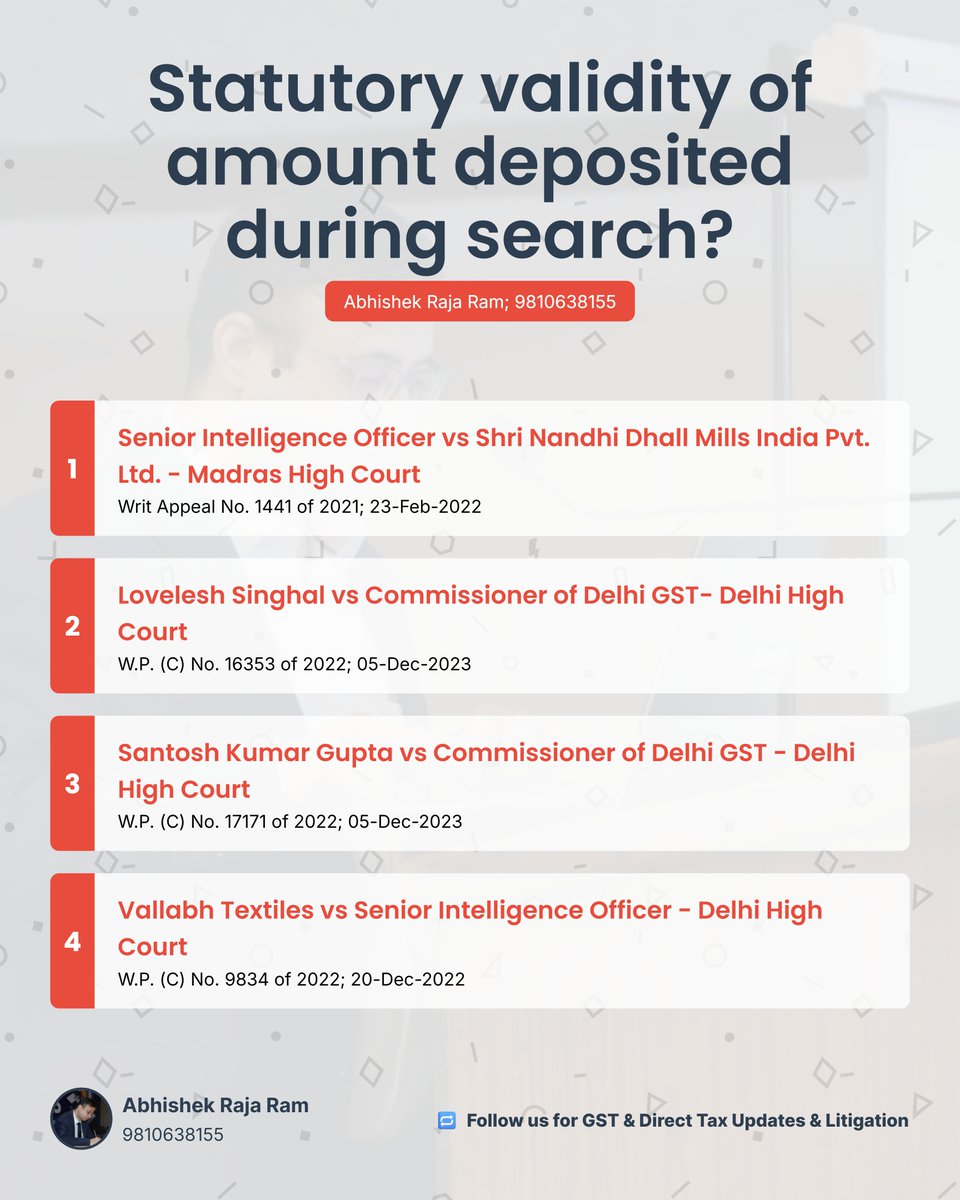

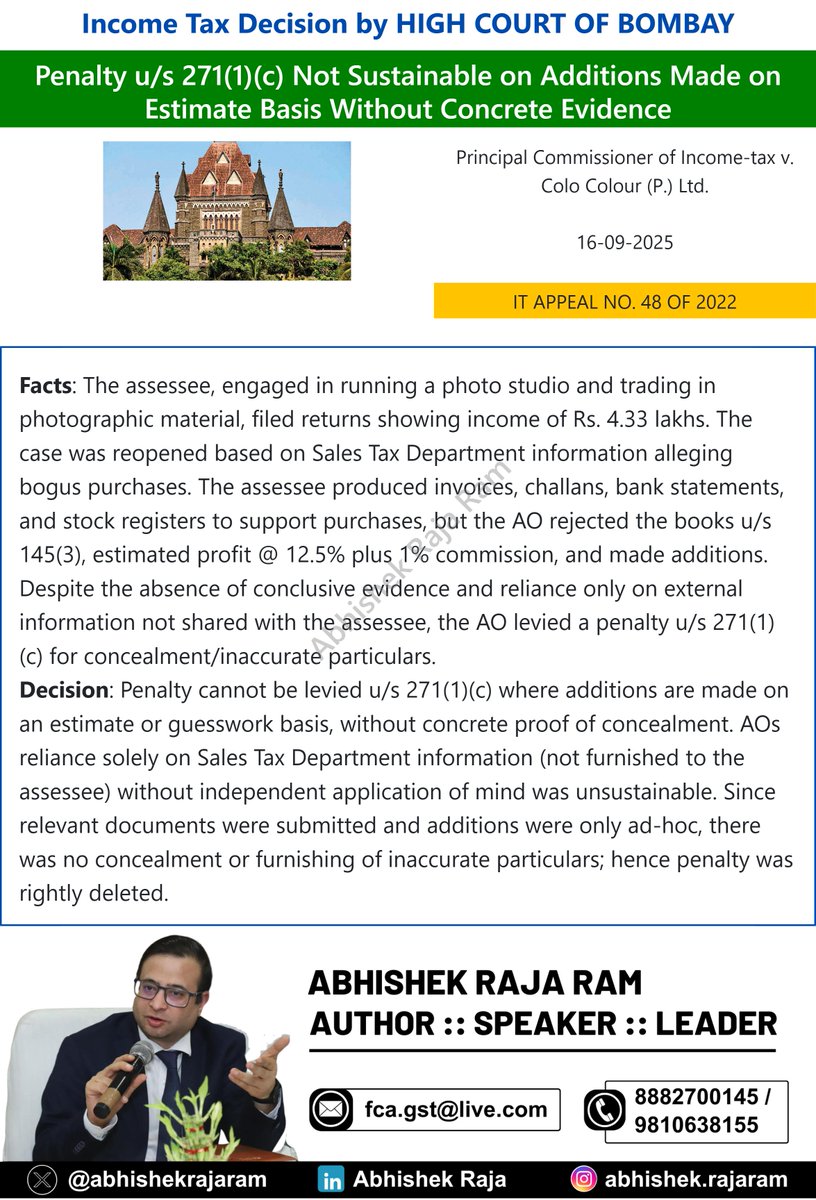

Abhishek Raja "Ram"

@abhishekrajaram

Tax Compliance & Litigation Expert | Author: Speaker: Leader | At War for Justice & Simplification in Tax Laws | Loves Information Technology | 9810638155

ID: 474054180

25-01-2012 16:14:40

34,34K Tweet

92,92K Followers

1,1K Following