Danr 👽

@0x_danr

Inventor of GammaSwap protocol & Co-founder at @gammaswaplabs | I enjoy discussing DeFi trading strategies, interest rates, and blockchain technology

ID: 2836956477

19-10-2014 09:05:36

270 Tweet

1,1K Followers

48 Following

How to measure the Implied Volatility (IV) of GammaSwap Perpetual Options A question we have been getting recently in the community is how to compare IV in GammaSwap 👽 perpetual options to other option venues, particularly Deribit. Before we dive into this, let's do a

Update on Hedging Uni V3 positions with GammaSwap 👽 : Some people misunderstand (myself included initially) that using leveraged UniV2 from GammaSwap will perfectly hedge IL of Uni V3 positions while still generating better trading fees than Uni V2. But this is not correct.

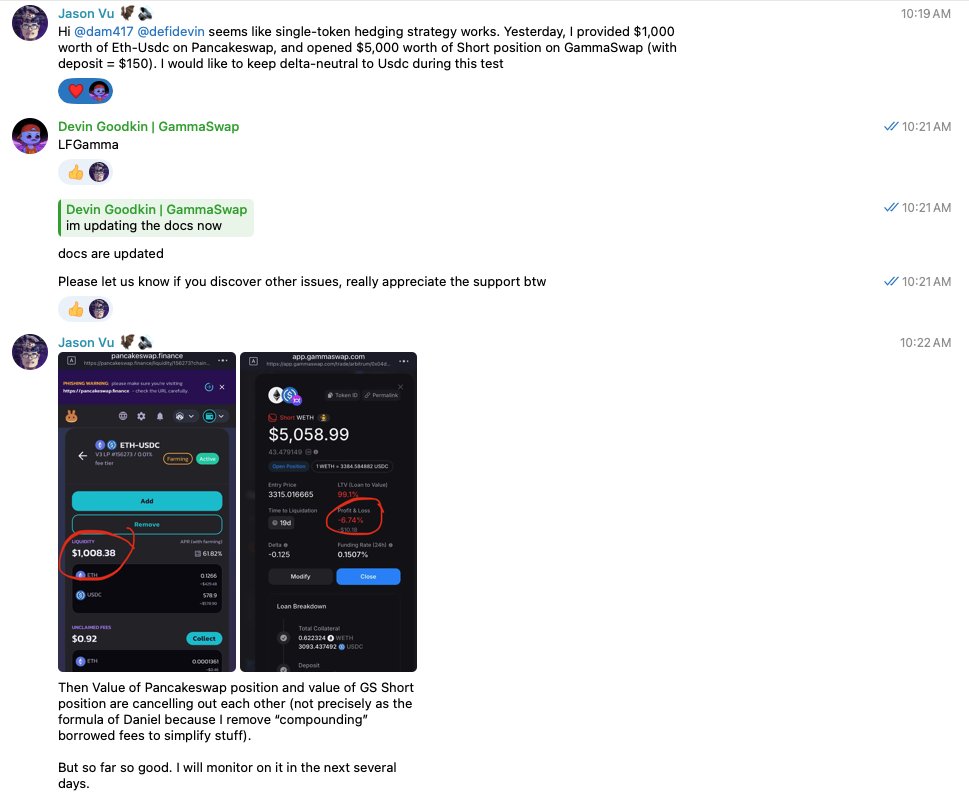

Although GammaSwap 👽 is still complex and nascent (working on automating complex hedging with yield tokens), it is great to see users executing successful hedges manually 👀 IL will soon be only a nightmare from the past🫡 MLGA (Make LPing Great Again)

Incredible story DeFi Devin . Makes it clear where your grit and resilience come from. Glad to be building alongside you.

Giga quants at GammaSwap 👽 figured out how to run Ethena-style basis trade on AMM yields. Works with any token. First up is ETH. Currently 38% APY. Read that again.