Chad

@chadhall16

Digital Asset Trading Analyst @ARKInvest | Disclosure: arkinv.st/2rxmMRG

ID: 169640417

https://ark-invest.com 22-07-2010 20:39:38

2,2K Tweet

9,9K Followers

1 Following

The October issue of The Bitcoin Monthly is now available! Read at ark-invest.com/crypto-reports… and enjoy insights from David Puell 👇

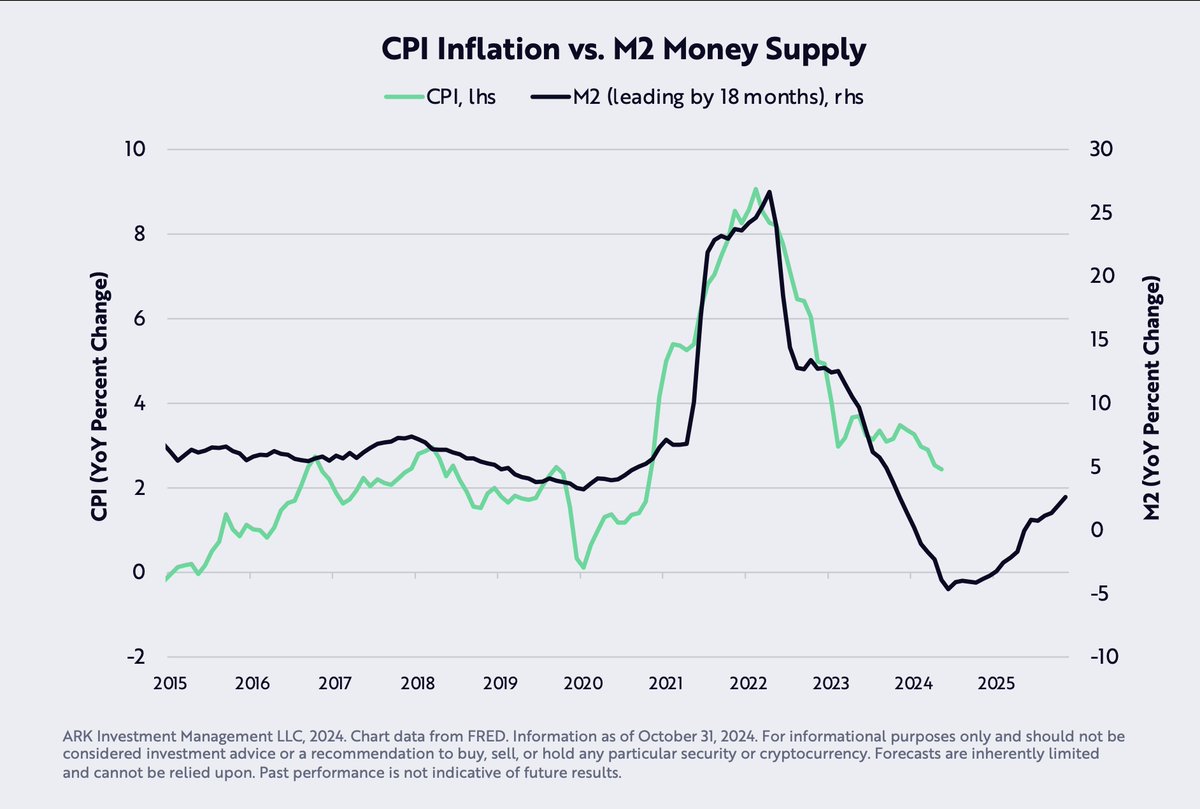

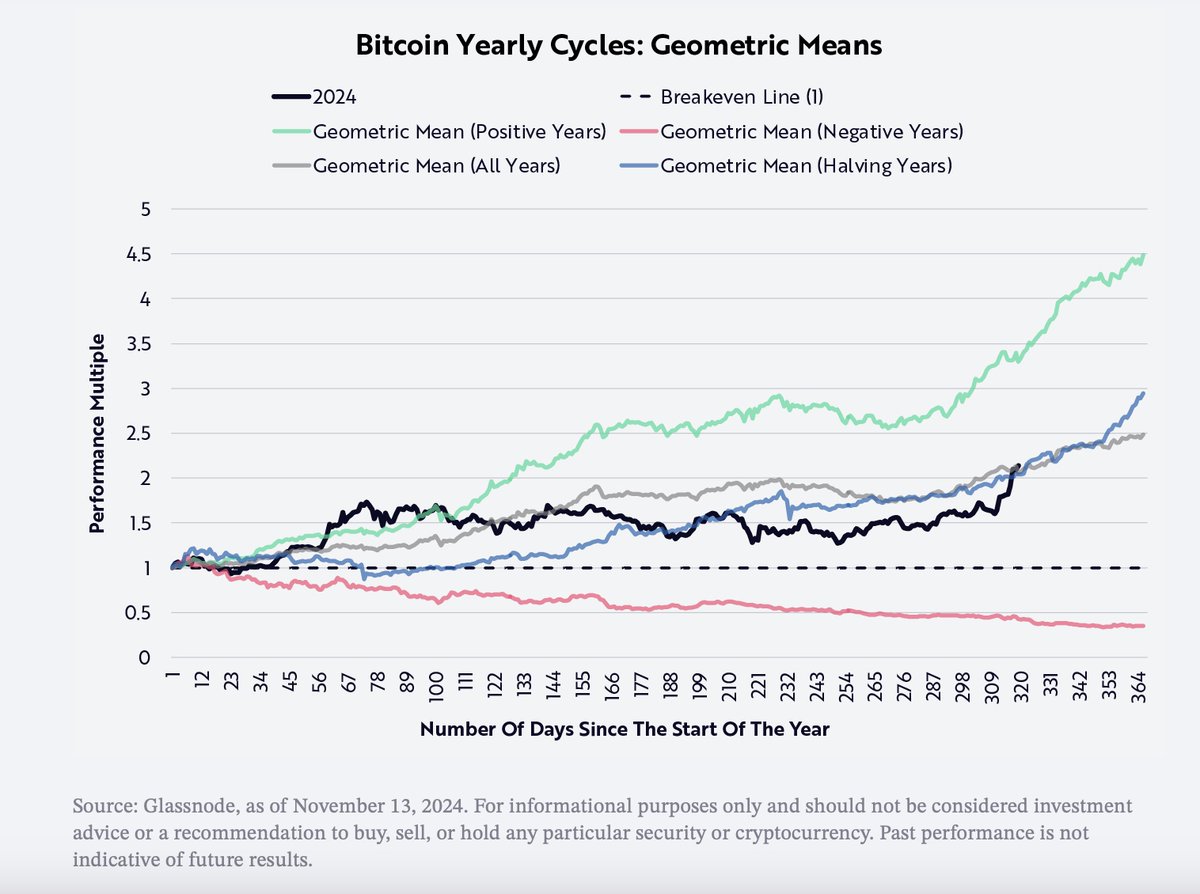

