Chester Ntonifor

@cntonifor

Chief Strategist @ BCA Research

ID: 1037415613285761024

http://www.bcaresearch.com 05-09-2018 19:02:11

56 Tweet

214 Followers

189 Following

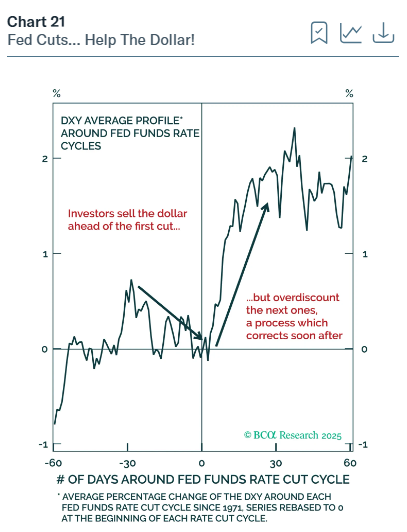

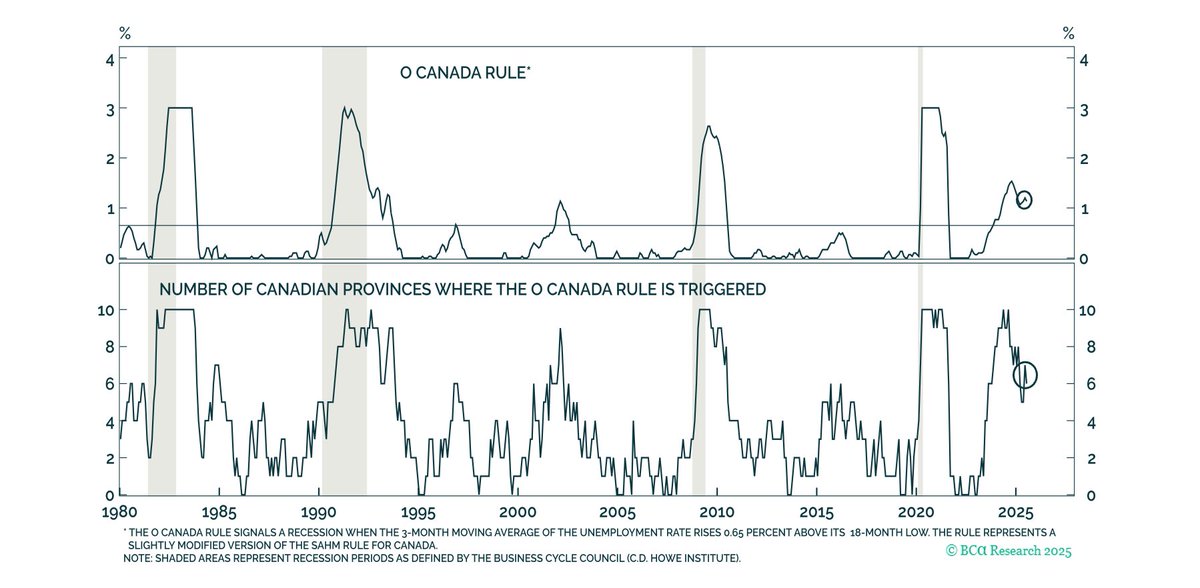

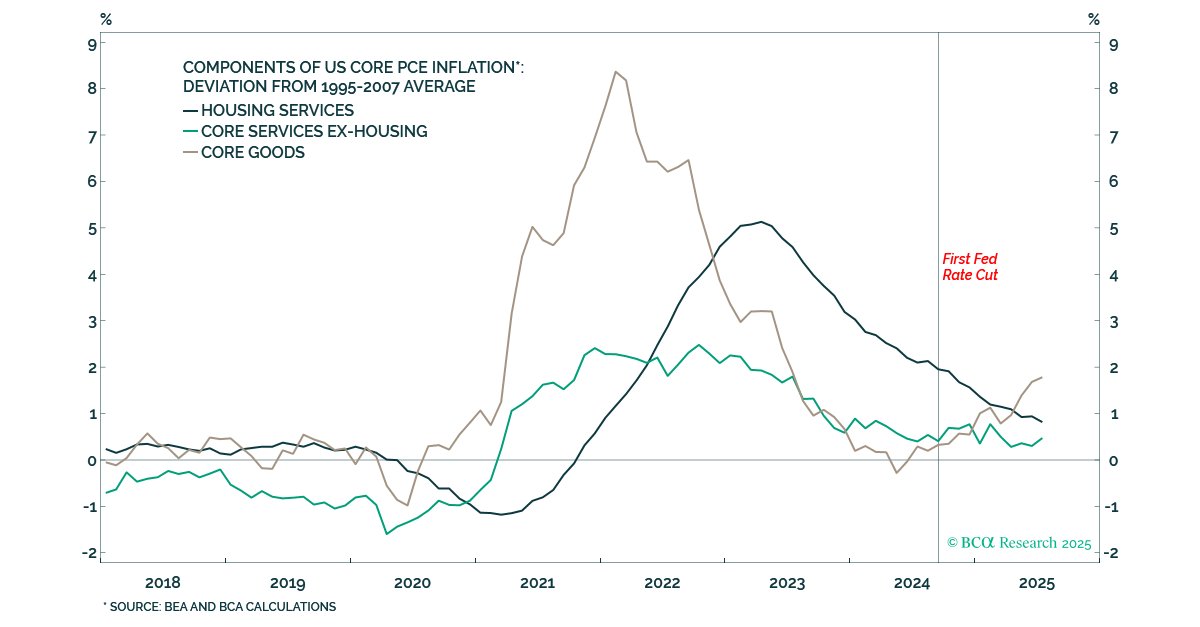

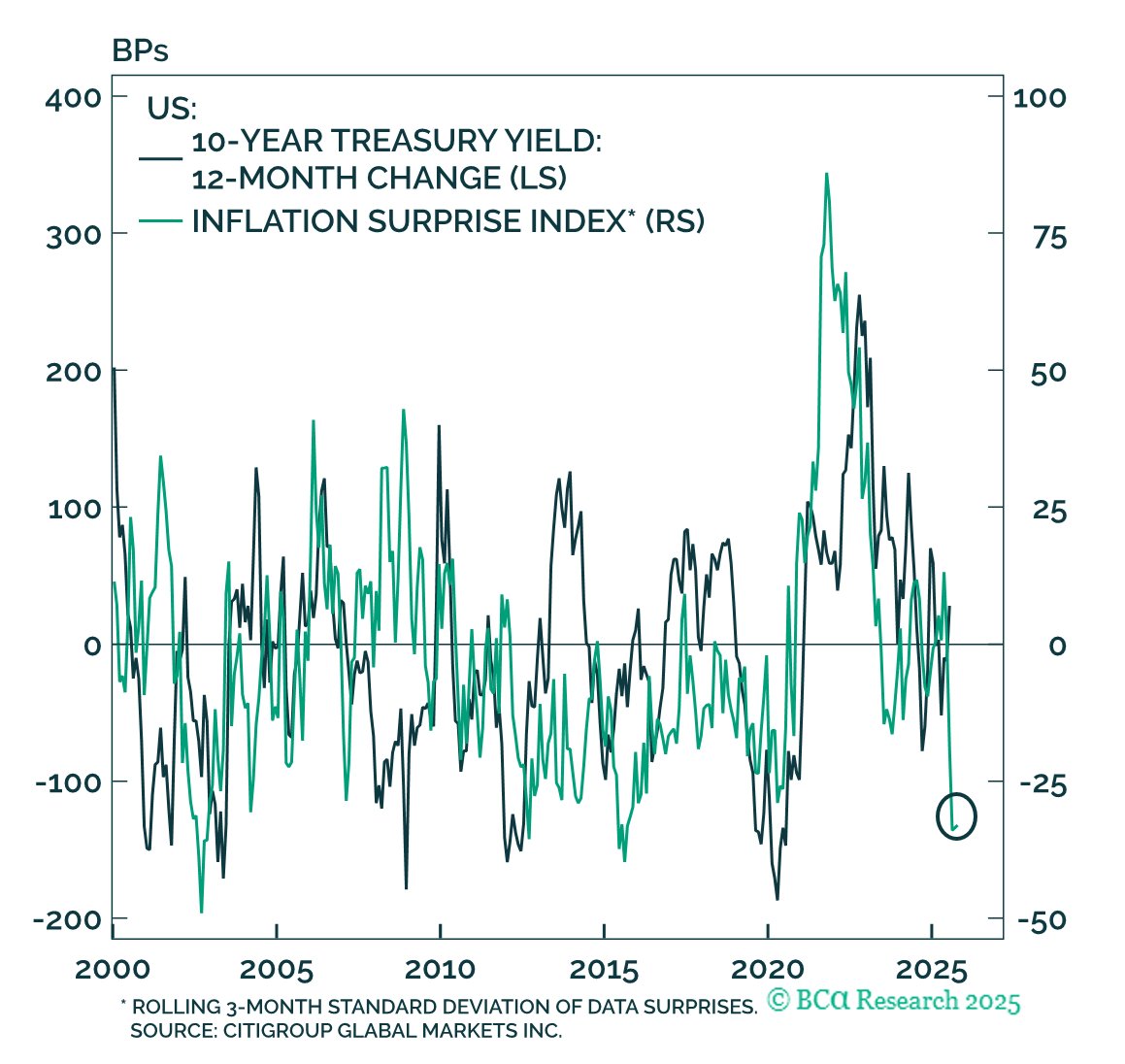

💡 Why cut rates with full employment and inflation still high? In his debut MarketWatch column, our Daily Insights Chief Strategist Felix Vezina-Poirier explains: 📉 Job market momentum has weakened, with unemployment drifting higher 🛑 The latest inflation spike looks temporary as

Is Fed easing a mistake? Jonathan LaBerge weighs in during BCA Live & Unfiltered (BLU).