Alan

@0xalan_

Crypto since 2017 || DeFi research ll Seed Investor || Solana || Built & sold two crypto businesses || Raised $40m in crypto VC

ID: 943954543930494977

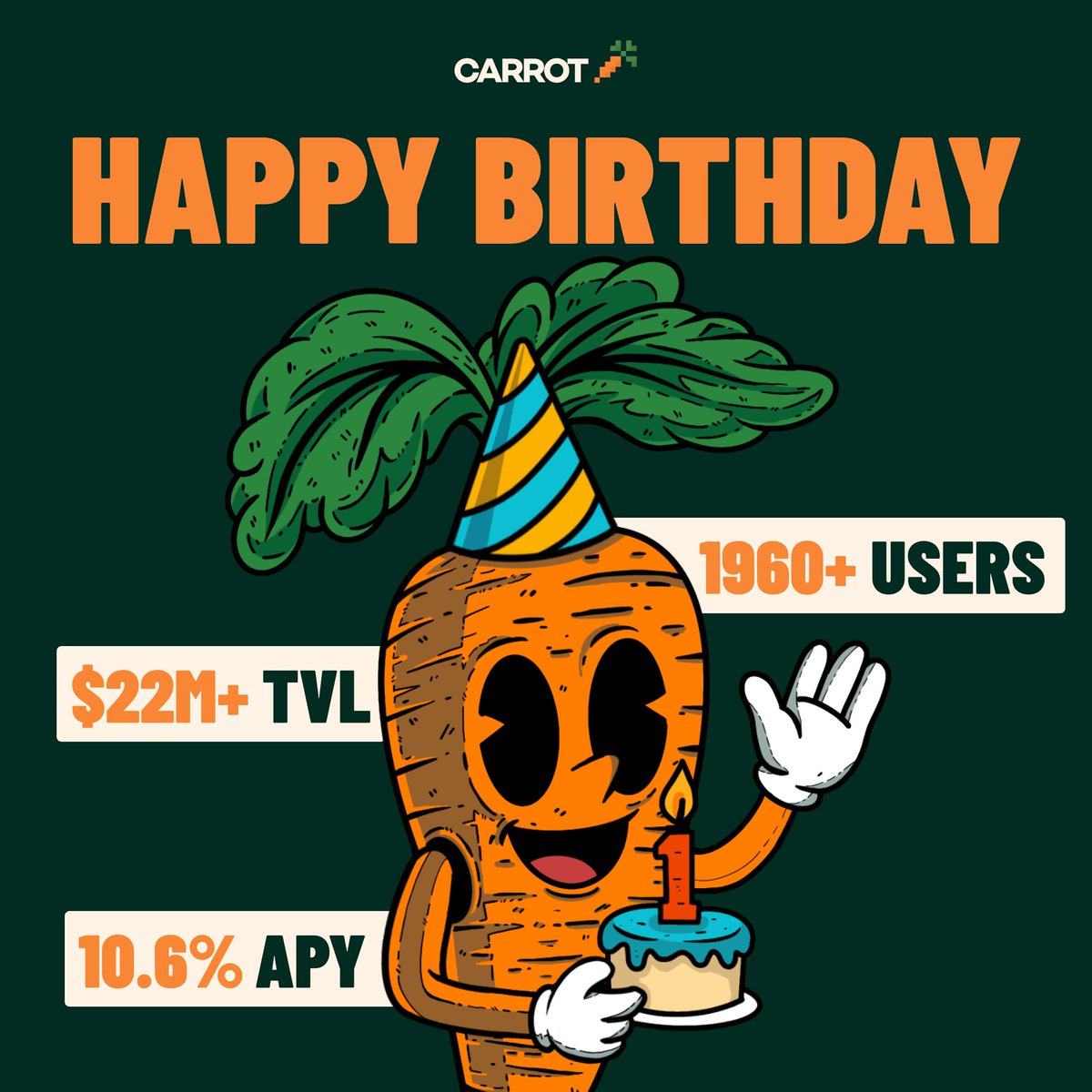

http://www.deficarrot.com 21-12-2017 21:21:15

9,9K Tweet

24,24K Followers

1,1K Following

Majority of alts are just chopping/struggling to do anything meaningful in this $BTC range. And then there's $HOME casually making ATHs. Bullish on Defi App 🎩

