Armin Popp (薛岸珉)

@armin_popp

Founder and Investment Strategist - fascinated by the implications of Remote Work & the Creator Economy

ID: 4216790199

18-11-2015 09:24:37

191 Tweet

253 Followers

3,3K Following

Muddy Waters's Carson Block on Squawk Box tomorrow ~8 am EST to discuss China / possible tariffs, and where the consensus view on this issue is wrong.

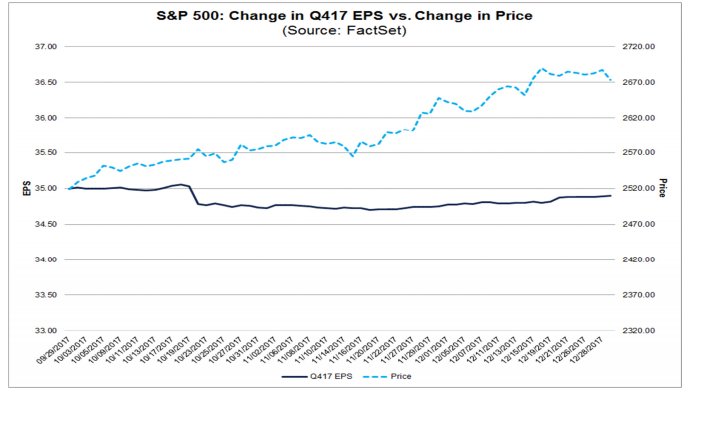

![Alberto Gallo (@macrocredit) on Twitter photo Greenspan: "I think we have two bubbles, a stock market bubble and a bond market bubble [...] but for the short term it's not too bad..."

#accountability Greenspan: "I think we have two bubbles, a stock market bubble and a bond market bubble [...] but for the short term it's not too bad..."

#accountability](https://pbs.twimg.com/media/DU8fe-ZWkAIr785.jpg)