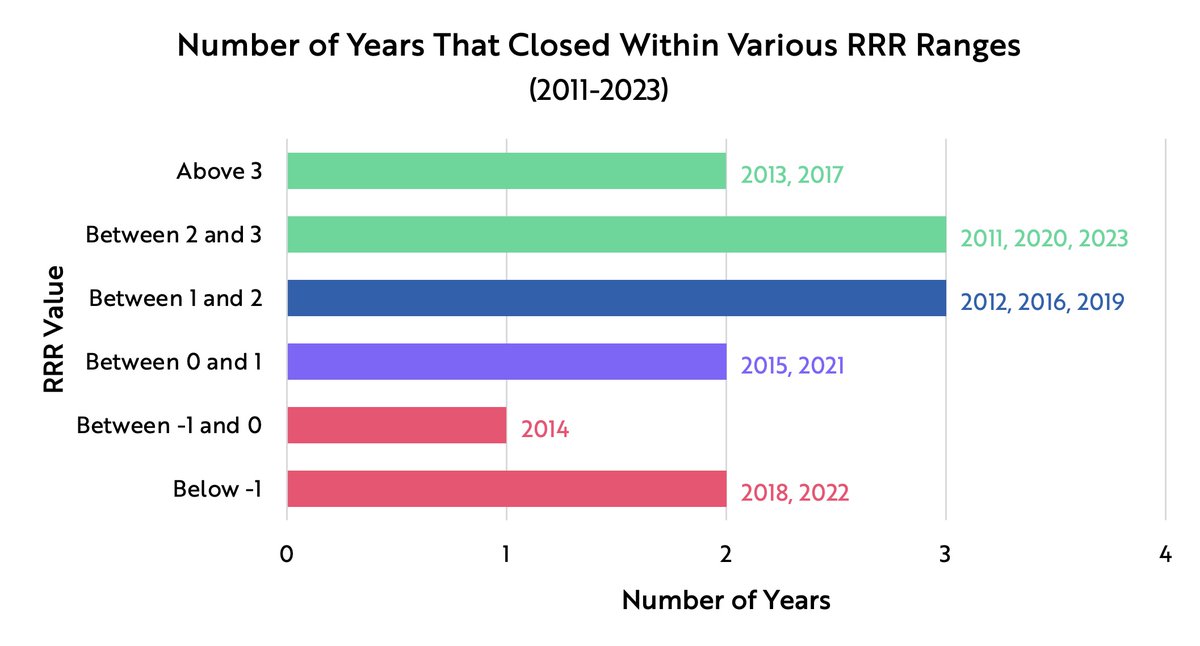

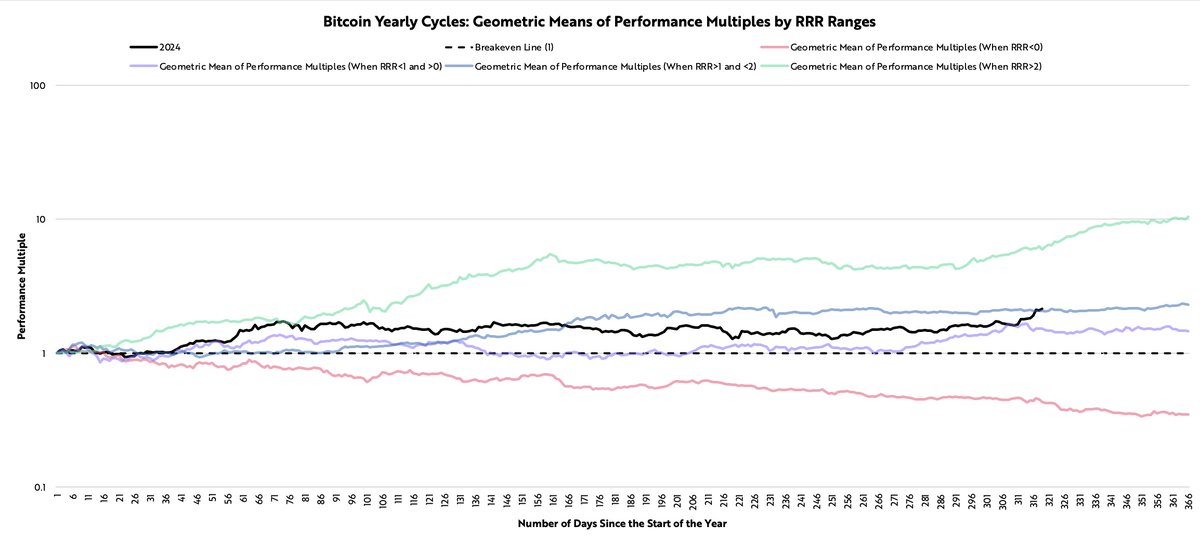

Bitcoin’s halving occurs roughly every four years, often aligning with early bull markets. The April 19 halving brought volatility, but performance aligns with past cycles, fueling our optimism for the next 6–12 months. David Puell explains in a new blog. ark-invest.com/articles/analy…

Based on David Puell’s on-chain analytics and analysis, the bull market in bitcoin is in good shape. After its halving in April, growth in the supply of bitcoin dropped to 0.9%, below the long term growth in the supply of gold for the first time!

Senator Cynthia Lummis 🦬 ‘s BITCOIN Act of 2024 gains momentum into 2025 after a Trump victory. If such a bill were to pass, it would bring America to the forefront of global monetary and financial innovation in the 21st century. Full newsletter here: