hold them. Your portfolio, revolutionized.

ID: 1957326471997075456

https://www.edel.finance 18-08-2025 06:19:48

3 Tweet

60 Followers

31 Following

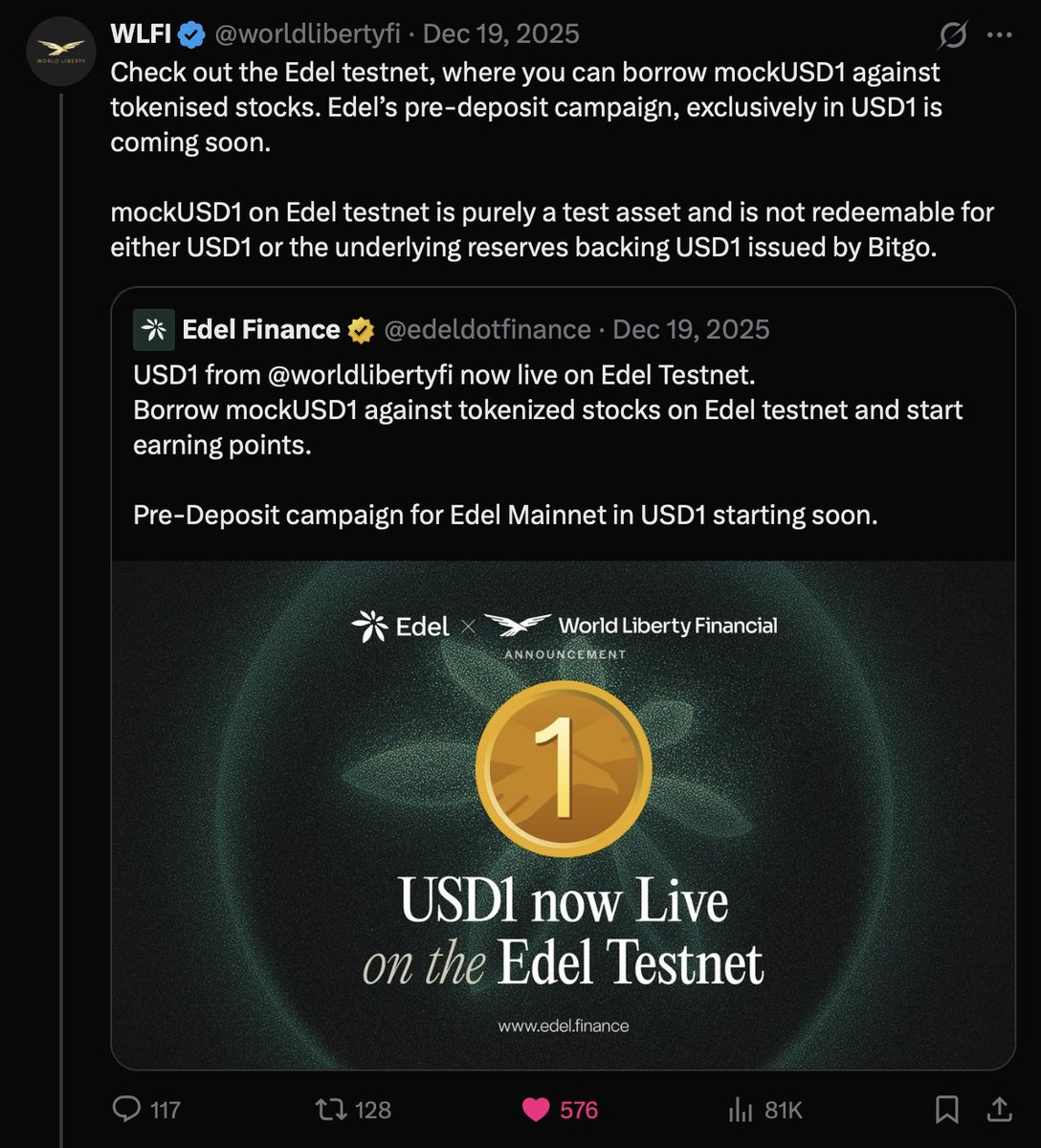

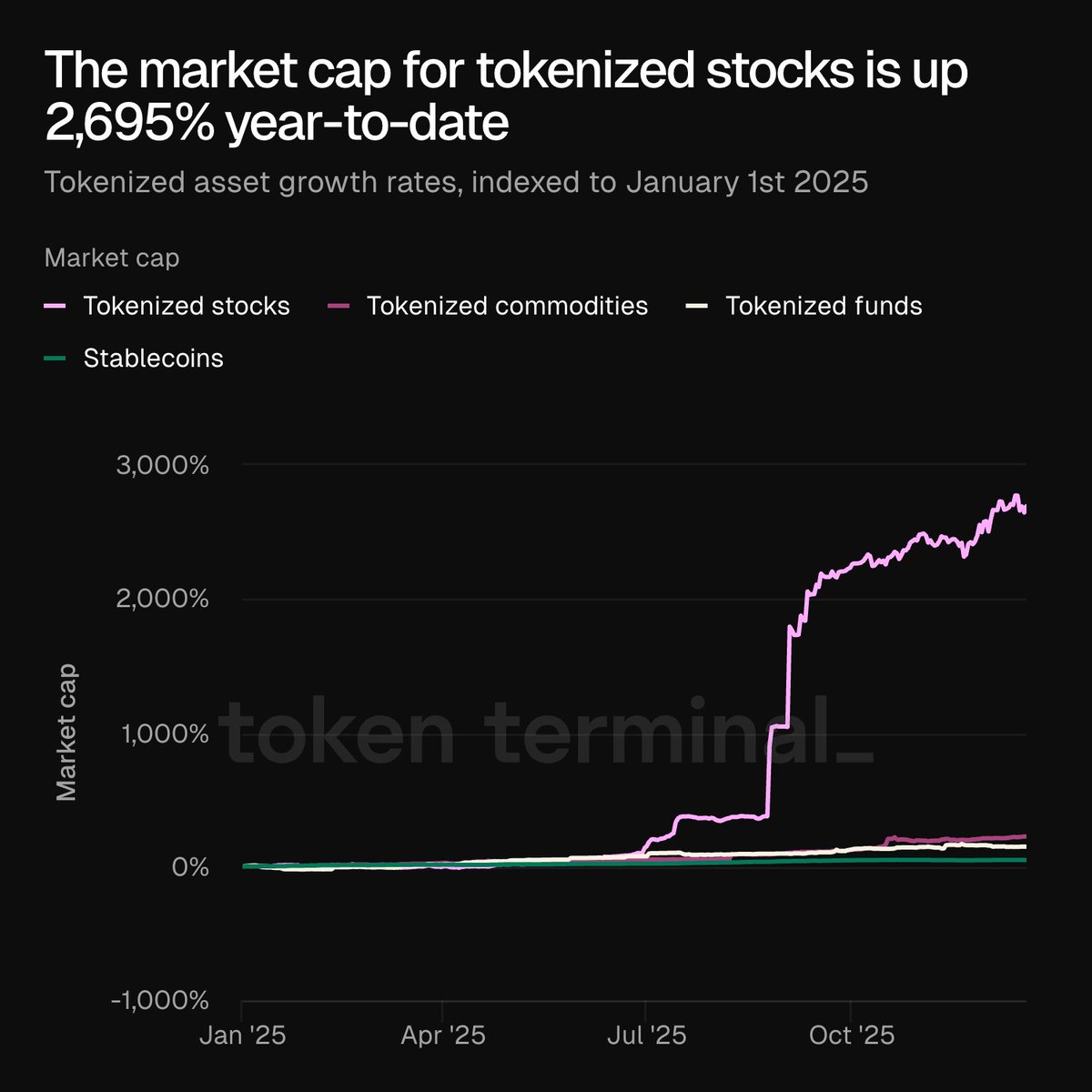

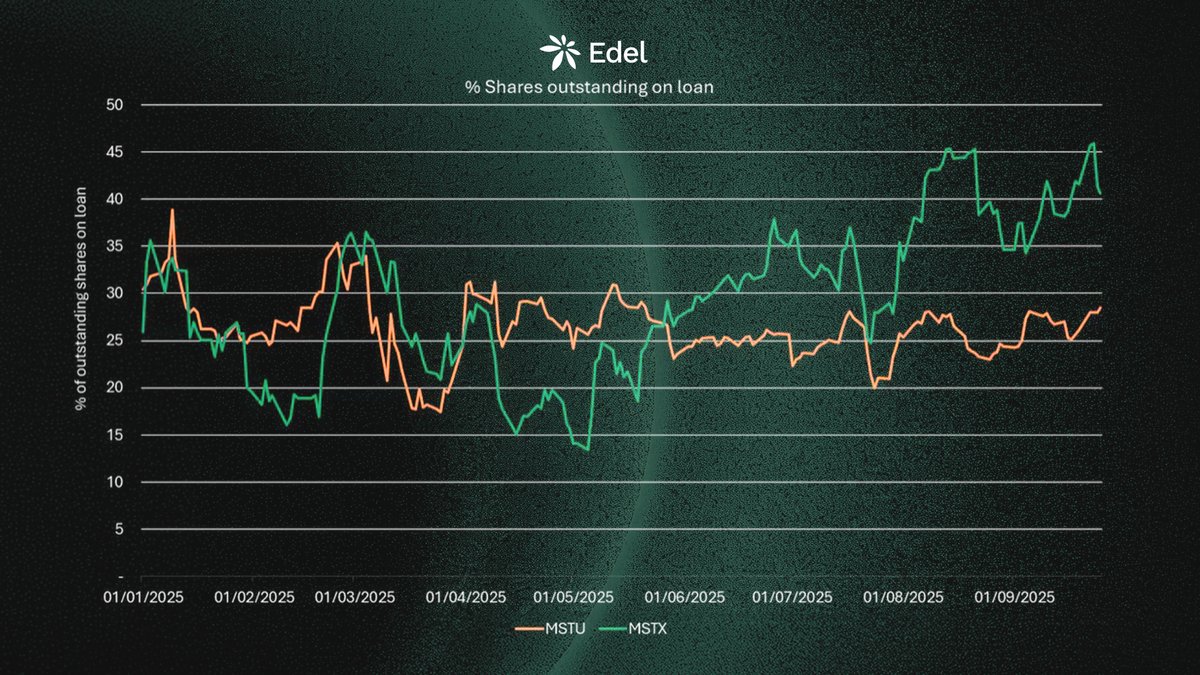

USD1 szn is official. Not because of hype. Because of flows. Zak Folkman said it: growth comes from "onchain settlement between counterparties." Treasury activation vote passing. Ecosystem incentives unlocking. Some partnerships were early. Ours has been cooking quietly.