Bitcoinmath.org

@bitcoinmath_org

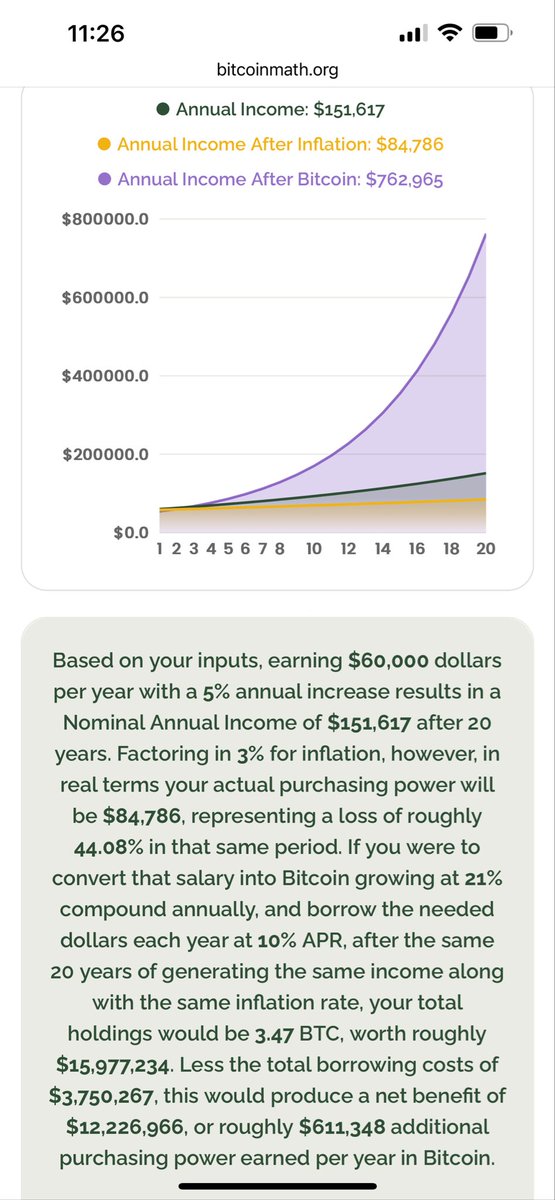

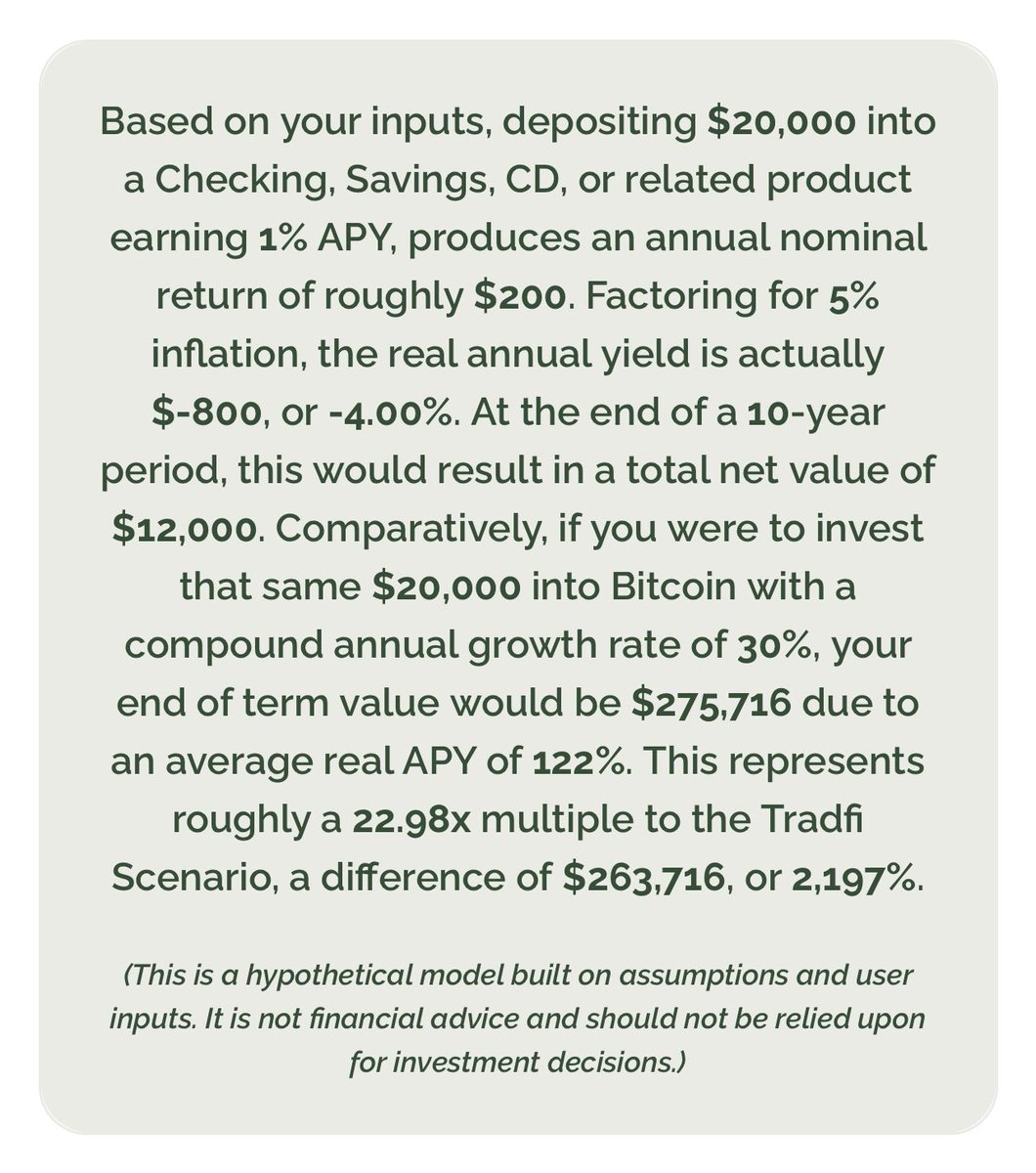