Phase 3 of Camp Network ⛺️'s Incentivized testnet just dropped, and it’s packed with a bunch of new exciting apps. I'm keeping track of new launches so I figured I'd share the TLDR with you of each of the ones I looked into below: @korprotocol - Gives creators the ability to

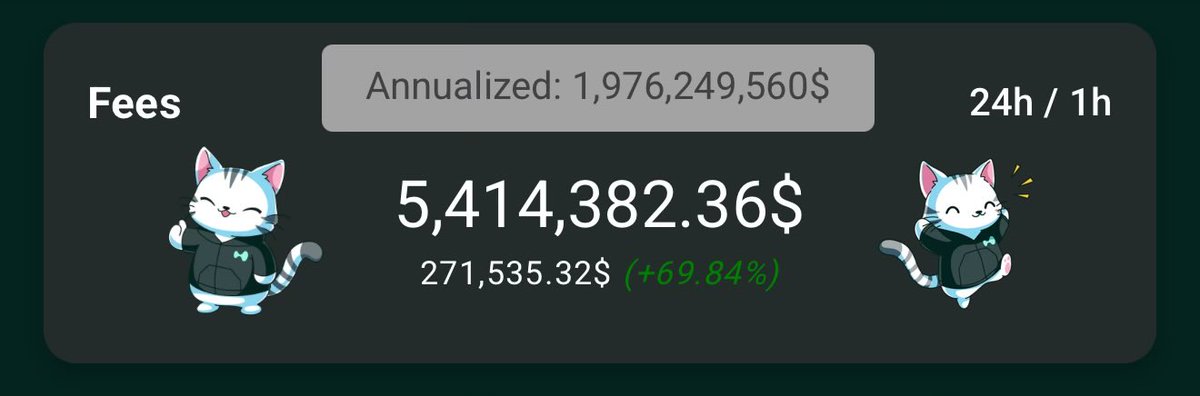

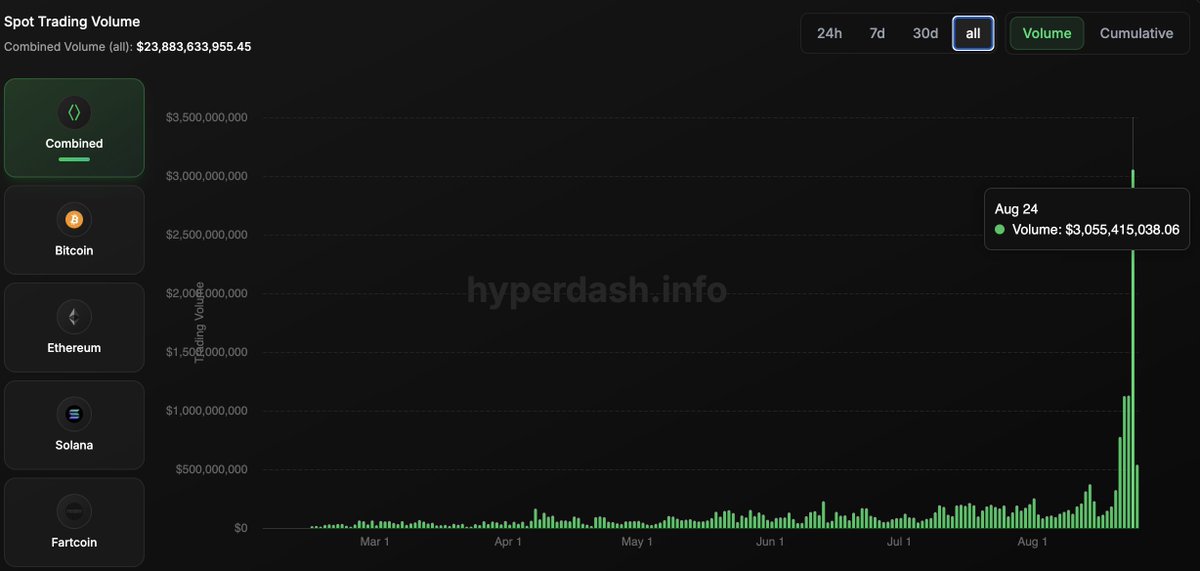

Happy to present my Hyperliquid Dashboard 🍌 hyperliquid-analytics.com It includes different categories: ⏩Hyperliquid Volume Breakdown ⏩Core vs EVM ⏩Hyperliquid vs CEX (Binance, Bybit, Okx) comparison across different fields ⏩Growth (perps, total protocol, core, etc.)