shakib shaikh

@00sshaikh

ID: 1498072907834032131

27-02-2022 23:10:09

7 Tweet

26 Followers

464 Following

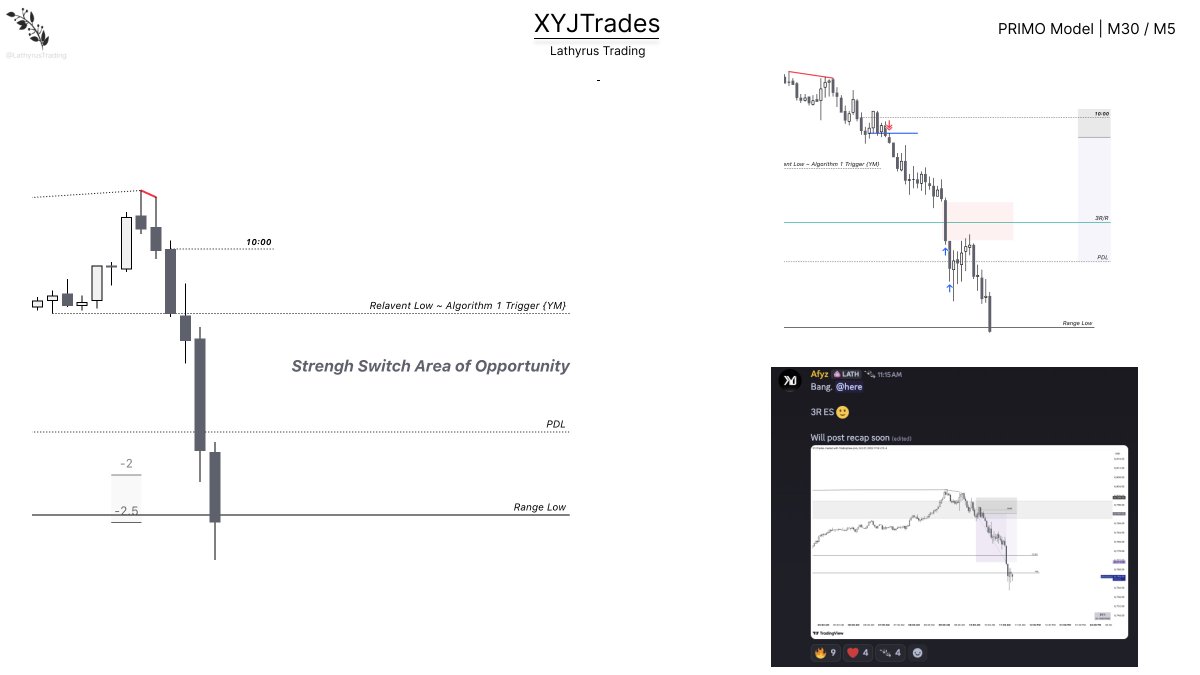

Yo Saiyan_trades 😎 Trader_by_ICT 🦁 @PTVExpressions 🎉 Y'all crushed the FunderPro giveaway! 💪 Slide into my DMs with them emails 📧 so I can hook it up with Youssef Galal 🙌 who made this epicness happen! 🚀You all followed rule so you get account

