Onedotfour 🌋

@consensus128

yieldorrrrr @upshift_fi, writing on GTM strategies for defi and stablecoin protocols

🦁// chess player // prev google

ID: 1474080424628523010

23-12-2021 18:12:28

2,2K Tweet

1,1K Followers

892 Following

Upshift Vaults on Suiii Finally Onedotfour

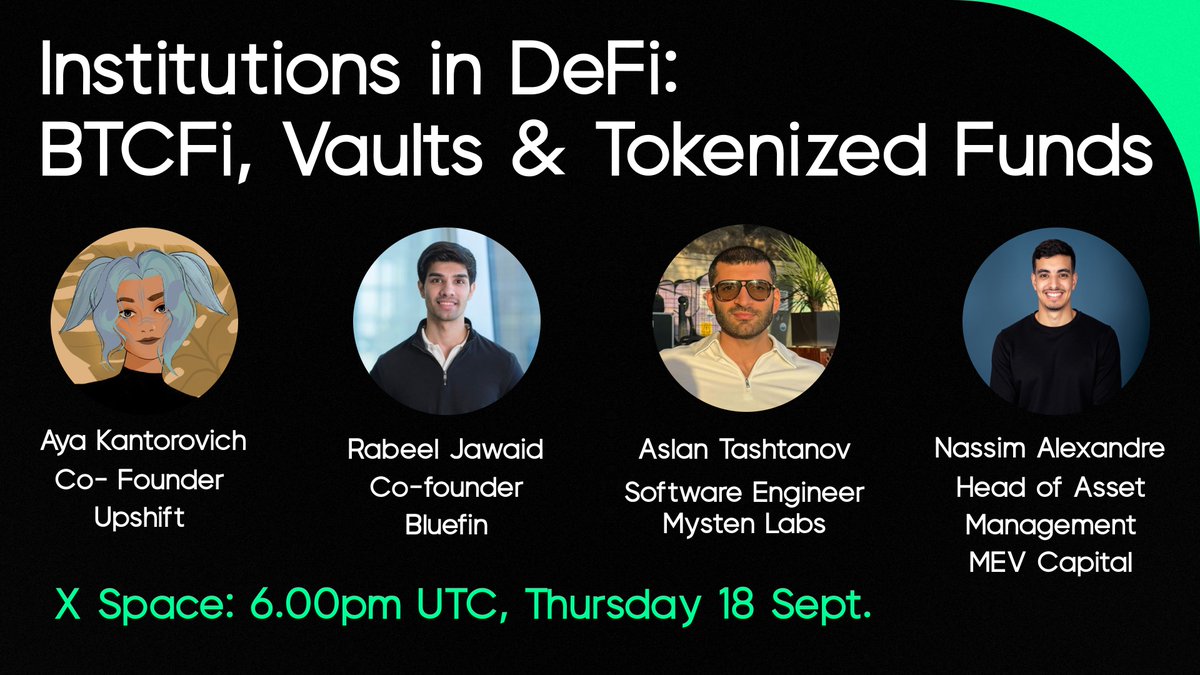

The third edition in our TradFi x DeFi series: Featuring speakers from August, MystenLabs.sui Bluefin and MEV Capital. Stablecoins are up 28x in the last year, Bitcoin is at all time highs - the institutions are here. Dive in this Thursday as we discuss the trends

