0pttimus.sign🦺🧡

@0pttimus

ⁱᴳᵃᵐᵉ ᵂᵉᵇ³ ᶠᵒʳ ᵃ ˡⁱᵛⁱⁿᵍ 🎮 | ᴵ ᵃᵐ @ˢⁱᵍⁿ ᶜᵒᵐᵐᵃⁿᵈᵉʳ 🧡 | ᴵ ʳᵉᵖ @ᵗʰᵉ_ʸᵉˢᶜᵒⁱⁿ | ⁱˢᵖᵉᵃᵏ ᵃˢ ᵃ ᴷᴼᴸ | ⁱᴿᵘⁿ ⁿᵒᵈᵉˢ ᶠᵒʳ ᶠᵘⁿ & ᵖʳᵒᶠⁱᵗ | ⁱᴮᵘⁱˡᵈ ᶜᵒᵐᵐᵘⁿⁱᵗⁱᵉˢ | ⁱⱽᵒⁱᶜᵉ ᵇʳᵃⁿᵈˢ

ID: 1493840346

https://www.notion.so/Victtor-Optimus-Web3-Builder-1d56abaa26ef80129373ea07ae4c7f7e?pvs=4 08-06-2013 20:39:18

6,6K Tweet

2,2K Followers

2,2K Following

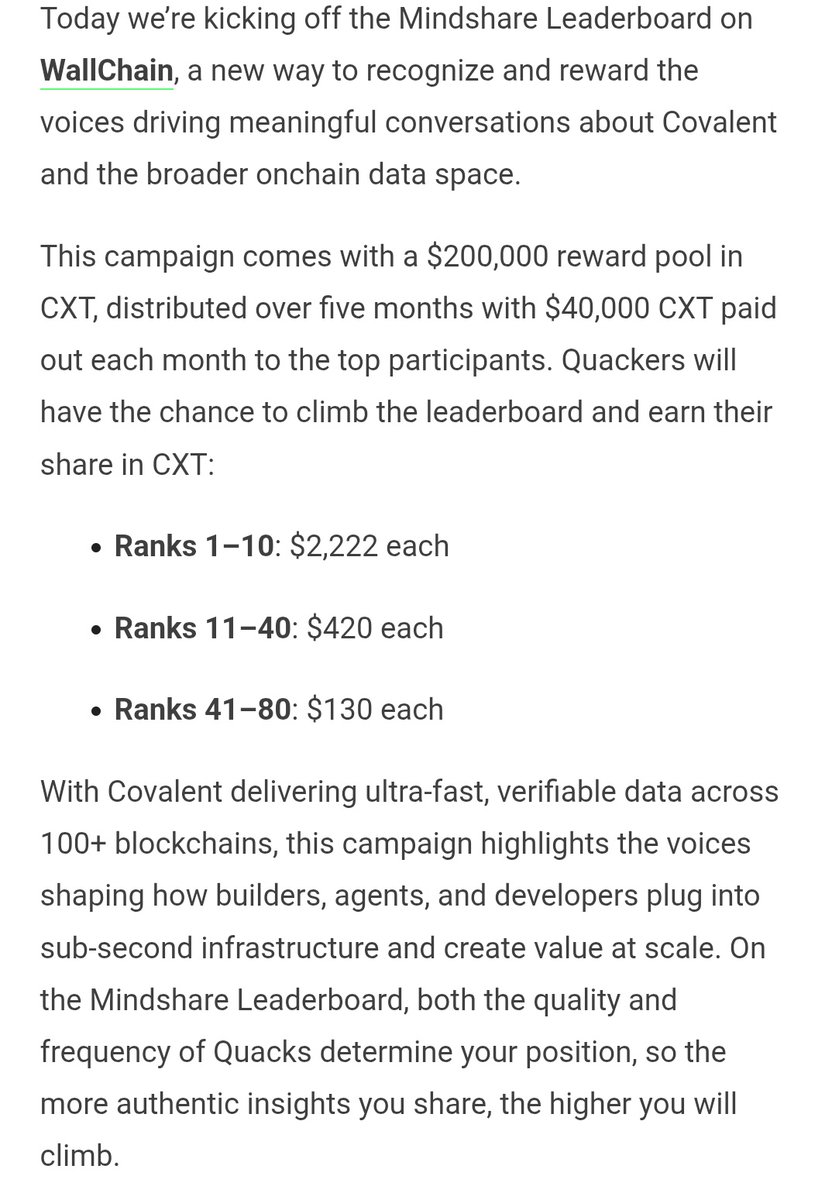

Most protocols in 2025: “We have major unlock events coming... maybe prepare for some volatility 😬” $CXT: "98% of our supply has been unlocked for years. Investor unlocks finished over 2 years ago. Cliff risk? What's that?" Zero overhang. Maximum transparency. Pure, uncut x.com/Covalent_HQ/st…