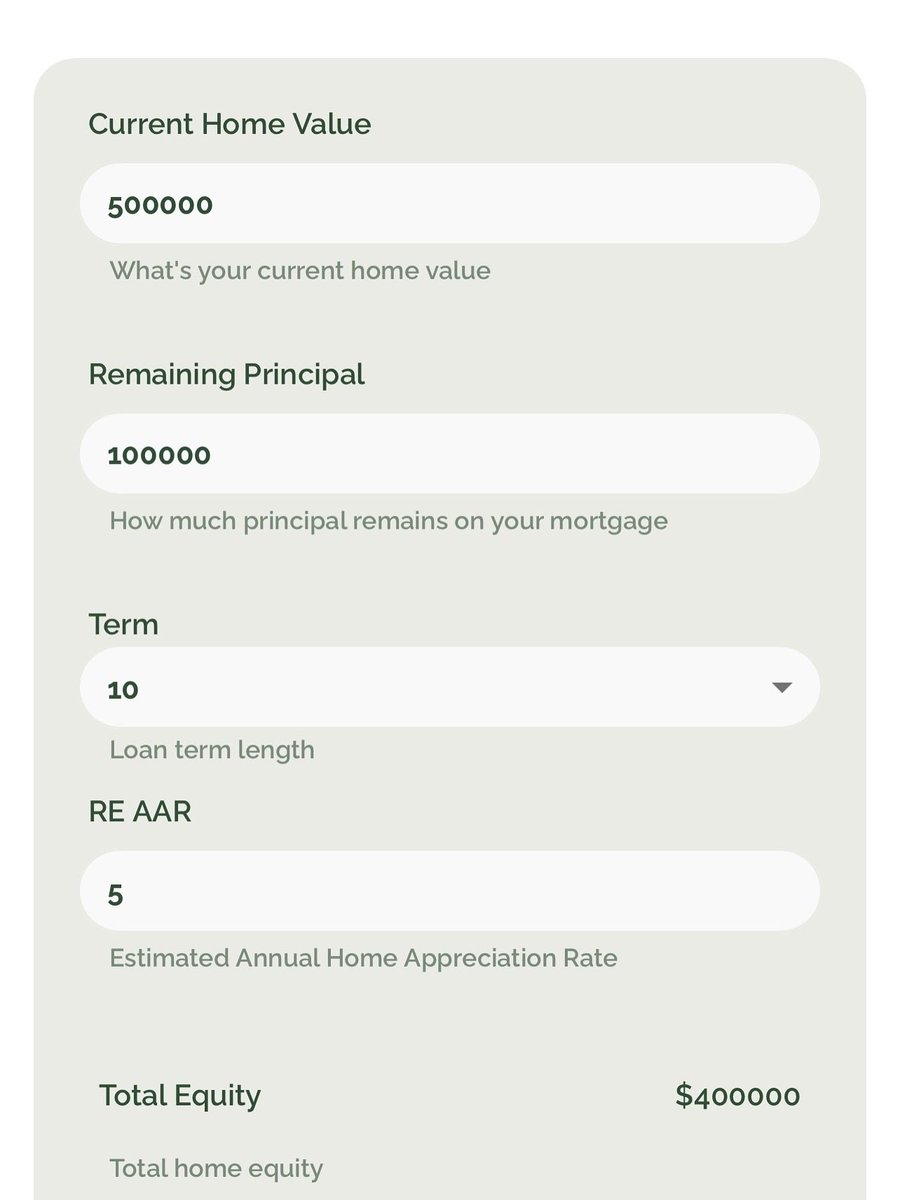

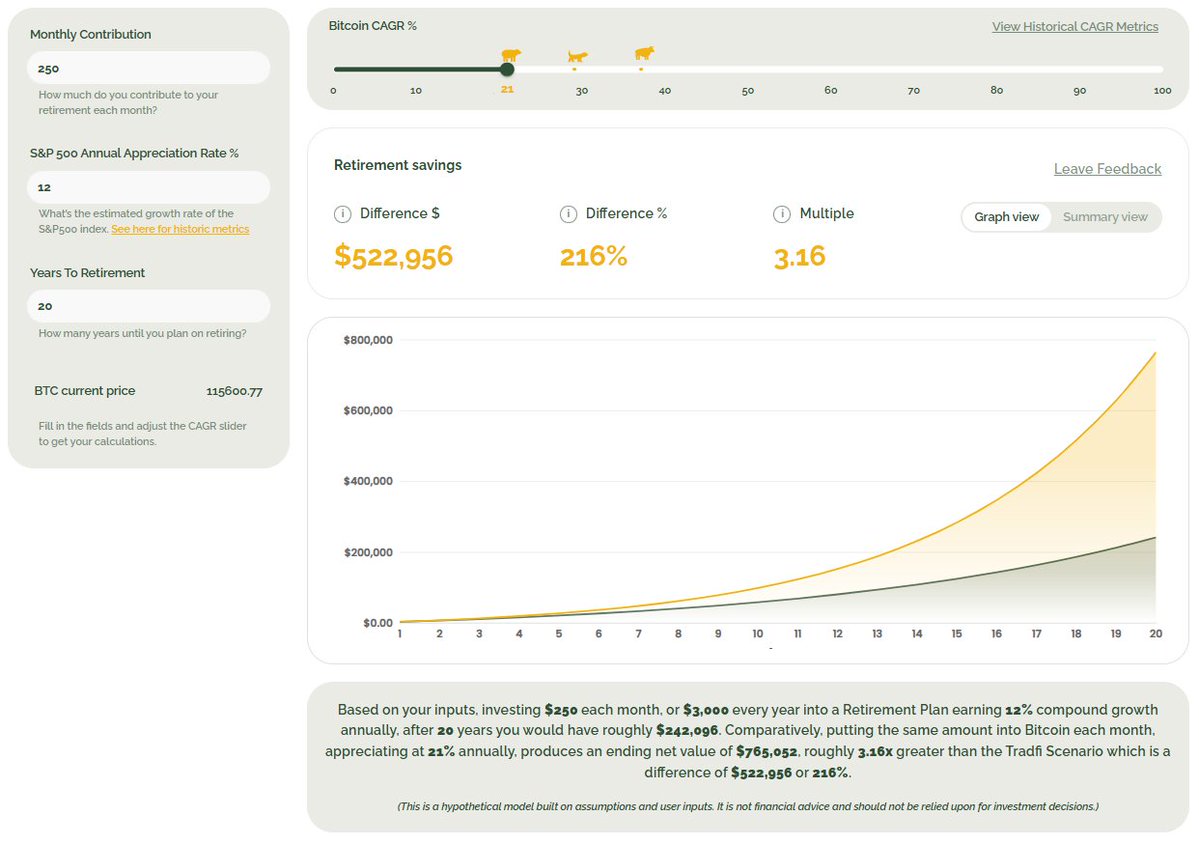

“Why should I care about Bitcoin?” We help people answer that question for themselves with real world calculators and easy to use tools, free to all! 🧡

