Elliott Wave International

@elliottwaveintl

EWI is the world's largest market forecasting firm providing forecasts of every major financial market in the world.

linktr.ee/elliottwaveintl

ID: 48434084

http://www.elliottwave.com 18-06-2009 18:06:56

12,12K Tweet

43,43K Followers

291 Following

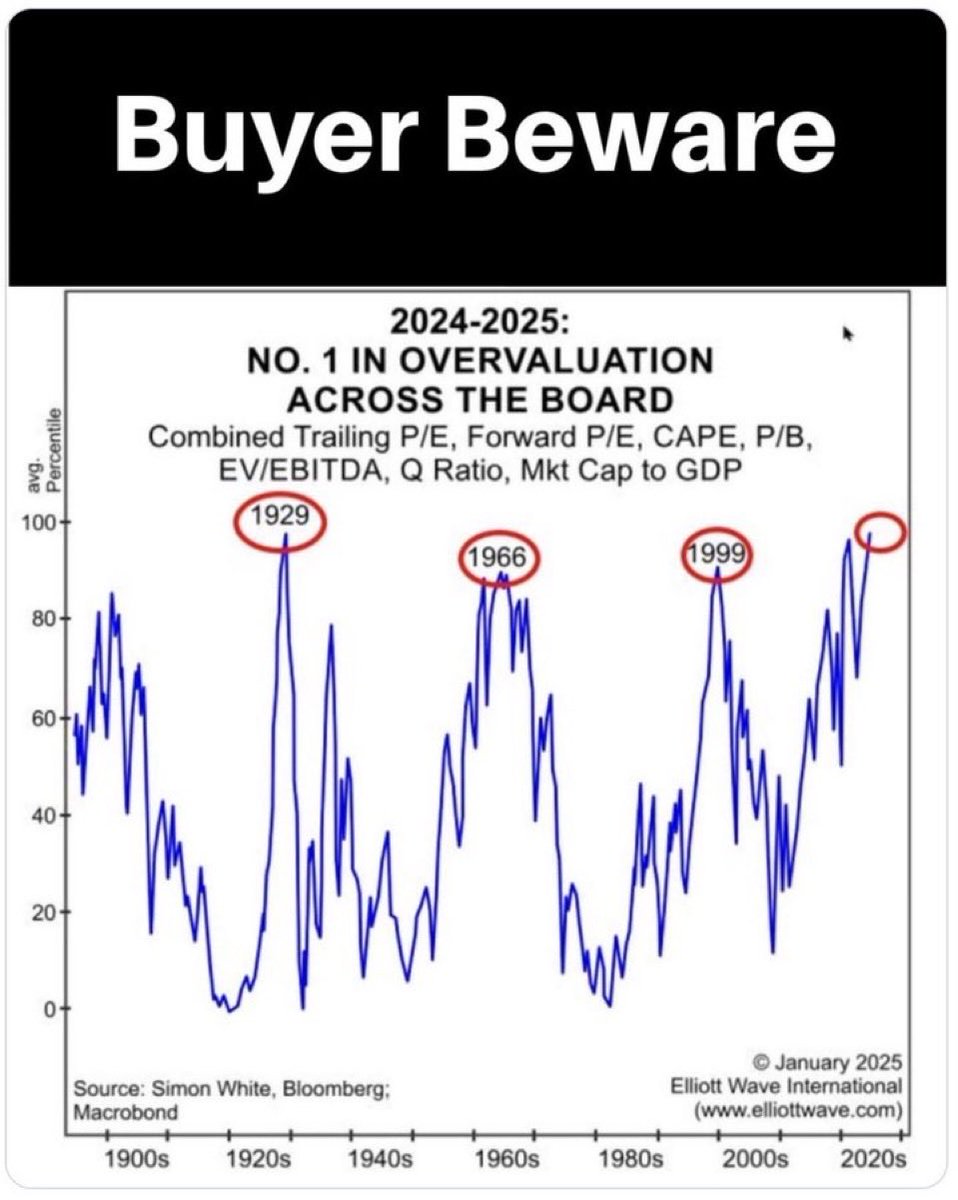

Jamie Dimon, CEO of J.P. Morgan warns of a “heightened risk of a major stock-market correction” within 6-24 months. Here's your guide to prepare now: ow.ly/oovX50Xa3zM #recession #stockmarketcrash