Brian Stoffers

@bfstof

Non-Exec Chairman @cbrecapitalmkts. Retired in ‘23 as leader of global #CBREDSF team that originated $350B+ in loan volume since '07. @MBAmortgage 2020 Chairman

ID: 2520950898

24-05-2014 17:31:17

4,4K Tweet

2,2K Followers

1,1K Following

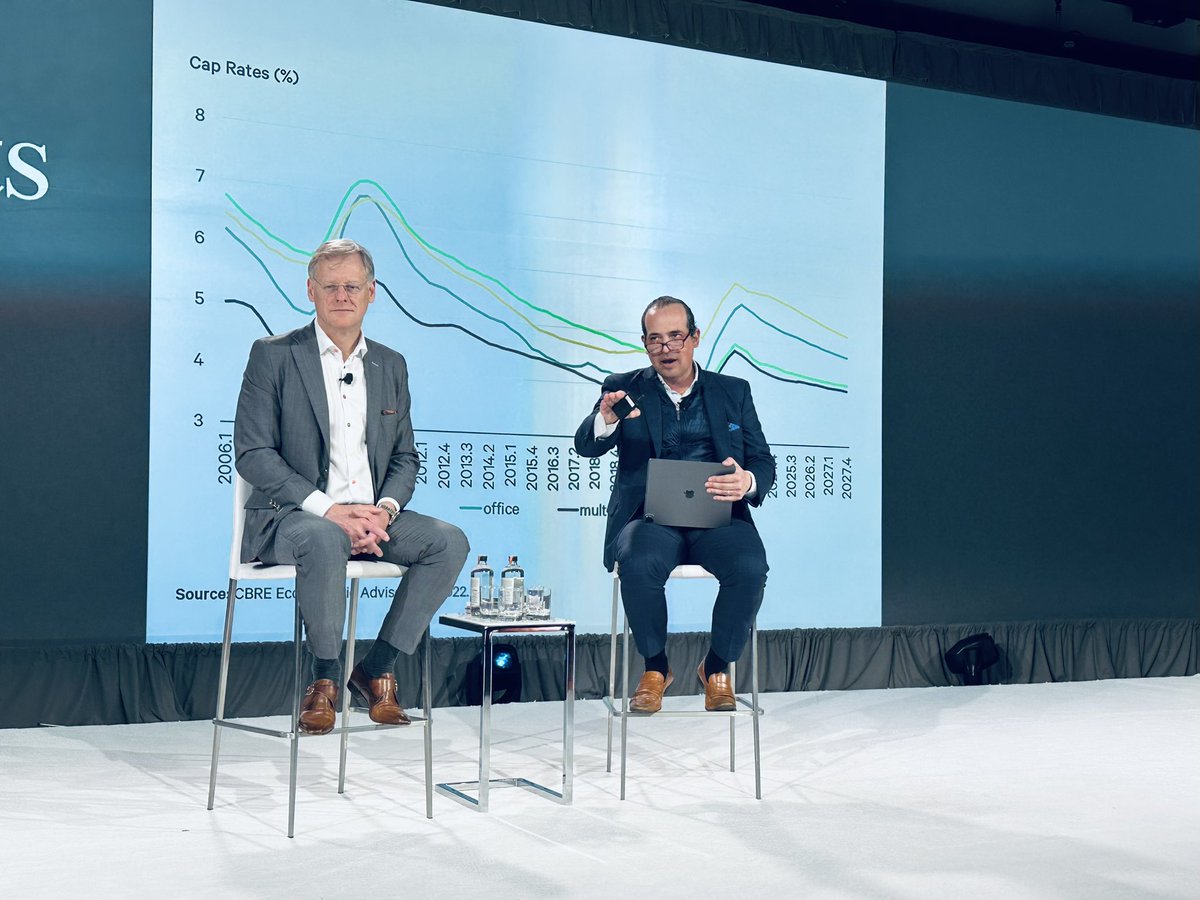

“While the banking crisis is short-term unhelpful and worsens sentiment, there are positive consequences as well - it acts as a force multiplier for the Fed and does a little bit of the work for it” Richard Barkham #CBREInvestorSymposium

“Private real estate has outperformed just about every major asset class in different types of environments, so keep the faith!” Spencer Levy #CBREInvestorSymposium

.Brian Stoffers closes another hugely successful #CBREInvestorSymposium and his last before retiring at the end of this month: “I just want to thank all of you - and it’s time!”

