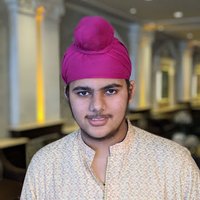

Pradeep Dham

@dhampradeep

Tennis enthusiast. Interested in global macro investment strategies, FX, Fixed income and Equities ideas.

ID: 3809479215

29-09-2015 01:26:33

188 Tweet

131 Followers

141 Following

David Hunter TheMarketSniper - MBA, CMT. #HVFmethod ried vallee ranch Respectfully Dave, if forecasts do not have a timeline, they are not very helpful. Yes, at some point in the future S&P will hit 6000 (or even 7000) and yes, at some point there will be a 70-80 percent correction. Without timelines, it's just a common sense statement.

Chris Ciovacco Indeed, the same is the case for resistance. Has the S&P been long enough above 200 dma to say that the current rally is not a bull trap ?

"That is one of the great shots we've seen here in YEARS!" Andrey Rublev, take a bow! 😱 #Wimbledon