Chloe Collins

@chloe_gdretail

Head of Apparel at GlobalData Retail @Retail__GD. All views expressed are my own.

ID: 1110217472035176467

25-03-2019 16:30:46

590 Tweet

385 Followers

286 Following

Our What's Happening in Retail newsletter is out today. In this edition we take a look at the rise and rise of resale, and talk to thredUP CEO, James Reinhart, about current and future trends. You can sign up here: news.whir.media/subscribe Neil Saunders

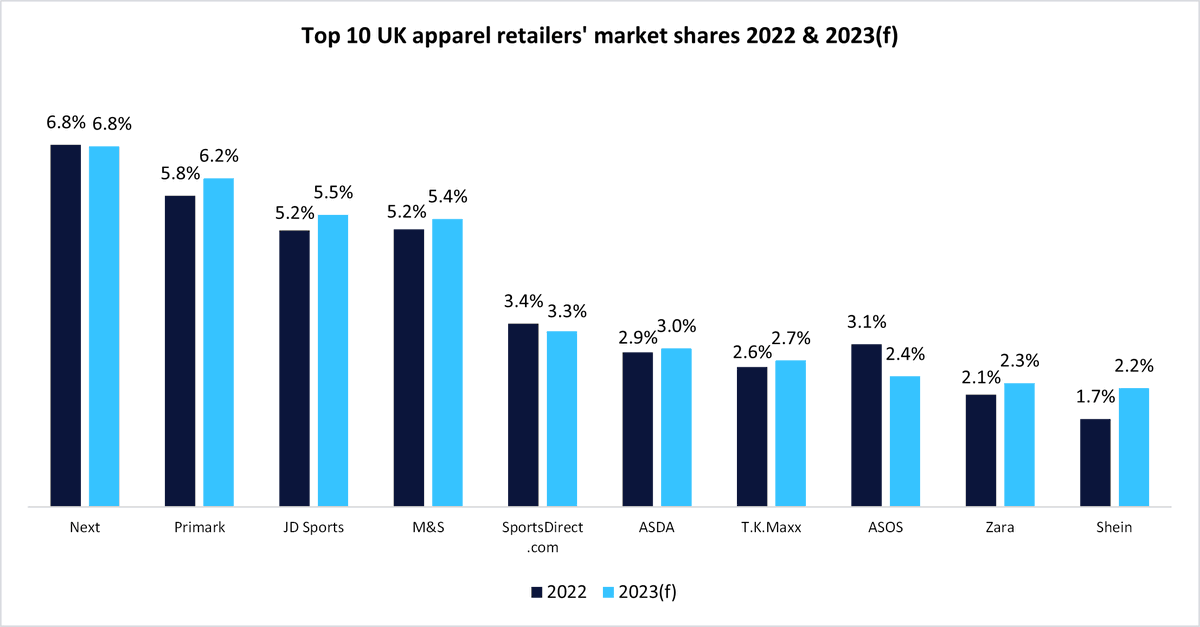

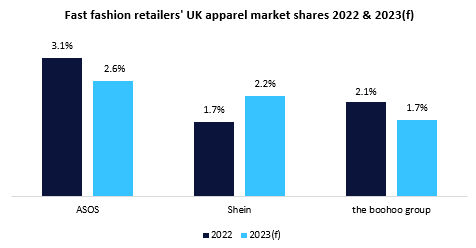

Join myself and Pippa Stephens next Thursday at 3pm for a 30 minute webinar on the outlook for the Global Apparel Market in 2024, featuring regional, category and channel forecasts, as well as top themes and trends. 👗 👔 👜 👠 Register today: bit.ly/45HhExc