Ambrosio👾

@cryptoambrosio

I Grind For My Bags; You Should Too | Dust Holder | $ROSE $SEI Maxi | t.me/CryptoAmbrosio

ID: 1363348934488248320

21-02-2021 04:45:03

8,8K Tweet

1,1K Followers

425 Following

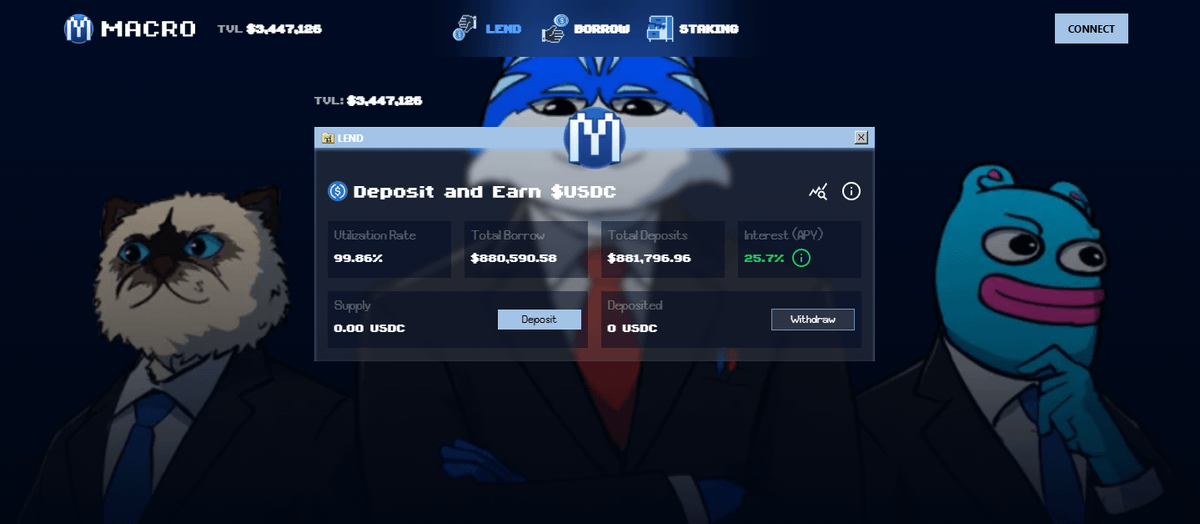

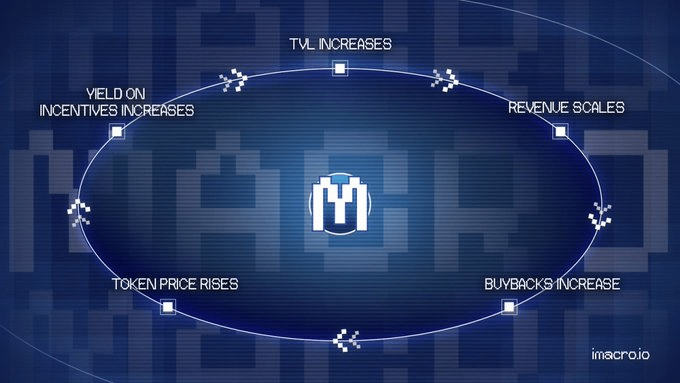

The first RWA to DeFi yield flow is live. Users can now take rewards earned from tokenized mining assets on PinLink and instantly deposit them into Peapods Finance USDC MetaVault directly from the PinLink app. One click, and your RWA income compounds automatically through DeFi.