Join Chelsea Cutler at Commercial Observer's Spring Financing CRE Forum to hear which deals are getting ahead of the market turbulence and an in-depth look at the cutting edge investment strategies shaping our national finance trends. Register here: bit.ly/3mobth4

.CBRE Capital Markets' Darcy Stacom and Bill Shanahan sourced the deal, while James Millon, Tom Traynor and Mark Finan arranged the financing. x.com/Bisnow/status/…

Congratulations to Tom Traynor and James Millon for placing 17th on Commercial Observer's 2023 Power Finance list. Read the full list here: cbre.co/3Vvl2Ig

Congratulations to Val Achtemeier for being named to Connect Commercial Real Estate's Top Mortgage Brokers and Lenders for 2023. cbre.co/3O5bBfk

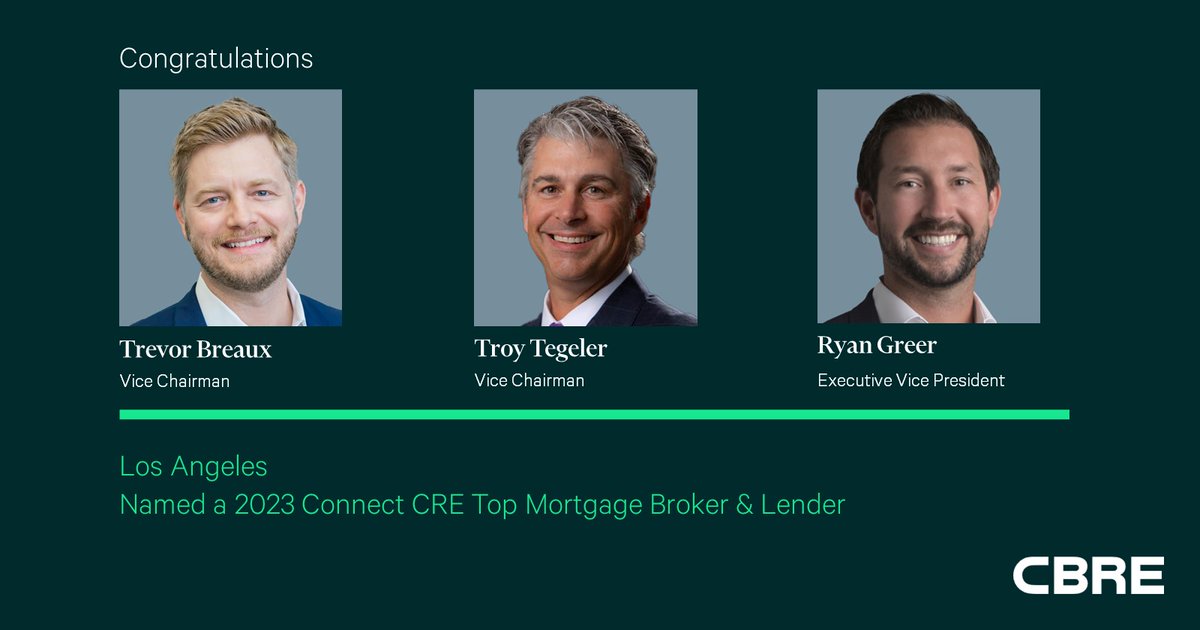

Congratulations to Troy Tegeler, Trevor Breaux and Ryan Greer for being named to Connect Commercial Real Estate's Top Mortgage Brokers and Lenders for 2023. cbre.co/43EdMfB