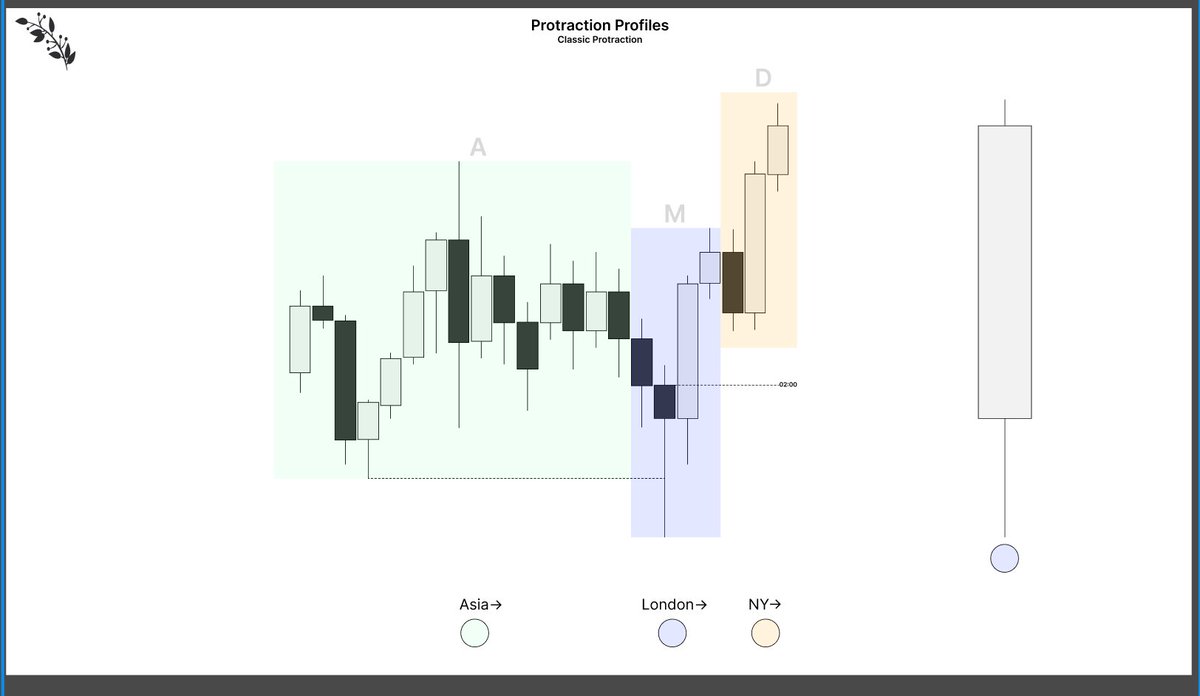

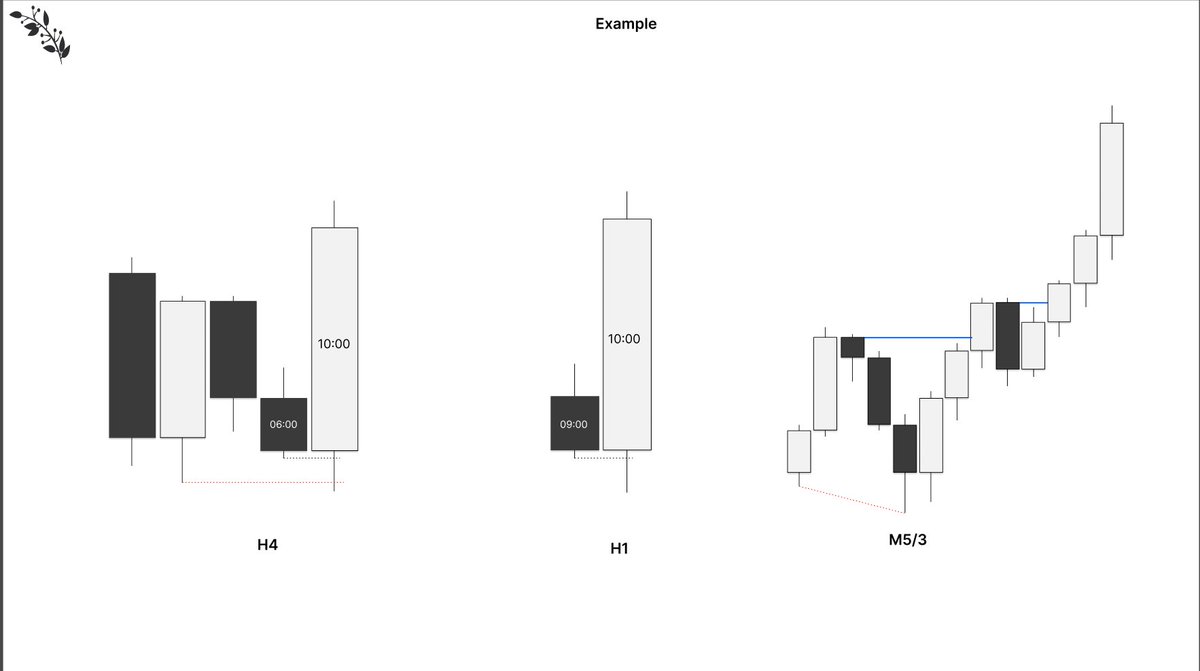

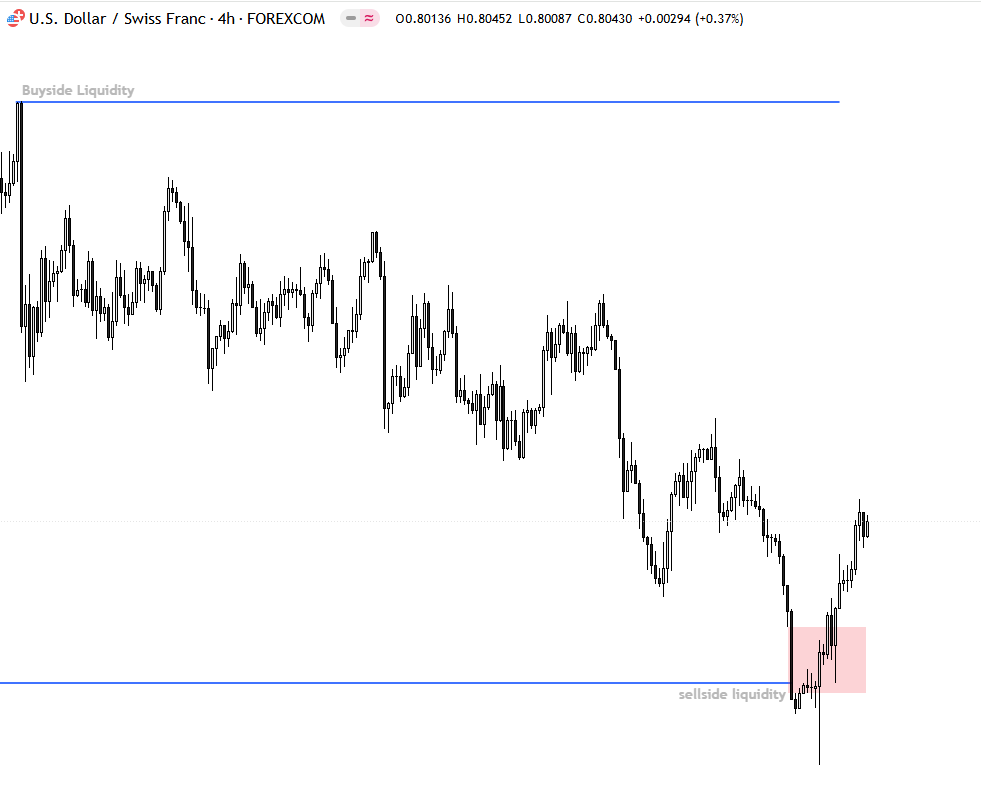

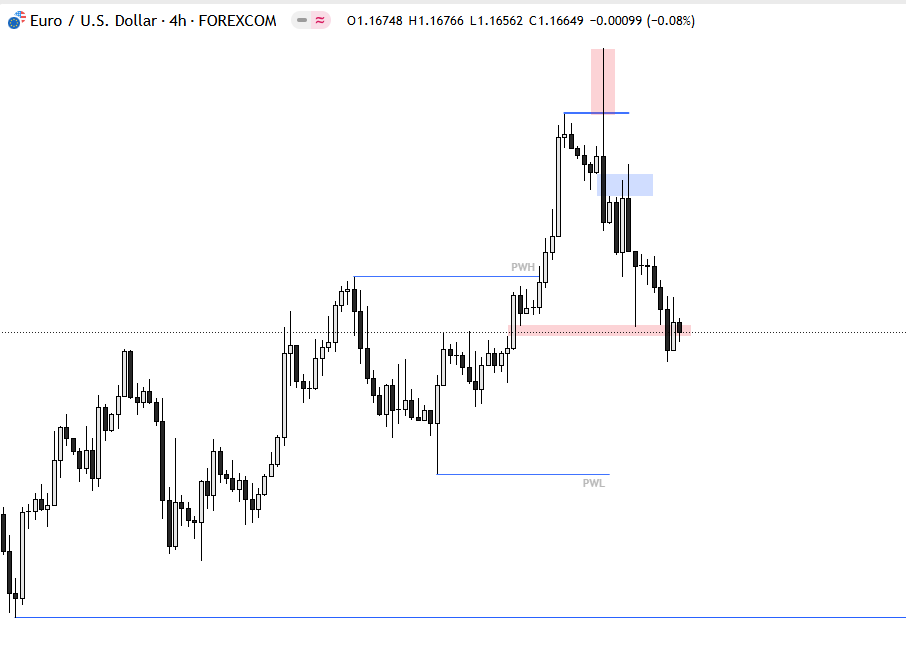

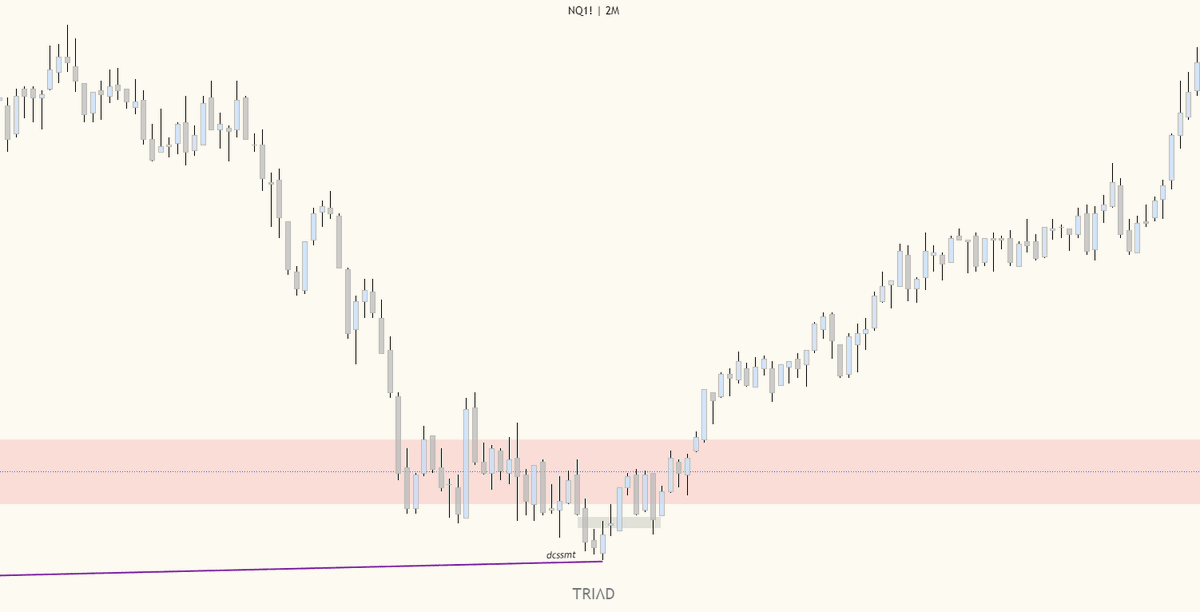

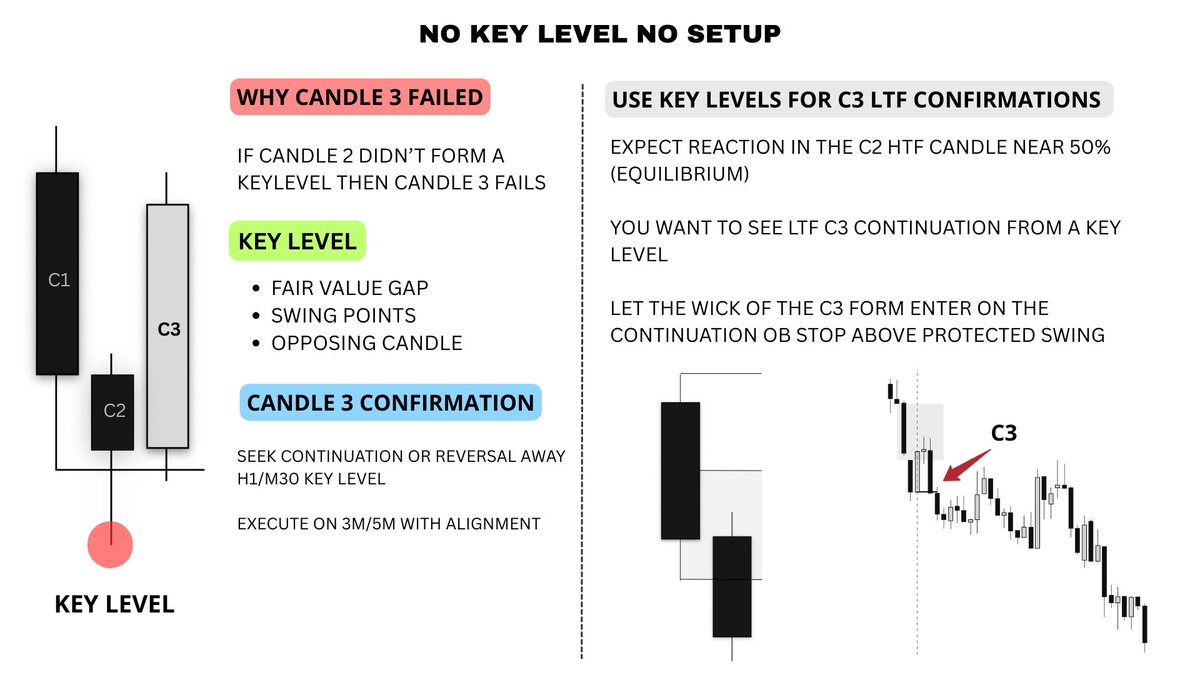