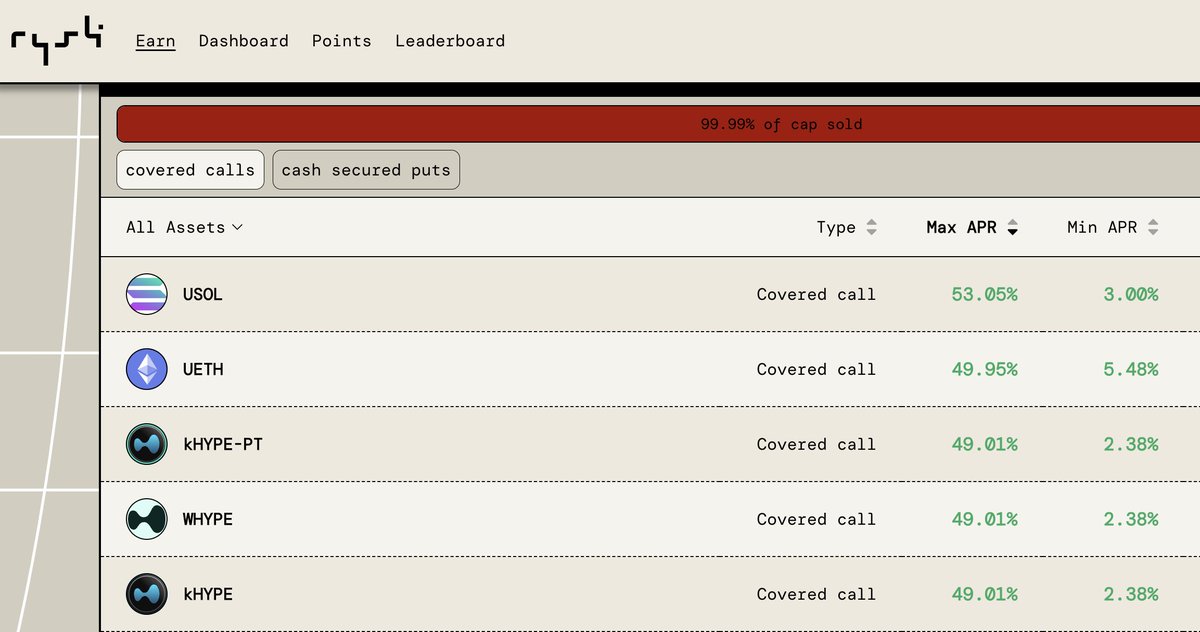

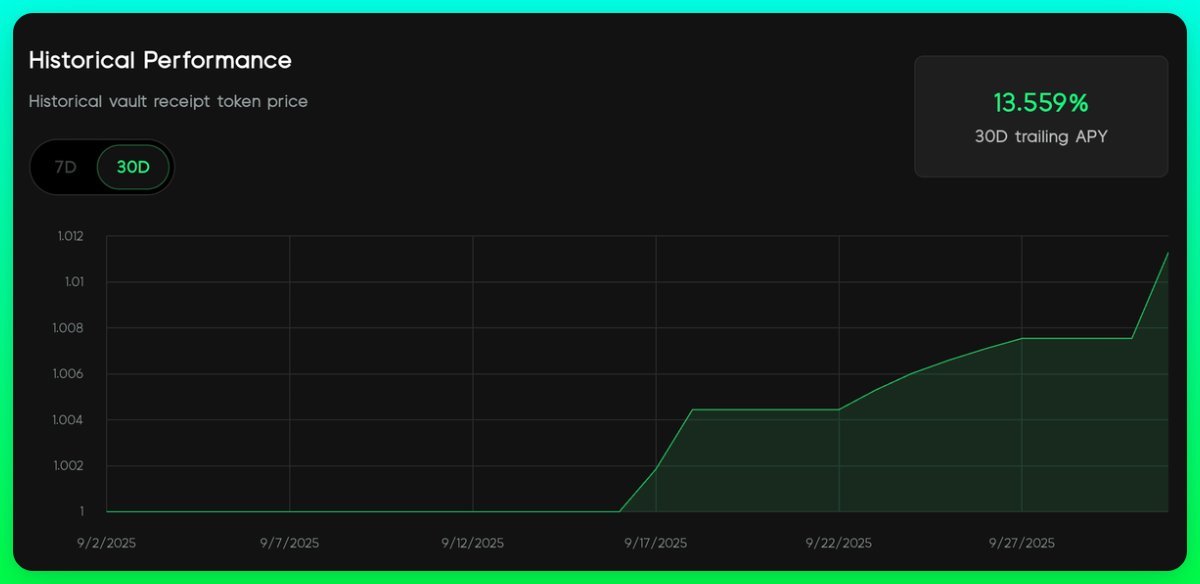

finally played around with rysk finance && 🤌 today covered calls and cash secured puts on HyperEVM: > covered calls = get paid upfront yield (premium) to sell your assets (e.g. uSOL). You only sell if the asset reaches a specific agreed upon prior price (strike) essentially you're