Bison Interests

@bisoninterests

Houston-based investment firm focused on publicly traded energy equities.

Read our latest insights on the energy space:

bisoninterests.com/content

ID: 1016854943087710208

http://www.bisoninterests.com 11-07-2018 01:21:25

3,3K Tweet

26,26K Followers

141 Following

Bison Interests Thanks for excellent thread. Been considering this. Have significant cash flow from natgas equities that’ve had an awesome year, so now yield % not so huge viz cap gains on the table… better ideas for that capital abound, very much including in oil. Josh Young is a gift!

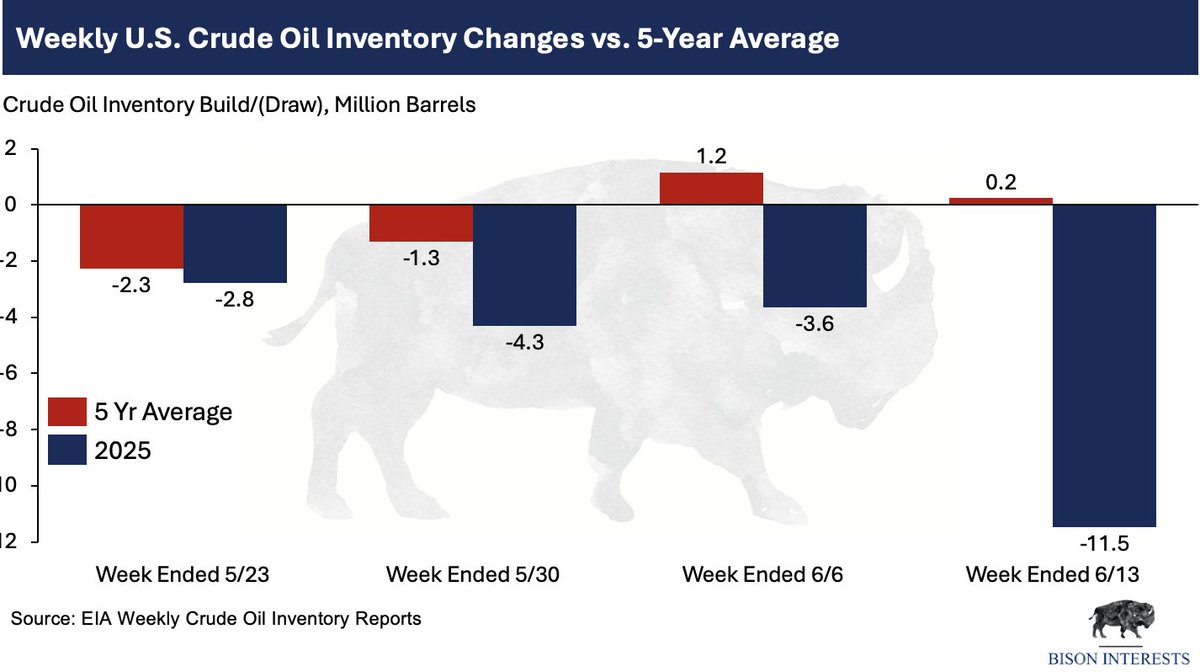

Our CIO Josh Young was on CNBC sharing our variant bullish view on oil despite consensus bearishness

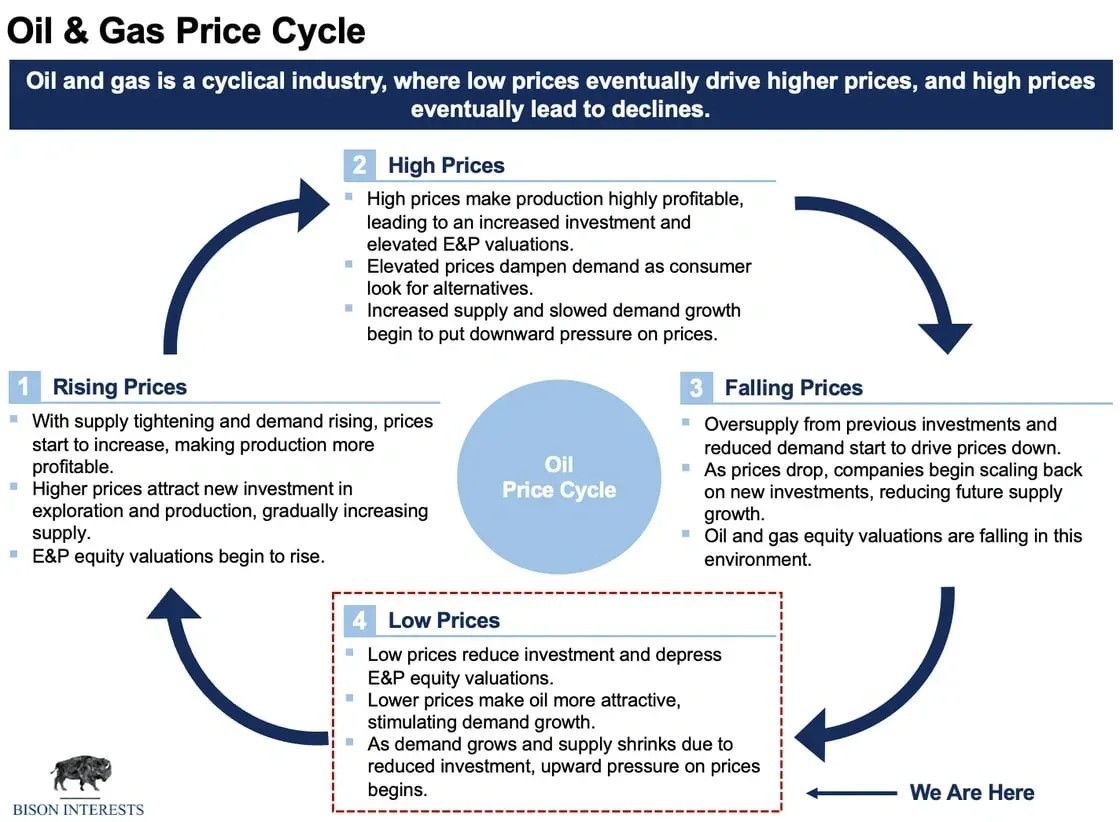

Bison Interests I see phenomenal opportunities in small cap producers and oil field services stocks, which may drive the sector to "catch up" with the broader market as we move back into the eventual rising oil prices part of the cycle x.com/Josh_Young_1/s…

Our CIO Josh Young was featured on the inthemoneypod. Josh shared his thoughts on the oil and gas industry, perspectives on recent M&A and shareholder activism, our shift from natural gas to oil exposure, and some of his favorite stocks at the moment. youtu.be/nn2vEvZFQL8?si…

Excellent oil market overview with oil hedge fund manager of Bison Interests, Josh Young youtu.be/GYa14LIY7rY?si…