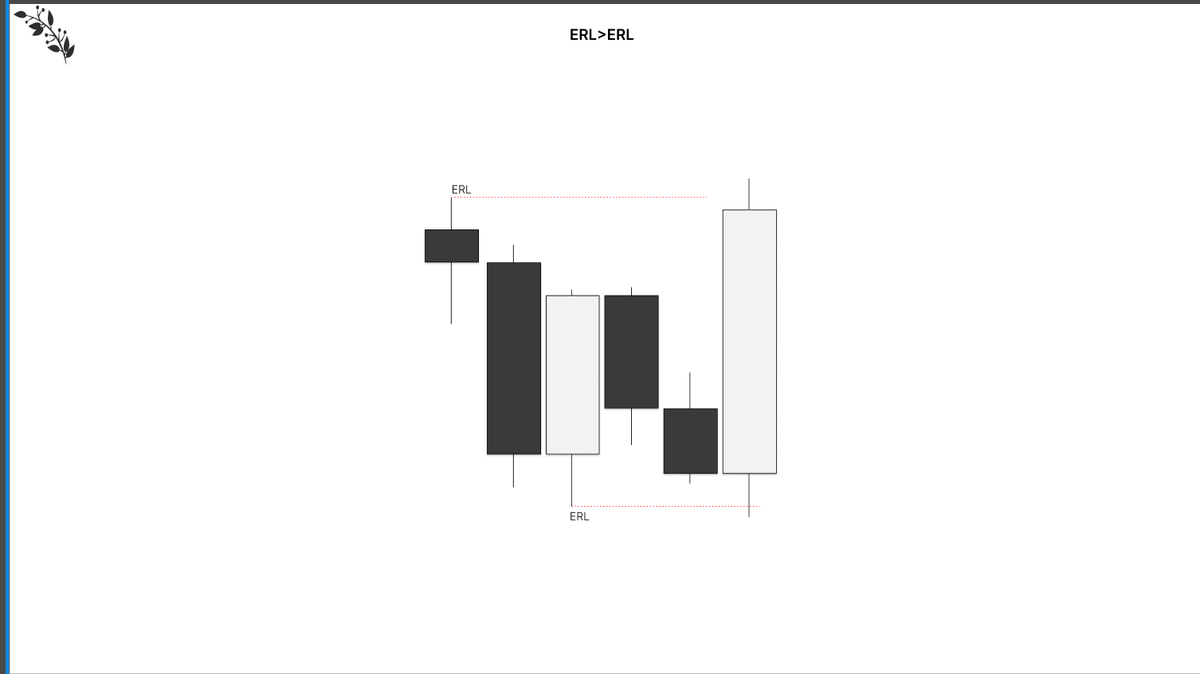

![Afyz (@xyjtrades) on Twitter photo A true reversal is a 2 stage crack in correlation.

A true reversal is the wick of a HTF candle.

If you want to trade C2 [the reversal candle] you must therefore see:

1. SMT confirming a PSP [where PSP is CiC 1 and SMT is CiC 2]

2. A two stage SMT (between relevant swings) A true reversal is a 2 stage crack in correlation.

A true reversal is the wick of a HTF candle.

If you want to trade C2 [the reversal candle] you must therefore see:

1. SMT confirming a PSP [where PSP is CiC 1 and SMT is CiC 2]

2. A two stage SMT (between relevant swings)](https://pbs.twimg.com/media/G4FS8tDXUAEKAvl.jpg)