ID: 1873505667275001856

https://www.bitcoinmath.org/ 29-12-2024 23:05:42

146 Tweet

424 Followers

239 Following

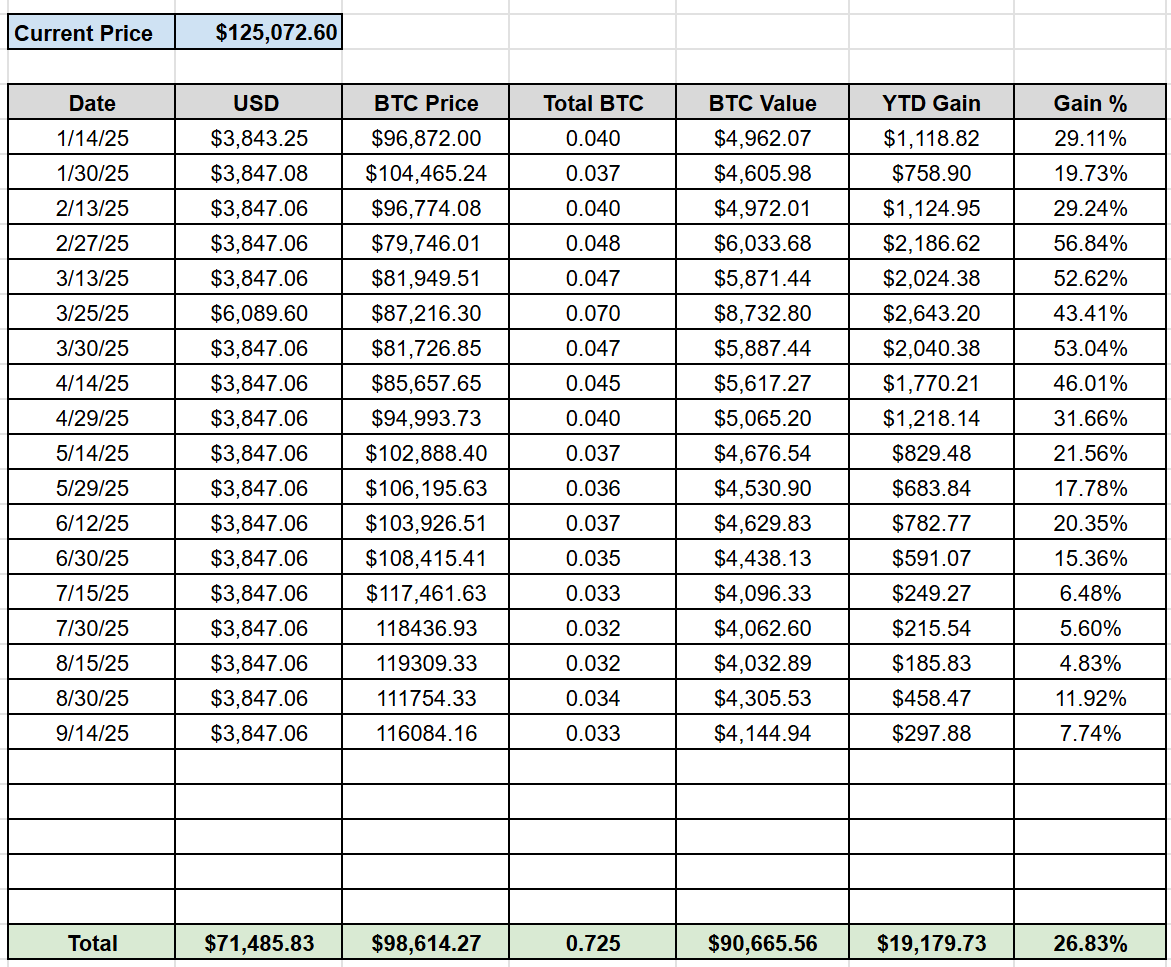

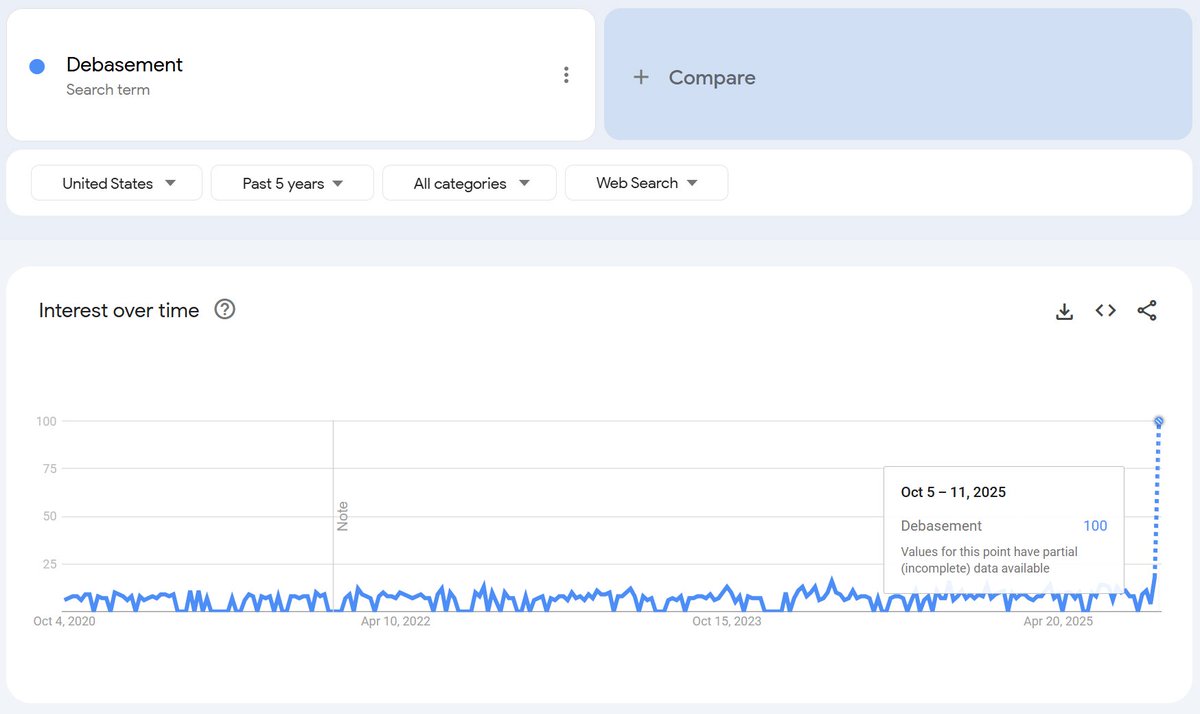

