David Rosenberg

@econguyrosie

Founder and President of Rosenberg Research & Associates Inc.

Retweets, Likes and Follows are not endorsements.

ID: 939121727581208576

https://web.rosenbergresearch.com/TWTrialRequest 08-12-2017 13:17:22

3,3K Tweet

286,286K Takipçi

342 Takip Edilen

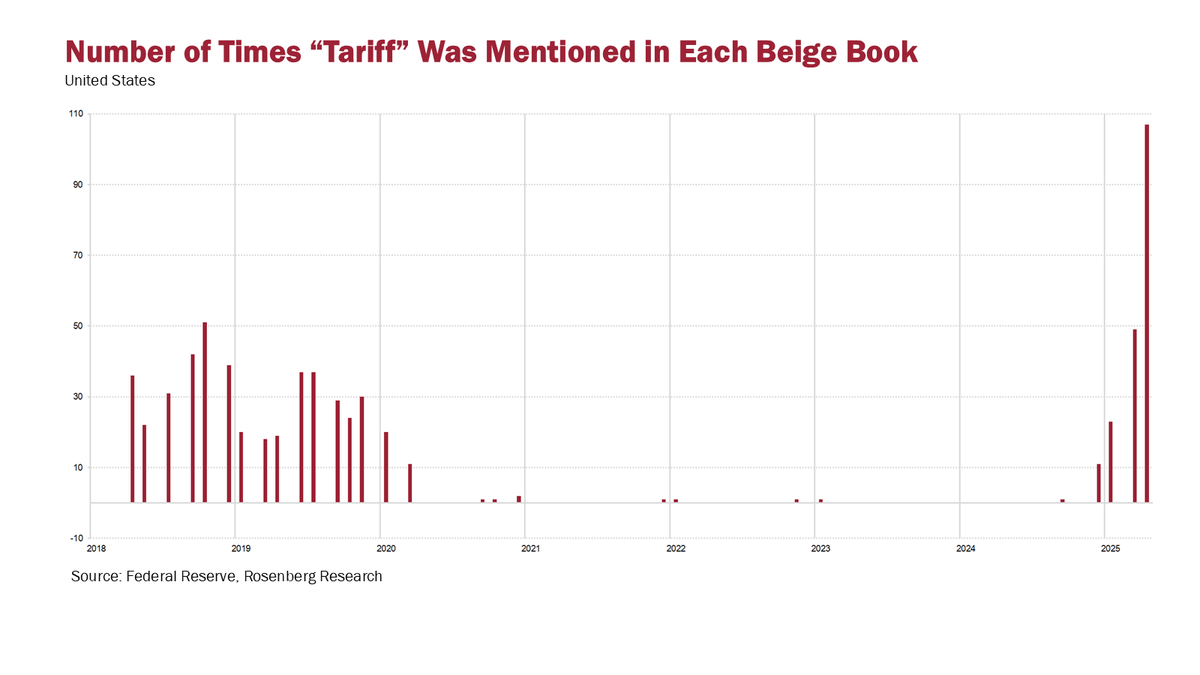

I was on BNN Bloomberg this morning where I gave my analysis on the potential impacts of tariffs on the U.S. economy and who is going to feel the long-term effects – and opportunities I see emerging from the chaos: youtube.com/watch?v=i94gkF…

Well, Donald Trump has managed to poke the Polar Bear in the eye. Not only has the President upended the Canadian election by pushing the left-leaning Liberals into the lead heading into today’s election, but the locals are cancelling their southbound vacations, unloading their