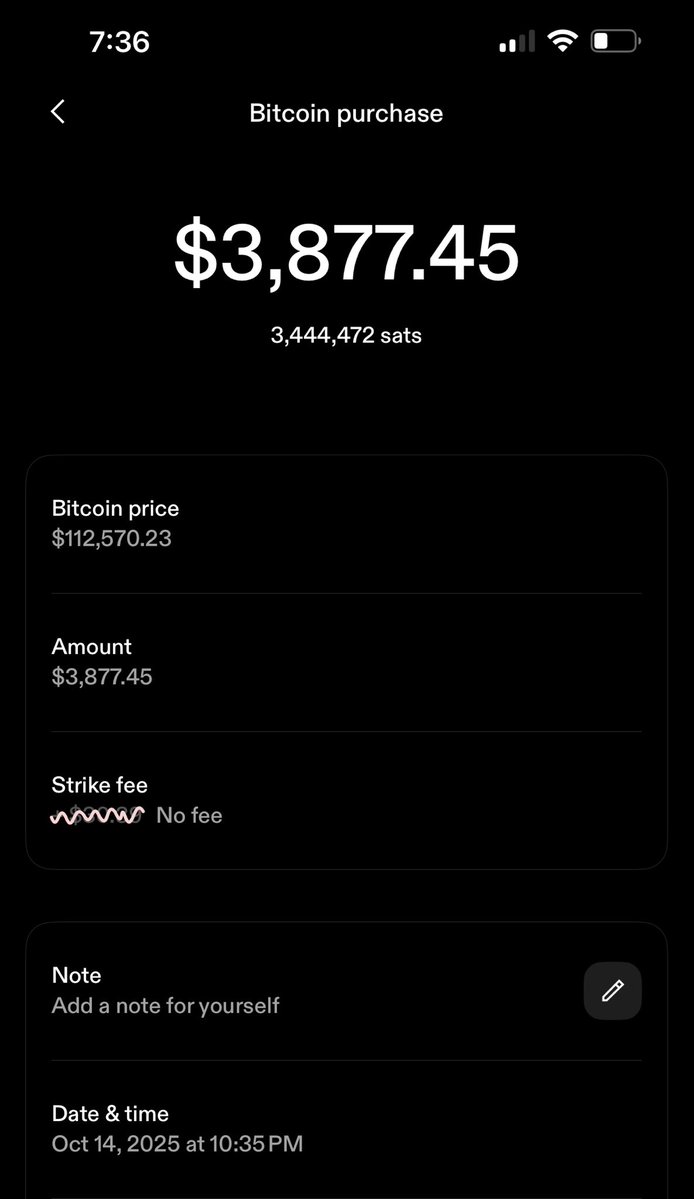

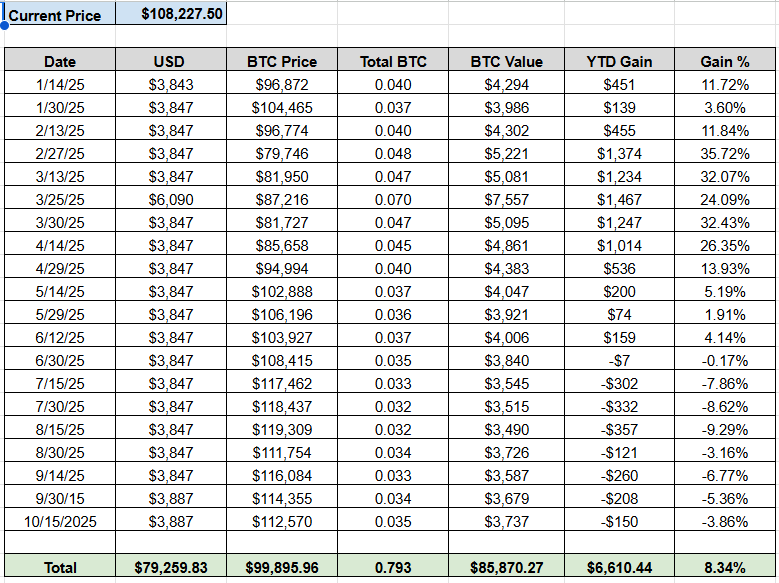

+26.83% pay increase YTD 2025 due to converting USD paychecks to Bitcoin. Jeff Booth ⚡️ is correct, the natural state of prices in a fair system is deflation. My life is almost 27% less expensive in 2025, following his thesis perfectly. Own Bitcoin. Rent Dollars.